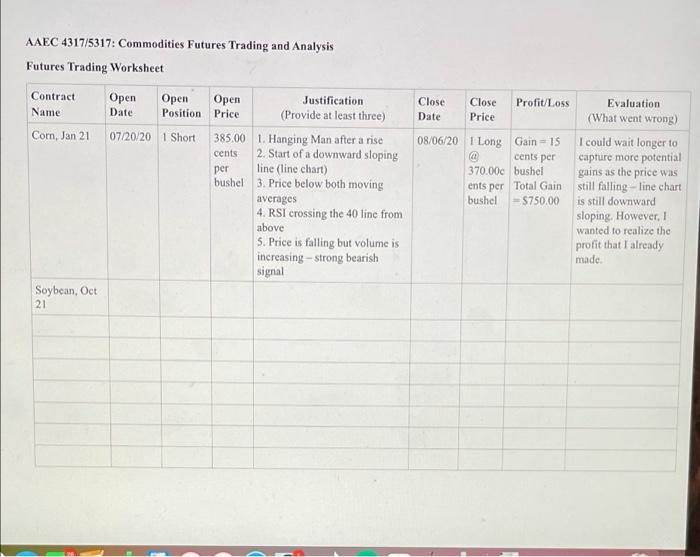

cents AAEC 4317/5317: Commodities Futures Trading and Analysis Futures Trading Worksheet Contract Open Open Open Justification Name Date Position Price (Provide at least three) Com, Jan 21 07/20/20 1 Short 385.00 1. Hanging Man after a rise 2. Start of a downward sloping per line (line chart) bushel 3. Price below both moving averages 4. RSI crossing the 40 line from above S. Price is falling but volume is increasing - strong bearish signal Soybean, Oct 21 Close Close Profit/Loss Evaluation Date Price (What went wrong) 08/06/20 1 Long Gain -15 I could wait longer to cents per capture more potential 370.000 bushel gains as the price was ents per Total Gainstill falling --line chart bushel - $750,00 is still downward sloping. However, 1 wanted to realize the profit that I already made Instructions: 1. There are 10 rows in the table (apart from the row for column heads). These are for 10 trades of commodity or financial futures contracts in the remaining 10 weeks - each row is for a specific trade. 2. Each week, you need to open 1 position (long or short) in one of the futures contracts listed in exchanges. List the contract name, date, position, and open price in the first 4 column as indicated. In the 5 column titled "Justification provide at least three reasons for taking the long or short position. Reasonable justifications include fundamental and technical analyses as shown in the example 3. You may close the position later that week or in the following weeks. List the closing date, price, and resulting profit or loss 4. Evaluate your trade in the last column - state what you did right or what mistakes you made, and what you have learned from this trade. 5. Save a copy of this page for your own trade, delete the contents of the first row and instructions, and save the file for your trading 6. Upon completion of all 10 trades, please turn in the completed document with your name written on the first page 7. You may add rows to the table if you want to show the results of more than 10 trades. cents AAEC 4317/5317: Commodities Futures Trading and Analysis Futures Trading Worksheet Contract Open Open Open Justification Name Date Position Price (Provide at least three) Com, Jan 21 07/20/20 1 Short 385.00 1. Hanging Man after a rise 2. Start of a downward sloping per line (line chart) bushel 3. Price below both moving averages 4. RSI crossing the 40 line from above S. Price is falling but volume is increasing - strong bearish signal Soybean, Oct 21 Close Close Profit/Loss Evaluation Date Price (What went wrong) 08/06/20 1 Long Gain -15 I could wait longer to cents per capture more potential 370.000 bushel gains as the price was ents per Total Gainstill falling --line chart bushel - $750,00 is still downward sloping. However, 1 wanted to realize the profit that I already made Instructions: 1. There are 10 rows in the table (apart from the row for column heads). These are for 10 trades of commodity or financial futures contracts in the remaining 10 weeks - each row is for a specific trade. 2. Each week, you need to open 1 position (long or short) in one of the futures contracts listed in exchanges. List the contract name, date, position, and open price in the first 4 column as indicated. In the 5 column titled "Justification provide at least three reasons for taking the long or short position. Reasonable justifications include fundamental and technical analyses as shown in the example 3. You may close the position later that week or in the following weeks. List the closing date, price, and resulting profit or loss 4. Evaluate your trade in the last column - state what you did right or what mistakes you made, and what you have learned from this trade. 5. Save a copy of this page for your own trade, delete the contents of the first row and instructions, and save the file for your trading 6. Upon completion of all 10 trades, please turn in the completed document with your name written on the first page 7. You may add rows to the table if you want to show the results of more than 10 trades