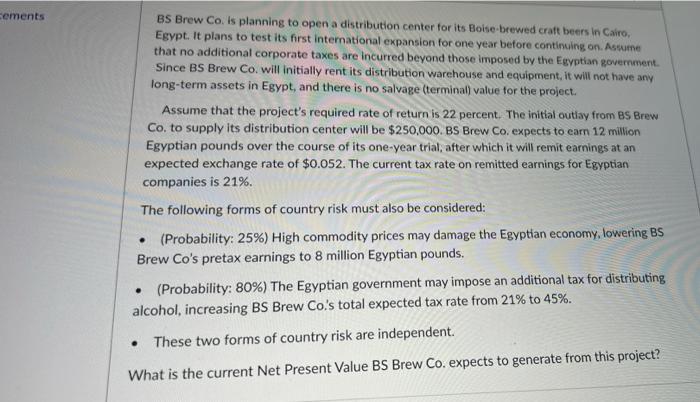

cements BS Brew Co. is planning to open a distribution center for its Boise-brewed craft beers in Cairo, Egypt. It plans to test its first international expansion for one year before continuing on. Assume that no additional corporate taxes are incurred beyond those imposed by the Egyptian government. Since BS Brew Co. will initially rent its distribution Warehouse and equipment, it will not have any long-term assets in Egypt, and there is no salvage (terminal value for the project. Assume that the project's required rate of return is 22 percent. The initial outlay from BS Brew Co. to supply its distribution center will be $250,000. BS Brew Co, expects to earn 12 million Egyptian pounds over the course of its one-year trial, after which it will remit earnings at an expected exchange rate of $0.052. The current tax rate on remitted earnings for Egyptian companies is 21%. The following forms of country risk must also be considered: (Probability: 25%) High commodity prices may damage the Egyptian economy, lowering BS Brew Co's pretax earnings to 8 million Egyptian pounds. (Probability: 80%) The Egyptian government may impose an additional tax for distributing alcohol, increasing BS Brew Co.'s total expected tax rate from 21% to 45%. These two forms of country risk are independent. . What is the current Net Present Value BS Brew Co. expects to generate from this project? O (-$34,328) O $7,869 O $30,374 O $50,066 Ston charina Hide cements BS Brew Co. is planning to open a distribution center for its Boise-brewed craft beers in Cairo, Egypt. It plans to test its first international expansion for one year before continuing on. Assume that no additional corporate taxes are incurred beyond those imposed by the Egyptian government. Since BS Brew Co. will initially rent its distribution Warehouse and equipment, it will not have any long-term assets in Egypt, and there is no salvage (terminal value for the project. Assume that the project's required rate of return is 22 percent. The initial outlay from BS Brew Co. to supply its distribution center will be $250,000. BS Brew Co, expects to earn 12 million Egyptian pounds over the course of its one-year trial, after which it will remit earnings at an expected exchange rate of $0.052. The current tax rate on remitted earnings for Egyptian companies is 21%. The following forms of country risk must also be considered: (Probability: 25%) High commodity prices may damage the Egyptian economy, lowering BS Brew Co's pretax earnings to 8 million Egyptian pounds. (Probability: 80%) The Egyptian government may impose an additional tax for distributing alcohol, increasing BS Brew Co.'s total expected tax rate from 21% to 45%. These two forms of country risk are independent. . What is the current Net Present Value BS Brew Co. expects to generate from this project? O (-$34,328) O $7,869 O $30,374 O $50,066 Ston charina Hide