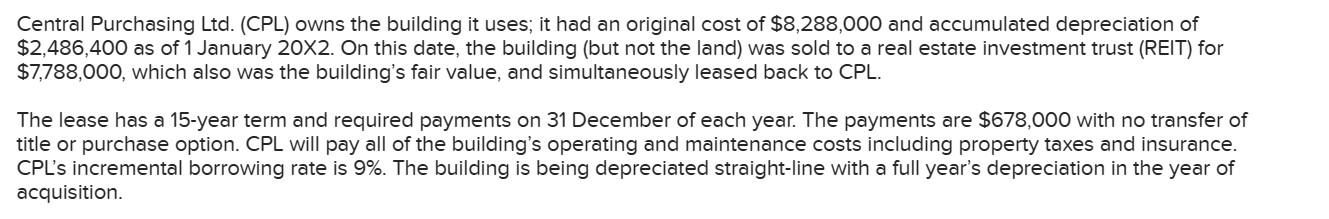

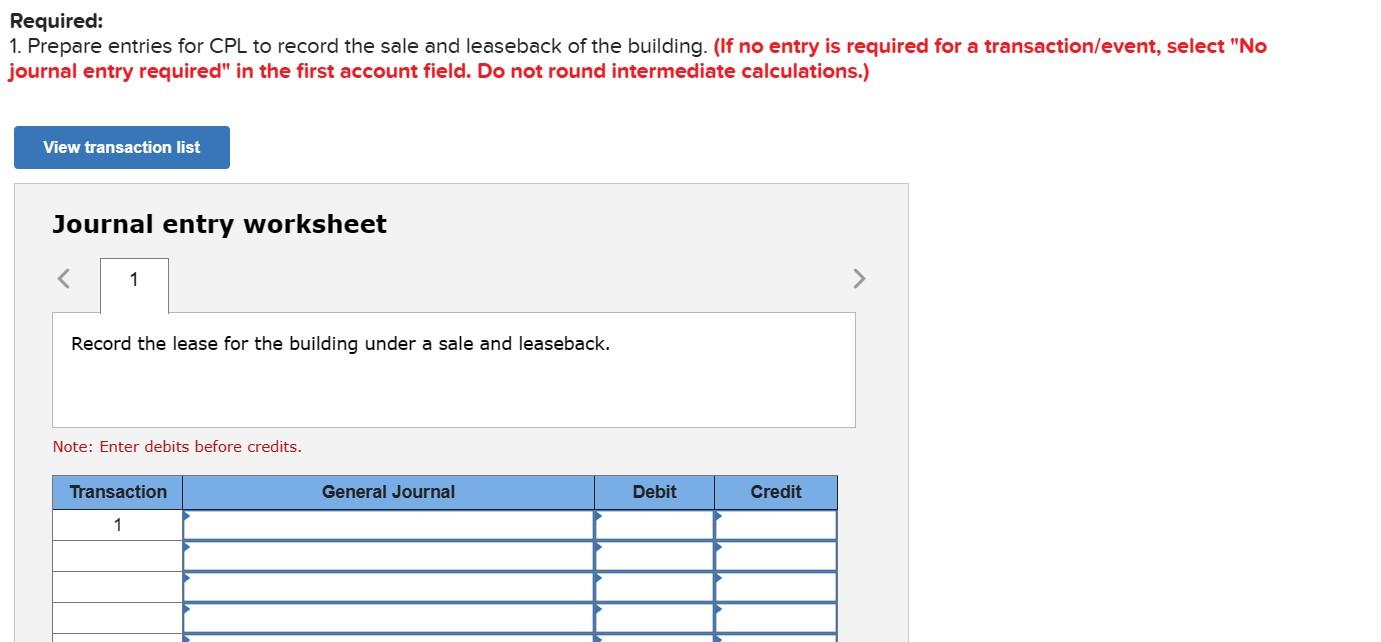

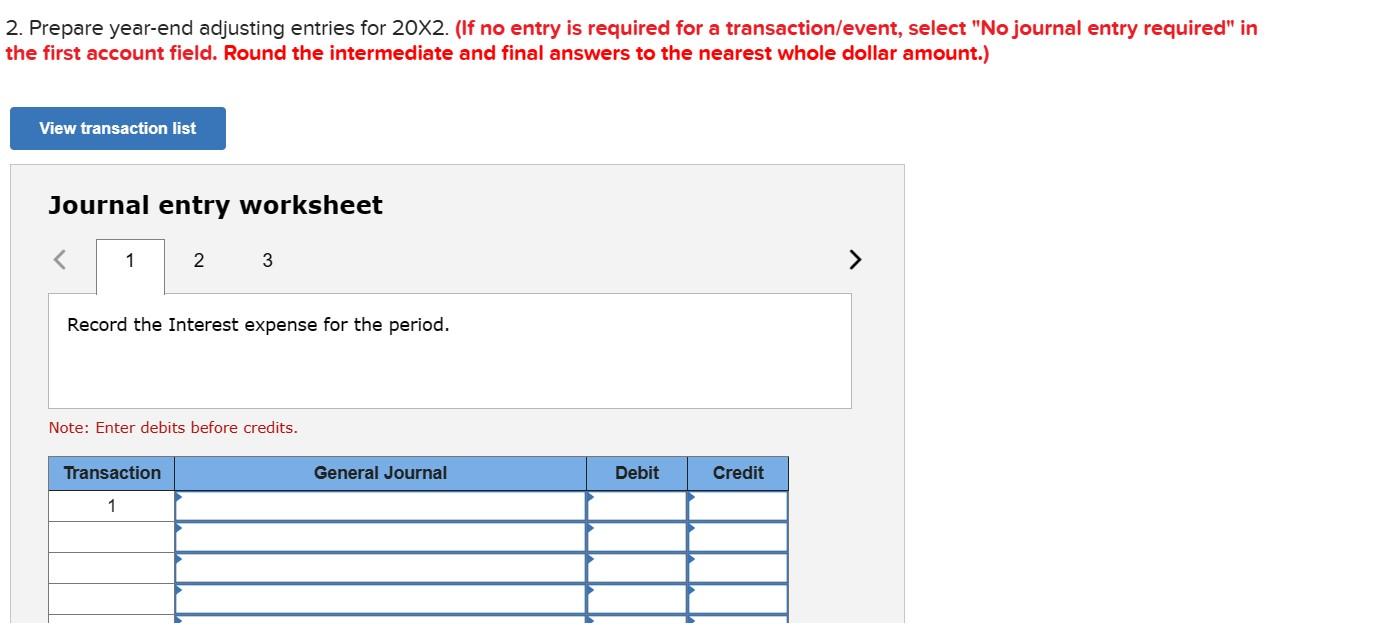

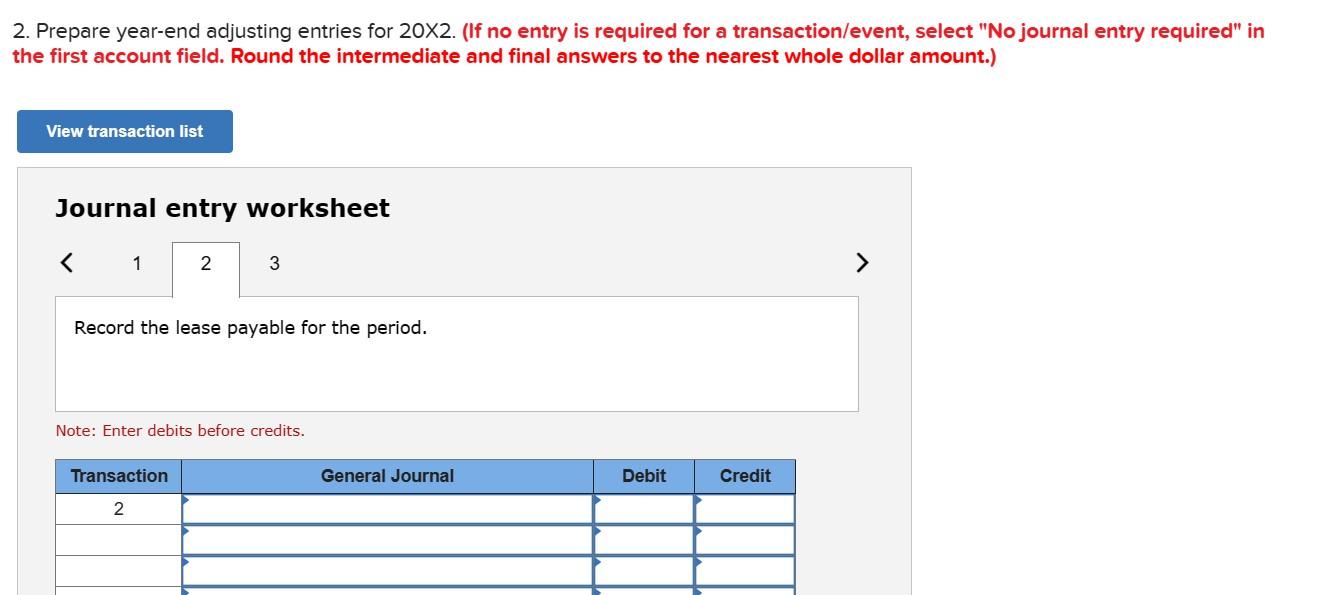

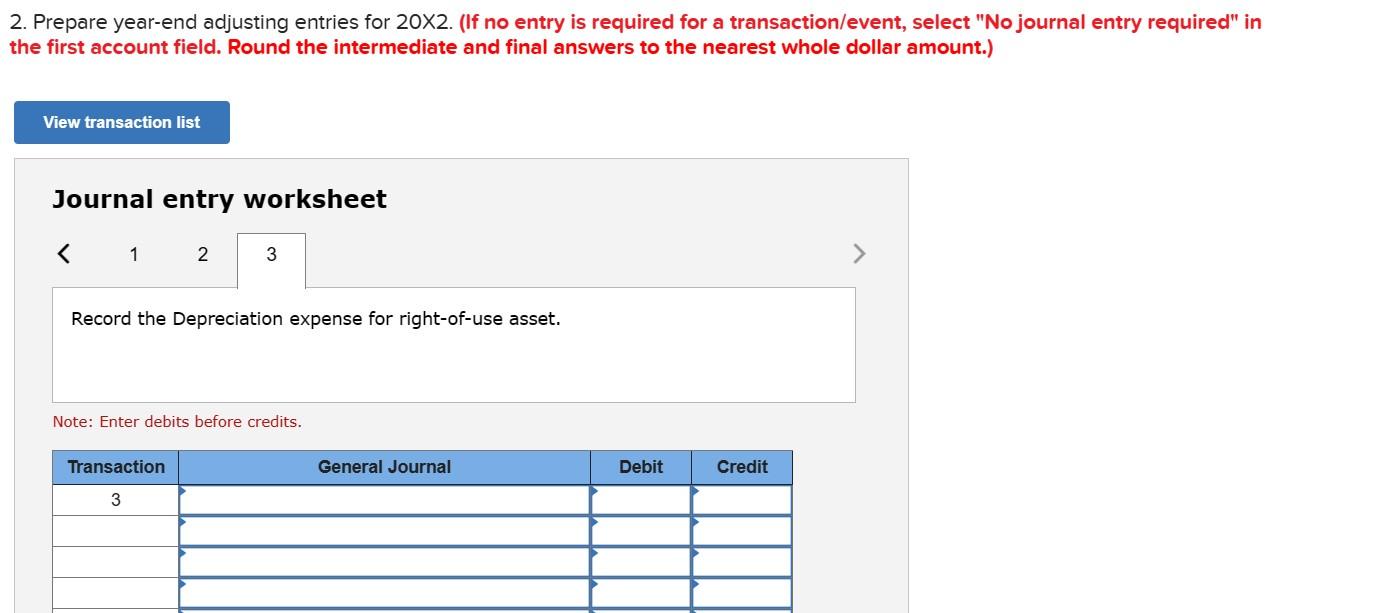

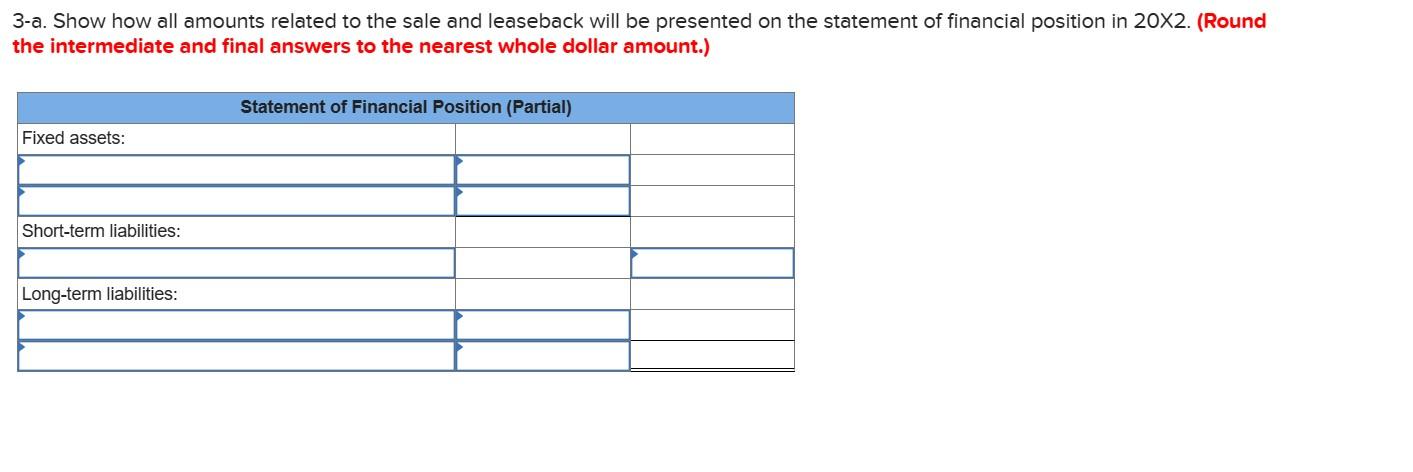

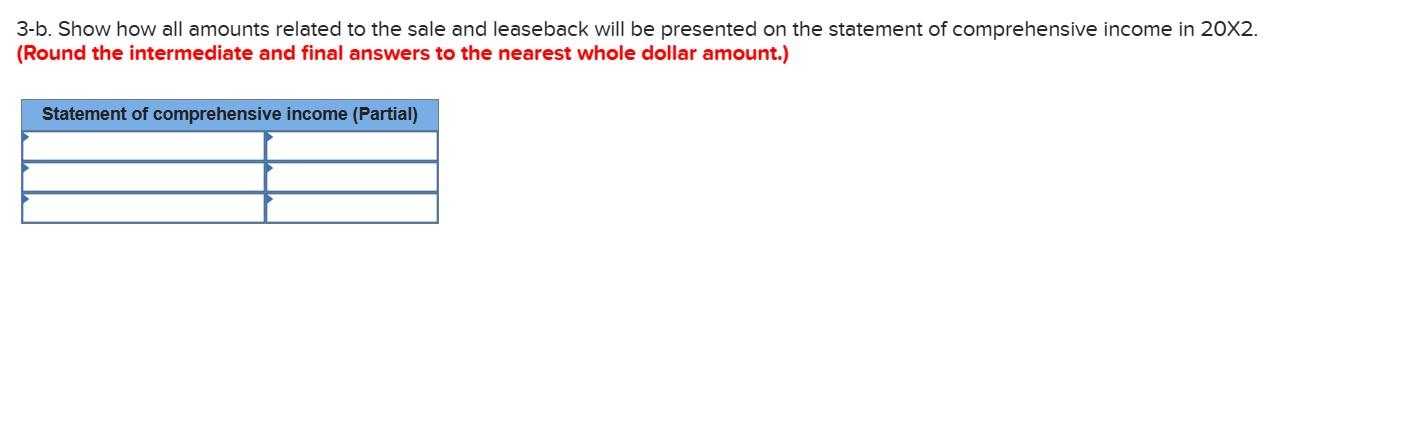

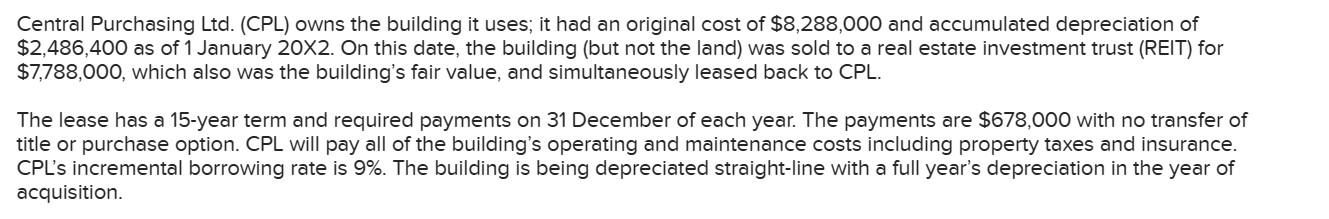

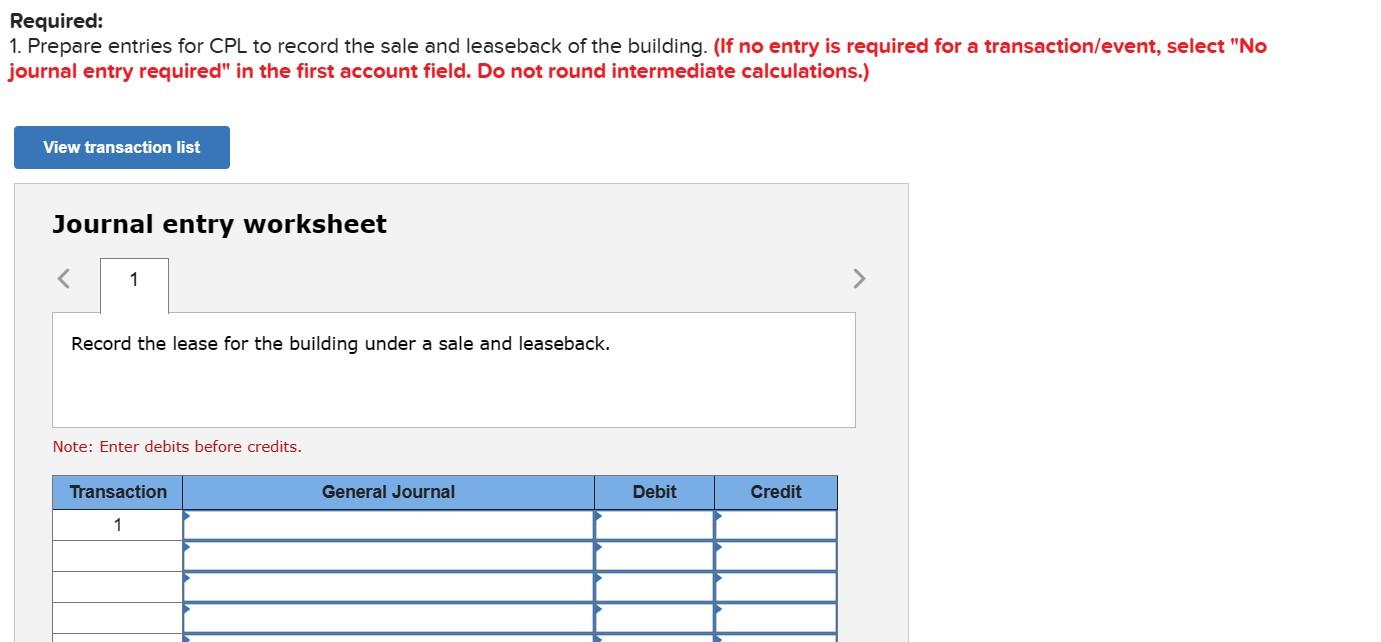

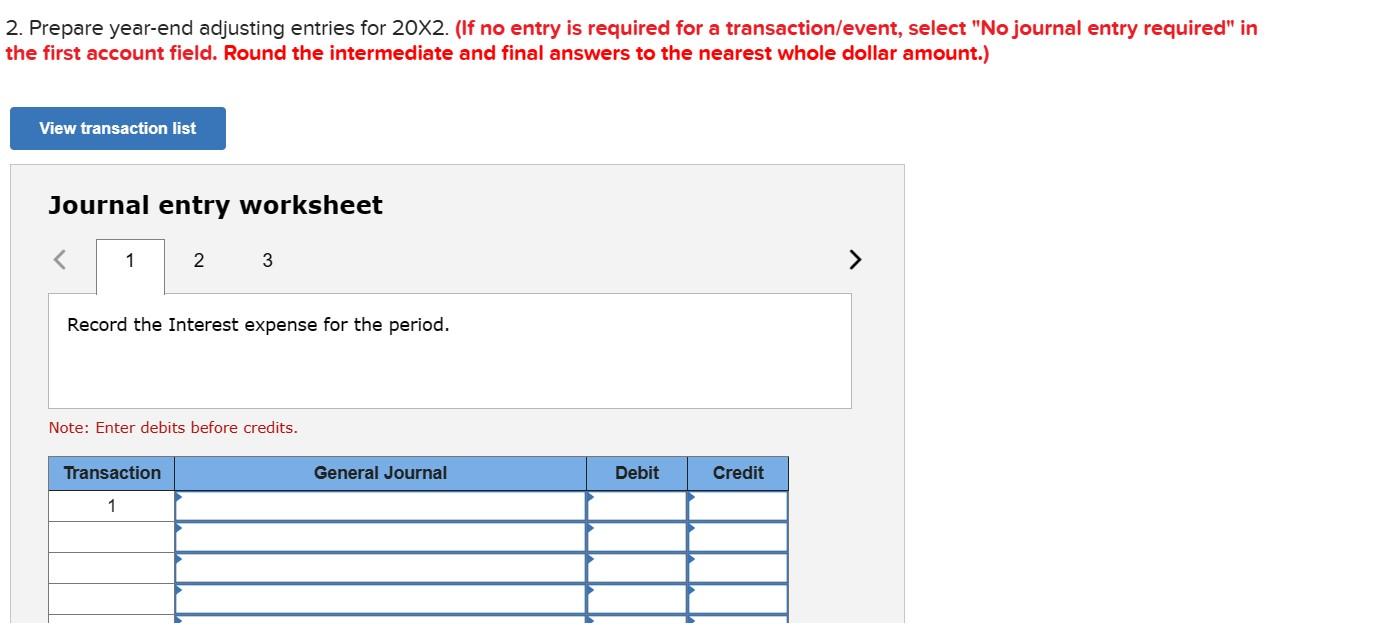

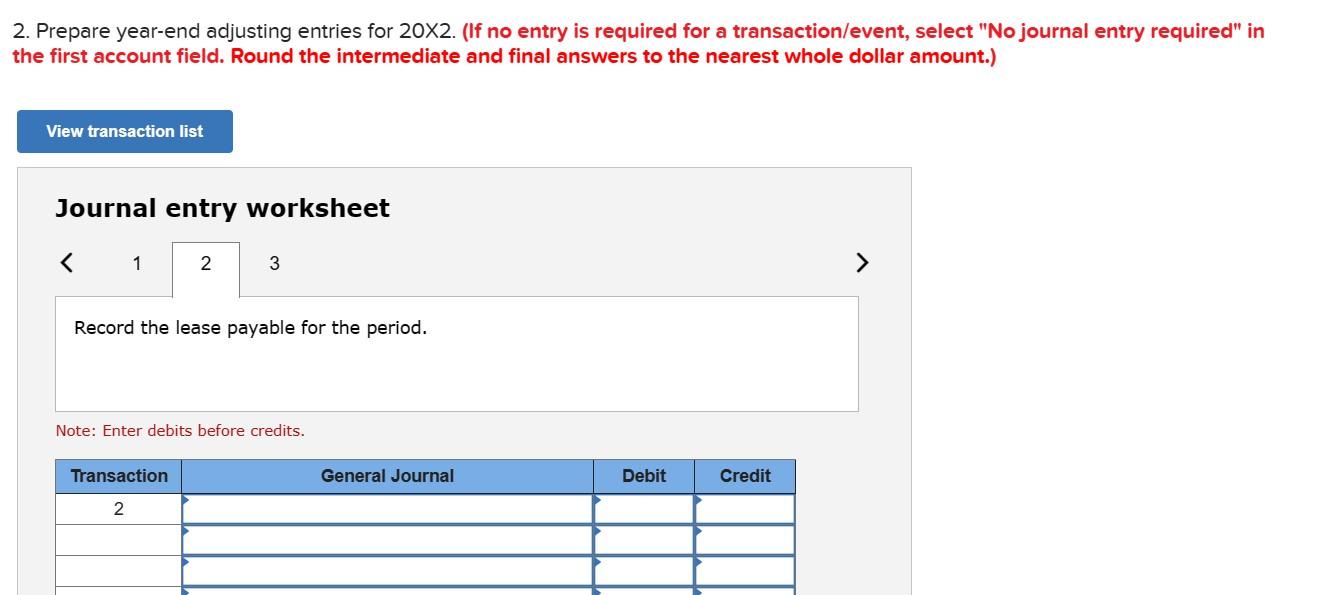

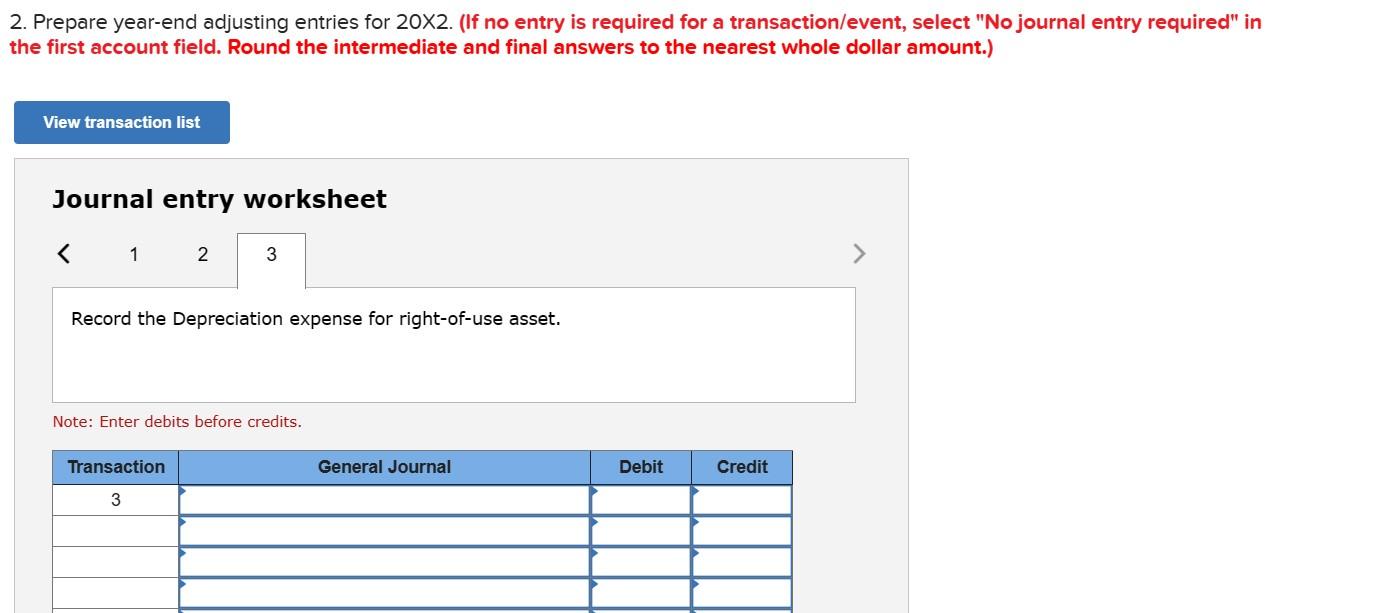

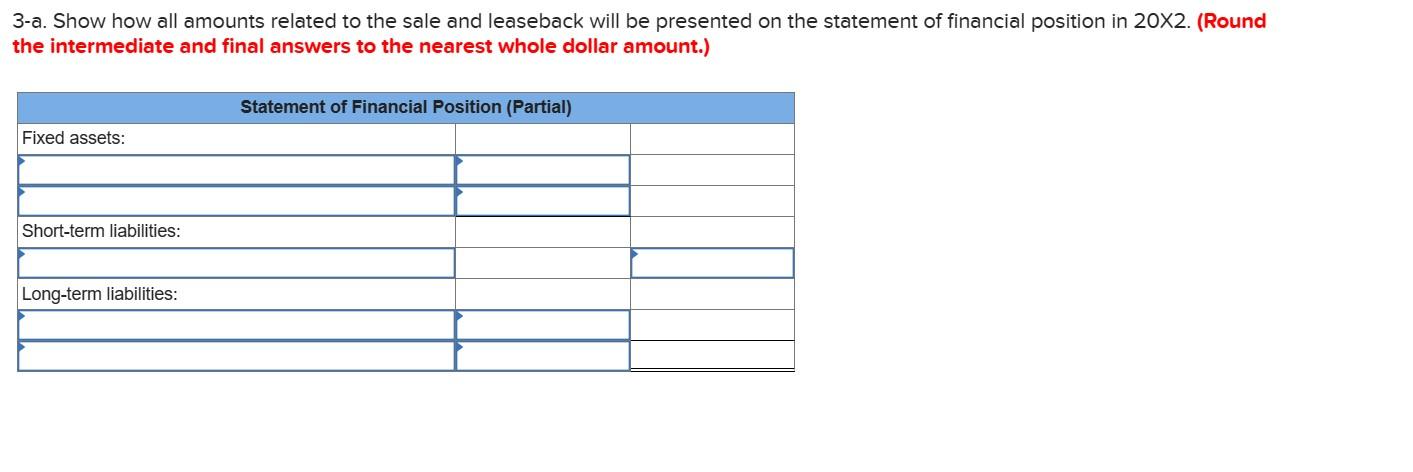

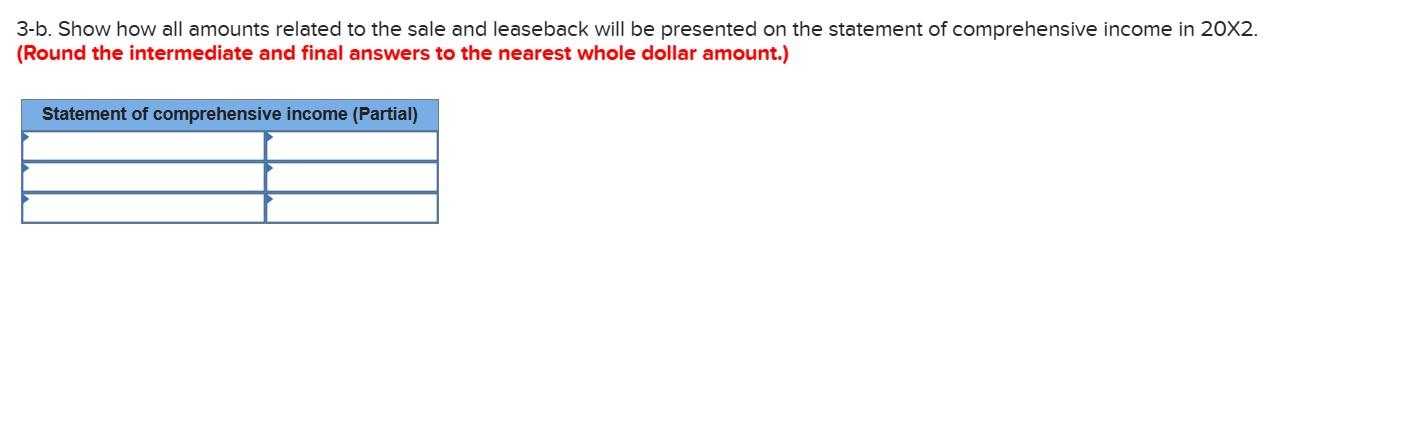

Central Purchasing Ltd. (CPL) owns the building it uses; it had an original cost of $8,288,000 and accumulated depreciation of $2,486,400 as of 1 January 202. On this date, the building (but not the land) was sold to a real estate investment trust (REIT) for $7,788,000, which also was the building's fair value, and simultaneously leased back to CPL. The lease has a 15 -year term and required payments on 31 December of each year. The payments are $678,000 with no transfer of title or purchase option. CPL will pay all of the building's operating and maintenance costs including property taxes and insurance. CPL's incremental borrowing rate is 9%. The building is being depreciated straight-line with a full year's depreciation in the year of acquisition. Required: 1. Prepare entries for CPL to record the sale and leaseback of the building. (If no entry is required for a transaction/event, select "No ournal entry required" in the first account field. Do not round intermediate calculations.) Journal entry worksheet Record the lease for the building under a sale and leaseback. Note: Enter debits before credits. Prepare year-end adjusting entries for 202. (If no entry is required for a transaction/event, select "No journal entry required" in he first account field. Round the intermediate and final answers to the nearest whole dollar amount.) Journal entry worksheet rvole: ciller uedils veiore creuls. 2. Prepare year-end adjusting entries for 202. (If no entry is required for a transaction/event, select "No journal entry required" in he first account field. Round the intermediate and final answers to the nearest whole dollar amount.) Journal entry worksheet Note: Enter debits before credits. Prepare year-end adjusting entries for 202. (If no entry is required for a transaction/event, select "No journal entry required" in he first account field. Round the intermediate and final answers to the nearest whole dollar amount.) Journal entry worksheet Record the Depreciation expense for right-of-use asset. Note: Enter debits before credits. 3-a. Show how all amounts related to the sale and leaseback will be presented on the statement of financial position in 202. (Round ihe intermediate and final answers to the nearest whole dollar amount.) 3-b. Show how all amounts related to the sale and leaseback will be presented on the statement of comprehensive income in 202 (Round the intermediate and final answers to the nearest whole dollar amount.)