Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Celin Company has just approached the bank for which you work as a loan officer to seek additional financing. Celin has not been profitable

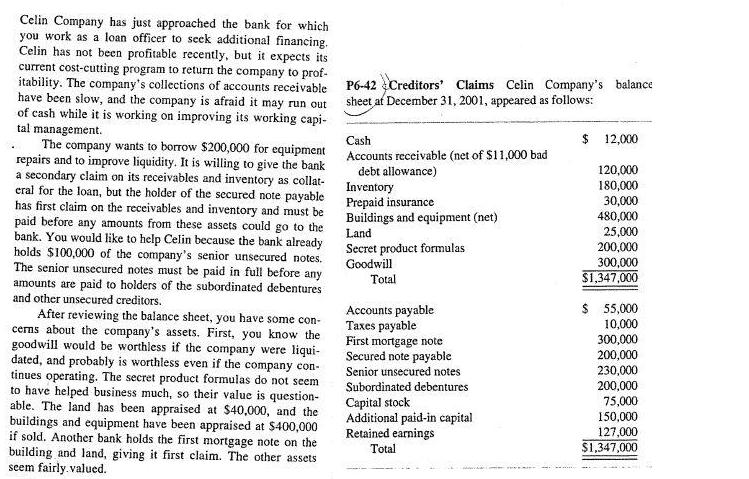

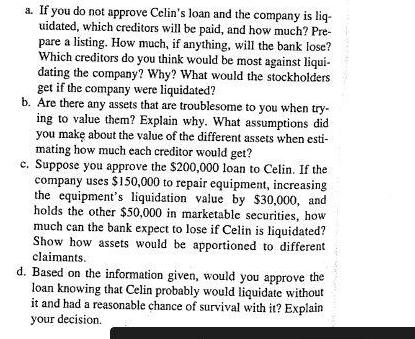

Celin Company has just approached the bank for which you work as a loan officer to seek additional financing. Celin has not been profitable recently, but it expects its current cost-cutting program to return the company to prof- itability. The company's collections of accounts receivable have been slow, and the company is afraid it may run out of cash while it is working on improving its working capi- tal management. The company wants to borrow $200,000 for equipment repairs and to improve liquidity. It is willing to give the bank a secondary claim on its receivables and inventory as collat- eral for the loan, but the holder of the secured note payable has first claim on the receivables and inventory and must be paid before any amounts from these assets could go to the bank. You would like to help Celin because the bank already. holds $100,000 of the company's senior unsecured notes. The senior unsecured notes must be paid in full before any amounts are paid to holders of the subordinated debentures and other unsecured creditors. After reviewing the balance sheet, you have some con- cerns about the company's assets. First, you know the goodwill would be worthless if the company were liqui- dated, and probably is worthless even if the company con- tinues operating. The secret product formulas do not seem to have helped business much, so their value is question- able. The land has been appraised at $40,000, and the buildings and equipment have been appraised at $400,000 if sold. Another bank holds the first mortgage note on the building and land, giving it first claim. The other assets seem fairly valued. P6-42Creditors' Claims Celin Company's balance sheet af December 31, 2001, appeared as follows: Cash Accounts receivable (net of $11,000 bad debt allowance) Inventory Prepaid insurance Buildings and equipment (net) Land Secret product formulas Goodwill Total Accounts payable Taxes payable First mortgage note Secured note payable Senior unsecured notes Subordinated debentures Capital stock Additional paid-in capital Retained earnings Total $ 12,000 120,000 180,000 30,000 480,000 25,000 200,000 300,000 $1,347,000 $ 55,000 10,000 300,000 200,000 230,000 200,000 75,000 150,000 127,000 $1,347,000 a. If you do not approve Celin's loan and the company is liq- uidated, which creditors will be paid, and how much? Pre- pare a listing. How much, if anything, will the bank lose? Which creditors do you think would be most against liqui- dating the company? Why? What would the stockholders get if the company were liquidated? b. Are there any assets that are troublesome to you when try- ing to value them? Explain why. What assumptions did you make about the value of the different assets when esti- mating how much each creditor would get? c. Suppose you approve the $200,000 loan to Celin. If the company uses $150,000 to repair equipment, increasing the equipment's liquidation value by $30,000, and holds the other $50,000 in marketable securities, how much can the bank expect to lose if Celin is liquidated? Show how assets would be apportioned to different claimants. d. Based on the information given, would you approve the loan knowing that Celin probably would liquidate without it and had a reasonable chance of survival with it? Explain your decision.

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a The secured note payable holder will be paid first followed by the first mortgage note holder The senior unsecured notes must be paid in full before any amounts are paid to holders of the subordinat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started