Answered step by step

Verified Expert Solution

Question

1 Approved Answer

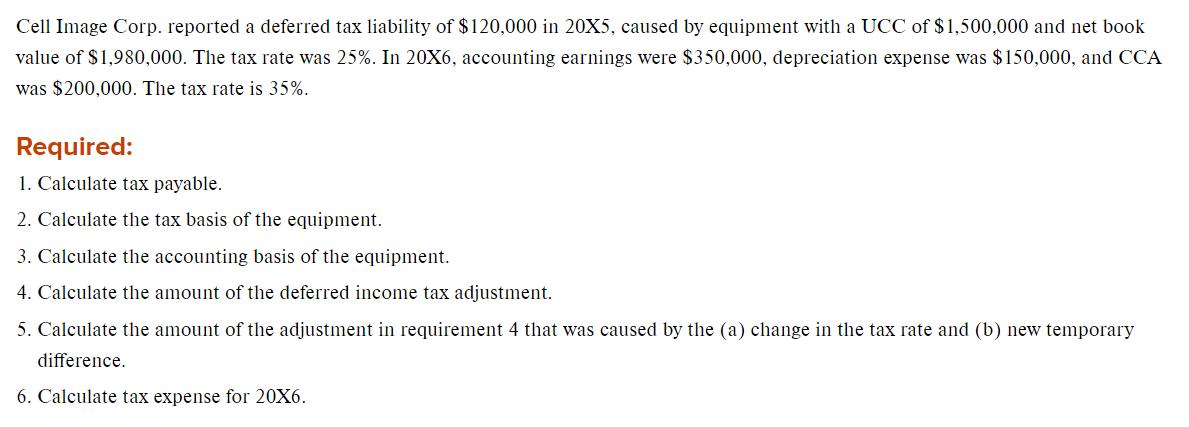

Cell Image Corp. reported a deferred tax liability of $120,000 in 20X5, caused by equipment with a UCC of $1,500,000 and net book value

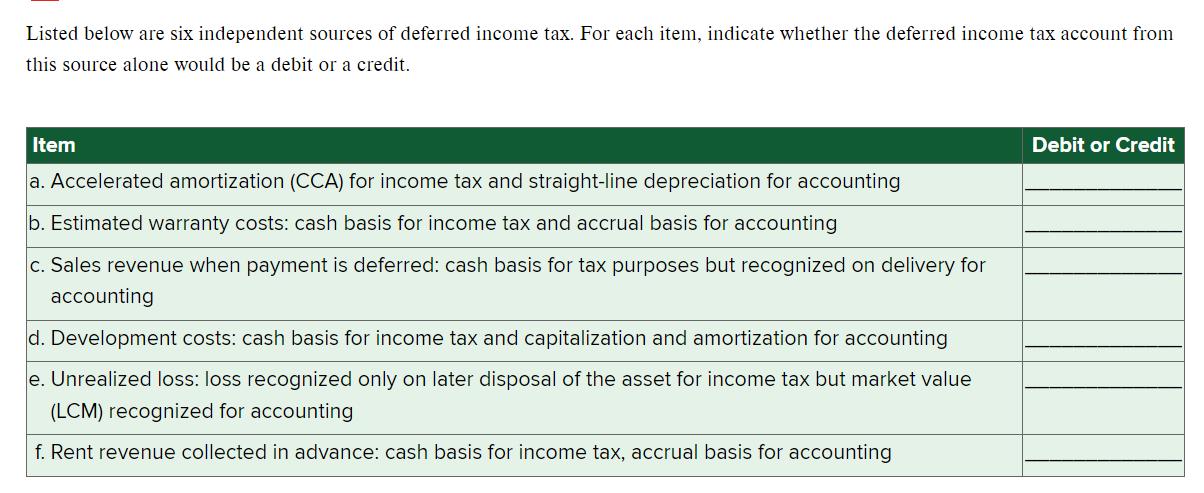

Cell Image Corp. reported a deferred tax liability of $120,000 in 20X5, caused by equipment with a UCC of $1,500,000 and net book value of $1,980,000. The tax rate was 25%. In 20X6, accounting earnings were $350,000, depreciation expense was $150,000, and CCA was $200,000. The tax rate is 35%. Required: 1. Calculate tax payable. 2. Calculate the tax basis of the equipment. 3. Calculate the accounting basis of the equipment. 4. Calculate the amount of the deferred income tax adjustment. 5. Calculate the amount of the adjustment in requirement 4 that was caused by the (a) change in the tax rate and (b) new temporary difference. 6. Calculate tax expense for 20X6. Listed below are six independent sources of deferred income tax. For each item, indicate whether the deferred income tax account from this source alone would be a debit or a credit. Item a. Accelerated amortization (CCA) for income tax and straight-line depreciation for accounting b. Estimated warranty costs: cash basis for income tax and accrual basis for accounting c. Sales revenue when payment is deferred: cash basis for tax purposes but recognized on delivery for accounting d. Development costs: cash basis for income tax and capitalization and amortization for accounting e. Unrealized loss: loss recognized only on later disposal of the asset for income tax but market value (LCM) recognized for accounting f. Rent revenue collected in advance: cash basis for income tax, accrual basis for accounting Debit or Credit

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of tax payable Accounting income for 20X6 350000 Add back depreciation expense 150000 Add back CCA 200000 Taxable income 700000 1 Tax paya...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started