CengageNOW - Managerial Accounting - CP.05.63

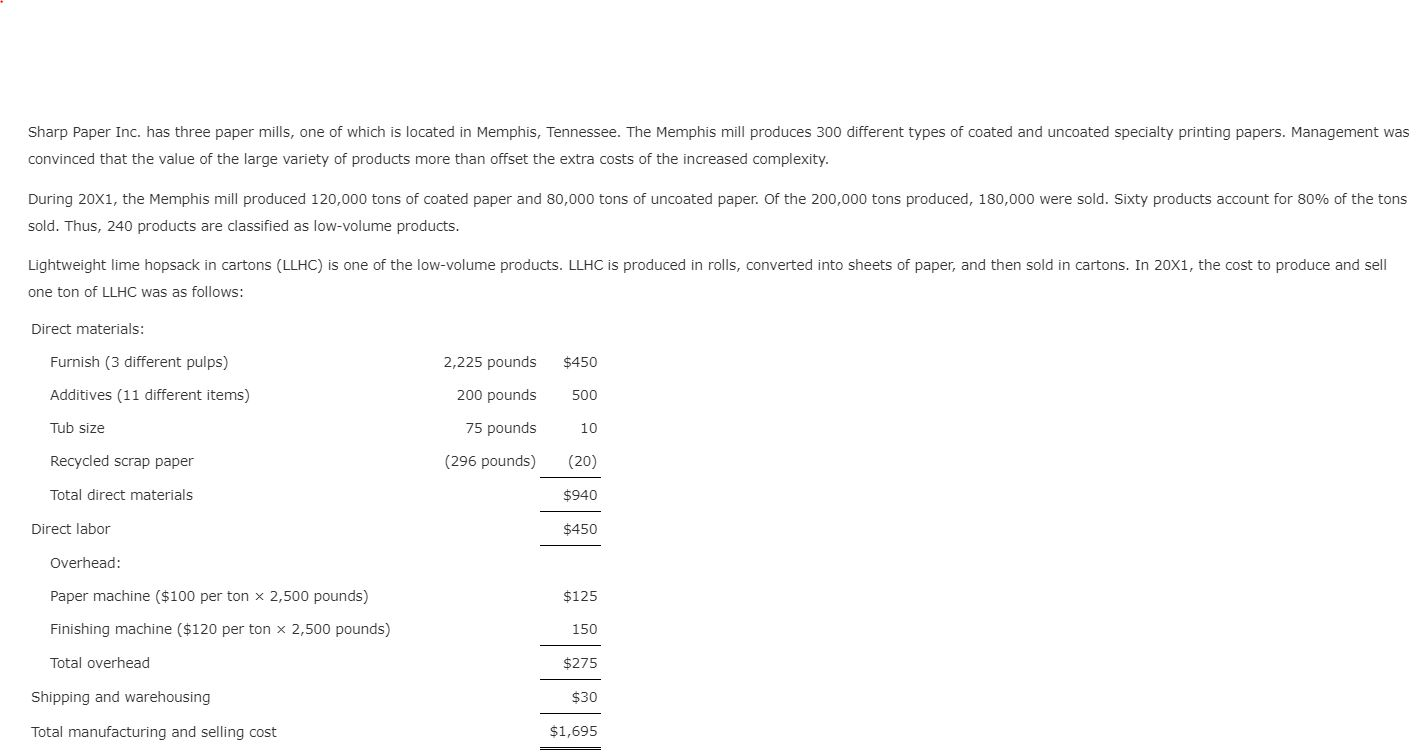

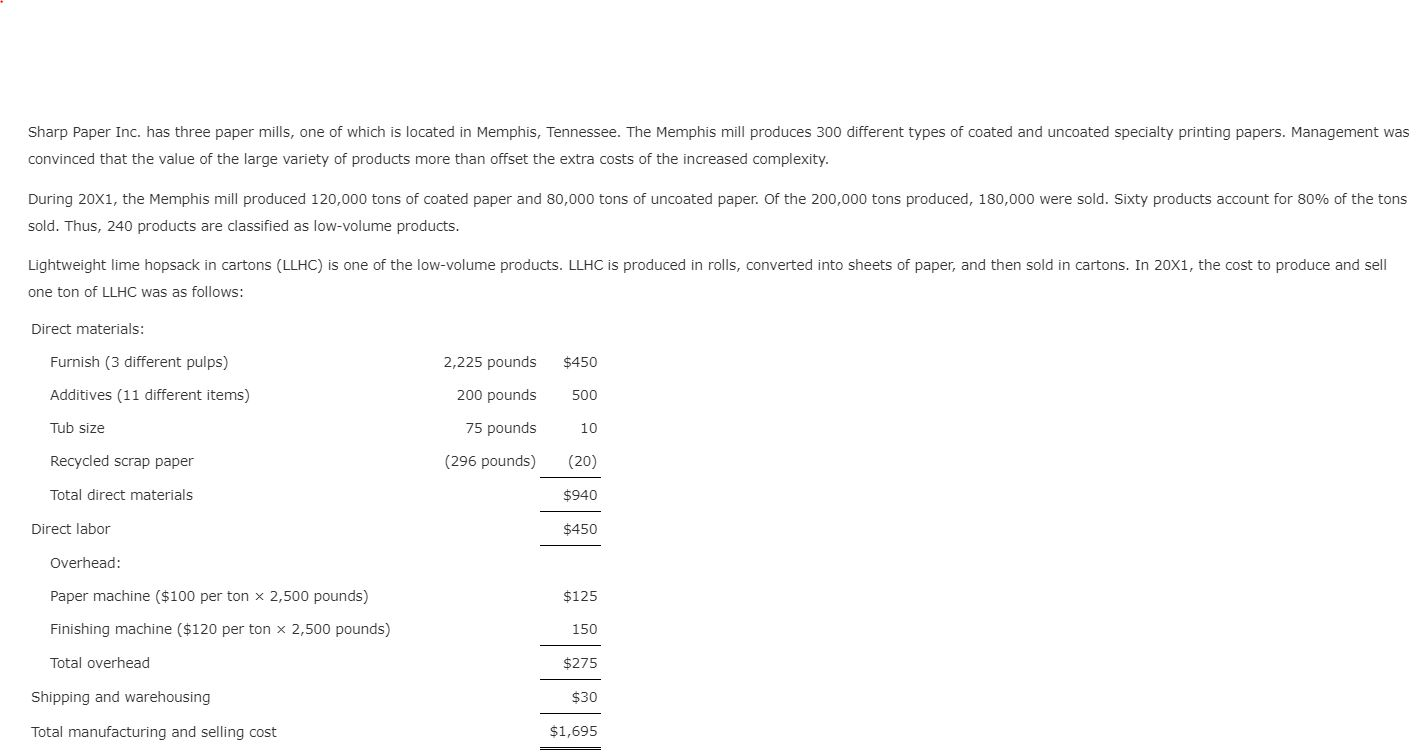

Sharp Paper Inc. has three paper mills, one of which is located in Memphis, Tennessee. The Memphis mill produces 300 different types of coated and uncoated specialty printing papers. Management was convinced that the value of the large variety of products more than offset the extra costs of the increased complexity. During 20x1, the Memphis mill produced 120,000 tons of coated paper and 80,000 tons of uncoated paper. Of the 200,000 tons produced, 180,000 were sold. Sixty products account for 80% of the tons sold. Thus, 240 products are classified as low-volume products. Lightweight lime hopsack in cartons (LLHC) is one of the low-volume products. LLHC is produced in rolls, converted into sheets of paper, and then sold in cartons. In 20x1, the cost to produce and sell one ton of LLHC was as follows: Direct materials: Furnish (3 different pulps) $450 500 Additives (11 different items) 2,225 pounds 200 pounds 75 pounds (296 pounds) Tub size 10 Recycled scrap paper (20) Total direct materials $940 Direct labor $450 Overhead: Paper machine ($100 per ton x 2,500 pounds) $125 Finishing machine ($120 per ton x 2,500 pounds) 150 Total overhead $275 Shipping and warehousing $30 Total manufacturing and selling cost $1,695 2. Compute the shipping and warehousing cost per ton of LLHC sold by using the new method suggested by Jennifer and Kaylin. Round rates and the cost per ton to two decimal places. Shipping and warehousing cost $ per ton sold. 3. Using the new costs computed in Requirement 2, compute the profit (or loss) per ton of LLHC. If necessary, round intermediate calculations and final answer to two decimal places. Use the minus sign to indicate loss. Revised profit (or loss) $ per ton of LLHC. Sharp Paper Inc. has three paper mills, one of which is located in Memphis, Tennessee. The Memphis mill produces 300 different types of coated and uncoated specialty printing papers. Management was convinced that the value of the large variety of products more than offset the extra costs of the increased complexity. During 20x1, the Memphis mill produced 120,000 tons of coated paper and 80,000 tons of uncoated paper. Of the 200,000 tons produced, 180,000 were sold. Sixty products account for 80% of the tons sold. Thus, 240 products are classified as low-volume products. Lightweight lime hopsack in cartons (LLHC) is one of the low-volume products. LLHC is produced in rolls, converted into sheets of paper, and then sold in cartons. In 20x1, the cost to produce and sell one ton of LLHC was as follows: Direct materials: Furnish (3 different pulps) $450 500 Additives (11 different items) 2,225 pounds 200 pounds 75 pounds (296 pounds) Tub size 10 Recycled scrap paper (20) Total direct materials $940 Direct labor $450 Overhead: Paper machine ($100 per ton x 2,500 pounds) $125 Finishing machine ($120 per ton x 2,500 pounds) 150 Total overhead $275 Shipping and warehousing $30 Total manufacturing and selling cost $1,695 2. Compute the shipping and warehousing cost per ton of LLHC sold by using the new method suggested by Jennifer and Kaylin. Round rates and the cost per ton to two decimal places. Shipping and warehousing cost $ per ton sold. 3. Using the new costs computed in Requirement 2, compute the profit (or loss) per ton of LLHC. If necessary, round intermediate calculations and final answer to two decimal places. Use the minus sign to indicate loss. Revised profit (or loss) $ per ton of LLHC