Answered step by step

Verified Expert Solution

Question

1 Approved Answer

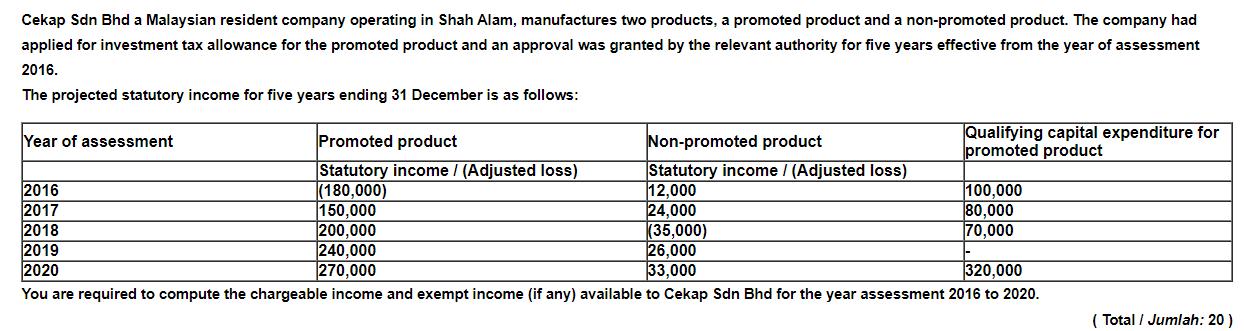

Cekap Sdn Bhd a Malaysian resident company operating in Shah Alam, manufactures two products, a promoted product and a non-promoted product. The company had

Cekap Sdn Bhd a Malaysian resident company operating in Shah Alam, manufactures two products, a promoted product and a non-promoted product. The company had applied for investment tax allowance for the promoted product and an approval was granted by the relevant authority for five years effective from the year of assessment 2016. The projected statutory income for five years ending 31 December is as follows: Year of assessment 2016 2017 2018 2019 2020 Promoted product Statutory income / (Adjusted loss) (180,000) 150,000 200,000 240,000 270,000 Non-promoted product Statutory income / (Adjusted loss) 12,000 24,000 (35,000) 26,000 33,000 Qualifying capital expenditure for promoted product 100,000 80,000 70,000 320,000 You are required to compute the chargeable income and exempt income (if any) available to Cekap Sdn Bhd for the year assessment 2016 to 2020. (Total / Jumlah: 20)

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

123 4 5 678910m2 11 13 A B Year of Assessment C 2016 2017 2018 2019 2020 A D Promoted Product It is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started