Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Center Strike 13 Calls/Puts TGT 1/21/22 C210 2 TGT 1/21/22 C2125 Ticker Bid 21-Jan-22 (0d); CSize 100; R .26; IFwd 216.06 5.80 3.65 1.77 Calls

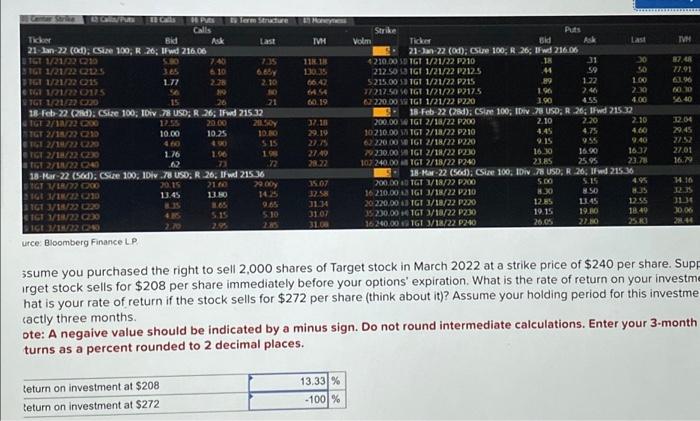

Center Strike 13 Calls/Puts TGT 1/21/22 C210 2 TGT 1/21/22 C2125 Ticker Bid 21-Jan-22 (0d); CSize 100; R .26; IFwd 216.06 5.80 3.65 1.77 Calls TGI 1/21/22 C215 TGT 1/21/22 (2175 TGT 1/21/22 C220 14 Puts Calls Return on investment at $208 Return on investment at $272 Ask 19 Term Structure 7.40 6.10 2.28 89 15 26 18-Feb-22 (28d); CSize 100; IDiv .78 USD; R 26; IFwd 215.32 TGT 2/18/22 C200 TGT 2/18/22 C210 17.55 20.00 10.00 10.25 TGT 2/18/22 C220 4.60 4.90 1.76 1.96 TGT 2/18/22 (230 TGT 2/18/22 C240 62 73 18-Mar-22 (56d); CSize 100; 1Div .78 USD; R.26; IFwd 215.36 TGT 3/18/22 (200 20.15 21GI 3/18/22 C210 13.45 TGT 3/18/22 (220 8.35 TGT 3/18/22 C230 4.85 IGI 3/18/22 C240 2.70 urce: Bloomberg Finance L.P. 21.60 13.80 8.65 5.15 2.95 Last 7.35 6.65y 2.10 80 21 28.50y 10.80 5.15 1.98 72 9. Dng 14.25 9.65 5.10 2.85 Moneyness IVM 118.18 130.35 66.42 60.19 37.18 29.19 27.75 27.49 28.22 35.07 32.58 31.34 31.07 31.08 Volm 13.33 % -100% Strike Ticker Bid 21-Jan-22 (0d); CSize 100; R 26; IFwd 216.06 .18 4210.00 SD TGT 1/21/22 P210 212.50 58 TGT 1/21/22 P212.5 5215.00 SD TGT 1/21/22 P215 77 217.50 54 TGT 1/21/22 P217.5 62 220,00 55) TGT 1/21/22 P220 Puts .89 1.96 3.90 Ask 31 59 1.22 2.46 4.55 2.20 4.75 9.55 16.90 25.95 Last 18-Feb-22 (28d); CSize 100; IDiv.78 USD; R 26; IFwd 215.32 200.00 5TGT 2/18/22 P200 10 210.00 37 TGT 2/18/22 P210 62 220.00 58 TGT 2/18/22 P220 79 230.00 5TGT 2/18/22 P230 102 240.00 60 TGT 2/18/22 P240 5.15 8.50 13.45 19.80 27.80 1.00 2.30 4.00 30 50 2.10 4.45 9.15 16.30 23.85 5.00 8.30 18-Mar-22 (56d); CSize 100; IDiv 78 USD; R .26; IFwd 215.36 200.00 61 TGT 3/18/22 P200 16 210.00 6 TGT 3/18/22 P210 20 220.00 60 TGT 3/18/22 P220 35 230.00 641 TGT 3/18/22 P230 16 240.00 65) TGT 3/18/22 P240 12.85 19.15 26.05 2.10 4.60 9.40 16.37 23.78 4.95 8.35 12.55 18.49 25.83 IVM 87.48 77.91 63.96 60.30 56.40 32.04 29.45 27.52 27.01 16.79 ssume you purchased the right to sell 2,000 shares of Target stock in March 2022 at a strike price of $240 per share. Supp irget stock sells for $208 per share immediately before your options' expiration. What is the rate of return on your investme hat is your rate of return if the stock sells for $272 per share (think about it)? Assume your holding period for this investme cactly three months. ote: A negaive value should be indicated by a minus sign. Do not round intermediate calculations. Enter your 3-month turns as a percent rounded to 2 decimal places. 34.16 32.35 31.34 30.06 28.44

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started