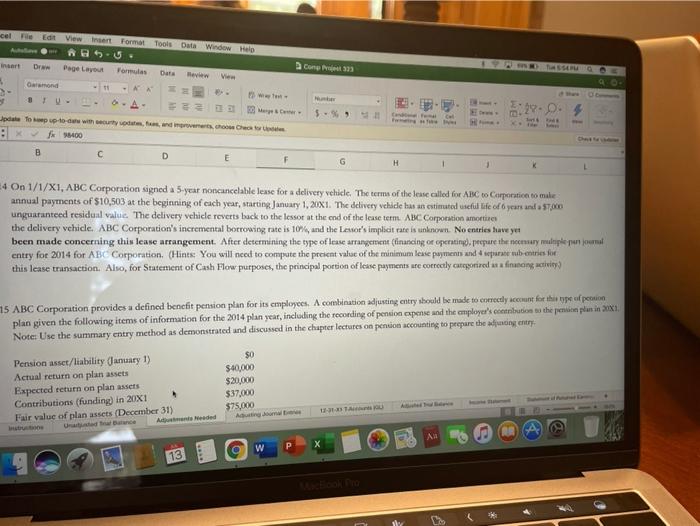

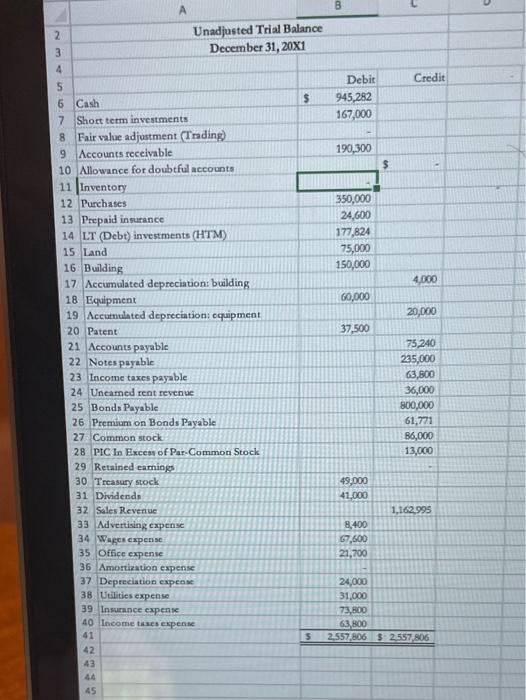

cele Edit View at Format Tools Date Window AU insert Dr Page Layout Formulas Date vw Garamond Comp23 0.4 del Topup-to-one with commandes et : f 1400 B D E G H 24 On 1/1/X1, ABC Corporation signed a 5-year noncancelable lease for a delivery vehicle. The terms of the lease called for ABC to Corporation to make annual payments of $10,503 at the beginning of each year, starting January 1, 20X1. The delivery vehide has an estimated useful lee of years and unguaranteed residual value. The delivery vehicle reverts back to the lessor at the end of the lease term. ABC Corporation amortizer the delivery vehicle. ABC Corporation's incremental borrowing rate is 10% and the lessor's implicit rate is unknown. No entries have yet been made concerning this lease arrangement. After determining the type of lease arrangement (financing or operating), peepure the neemsury multiple en formal entry for 2014 for ABC Corporation. (Hints: You will need to compute the present value of the minimum lease payment and 4 sepure tub entries for this lease transaction. Also, for Statement of Cash How purposes, the principal portion of lease payments are correctly cregorired as a financing activity) 15 ABC Corporation provides a defined benefit pension plan for its employees. A combination adjusting entry should be made to correctly account for this type of persican plan given the following items of information for the 2014 plan year, including the recording of pention expense and the employer's celudios so the petite planin x1 Note: Use the summary entry method as demonstrated and discussed in the chapter lectures on pension accounting to prepare the funding cery. Pension asset/liability (January 1) Actual return on plan assets Expected return on plan assets Contributions (funding) in 20X1 Fair value of plan assets (December 31) Undance An eaded $0 $40,000 $20,000 $37,000 $75,000 Am w P 13 B D 2 3 4 Unadjusted Trial Balance December 31, 20X1 Credit $ Debit 945,282 167,000 190,300 $ 350,000 24,600 177,824 75,000 150,000 4.000 60,000 20,000 37,500 5 6 Cash 7 Short term investments 8 Fair value adjustment (Trading) 9 Accounts receivable 10 Allowance for doubtful accounts 11 Inventory 12 Purchases 13 Prepaid insurance 14 LT (Debt) investments (HTM) 15 Land 16 Building 17 Accumulated depreciation building 18 Equipment 19 Accumulated depreciation: equipment 20 Patent 21 Accounts payable 22 Notes payable 23 Income taxes payable 24 Uncamed rent revenue 25 Bonds Payable 26 Premium on Bonds Payable 27 Common stock 28 PIC In Excem of Par-Common Stock 29 Retained carings 30 Treasury stock 31 Dividends 32 Sales Revenue 33 Advertising expense 34 Wages capens 35 Office expense 36 Amortization expense 37 Depreciation expense 38 Utilities expense 39 Insurance expense 40 Income teses expense 41 42 43 44 45 75,240 235,000 63,800 36,000 800,000 61,771 86,000 13,000 49,000 41,000 1,162.995 8,400 67,600 21,700 24,000 31,000 73,800 63,800 2,557,806 $ 2.557,806 5