Question

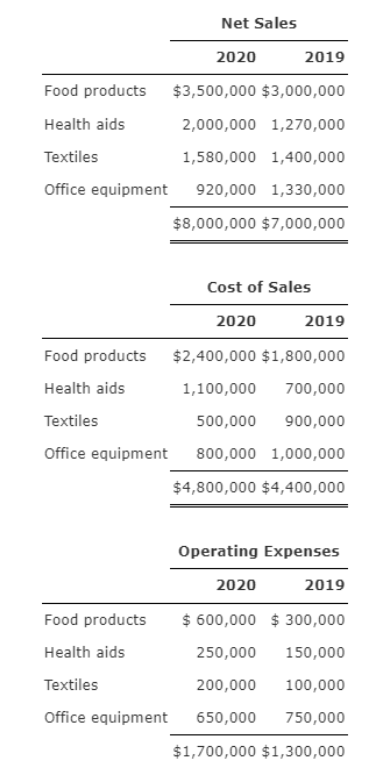

Century Company, a diversified manufacturing company, had four separate operating divisions engaged in the manufacture of products in each of the following areas: food products,

Century Company, a diversified manufacturing company, had four separate operating divisions engaged in the manufacture of products in each of the following areas: food products, health aids, textiles, and office equipment. Financial data for the 2 years ended December 31, 2020 and 2019 are presented here:

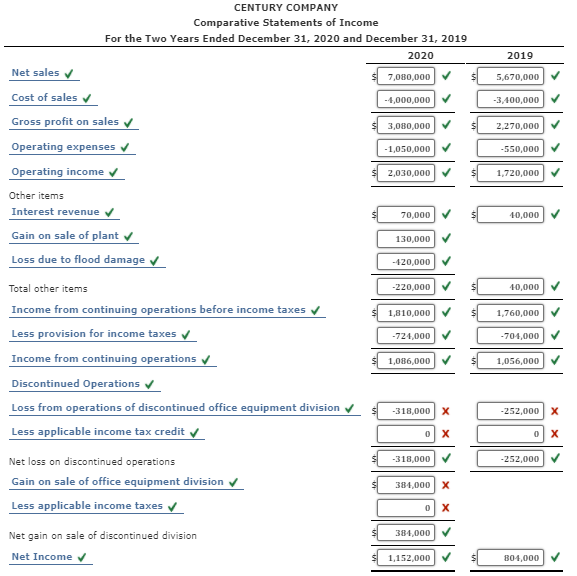

On January 1, 2020, Century adopted a plan to sell the assets and product line of the office equipment division and considered it a component of the company. On September 1, 2020, the division's assets and product line were sold for $2,100,000 cash, resulting in a gain of $640,000.

The company's textiles division had six manufacturing plants that produced a variety of textile products. In April 2020, the company sold one of these plants and realized a gain of $130,000. After the sale, the operations at the plant that was sold were transferred to the remaining five textile plants which the company continued to operate.

In August 2020, the main warehouse of the food products division, located on the banks of the Bayer River, was flooded when the river overflowed. The resulting damage of $420,000 is not included in the financial data given previously. Historical records indicate that the Bayer River normally overflows every 4 to 5 years, causing flood damage to adjacent property.

For the 2 years ended December 31, 2020 and 2019, the companys investments generated interest income of $70,000 and $40,000, respectively.

The provision for income tax expense for each of the 2 years should be computed at a rate of 40%.

Required:

Prepare in proper form a multiple-step comparative income statement for Century for the 2 years ended December 31, 2020, and December 31, 2019. Earnings per share information and footnotes are not required.

I have got most of them correct and I only need to know couple of them. Please use the exactly same format, thank you!

Net Sales 2020 2019 Food products $3,500,000 $3,000,000 Health aids 2,000,000 1,270,000 Textiles 1,580,000 1,400,000 Office equipment 920,000 1,330,000 $8,000,000 $7,000,000 Cost of Sales 2020 2019 Food products $2,400,000 $1,800,000 Health aids 1,100,000 700,000 Textiles 500,000 900,000 Office equipment 800,000 1,000,000 $4,800,000 $4,400,000 Operating Expenses 2020 2019 Food products $ 600,000 $ 300,000 Health aids 250,000 150,000 Textiles 200,000 100,000 Office equipment 650,000 750,000 $1,700,000 $1,300,000 2019 5,670,000 -3,400,000 s 2.270,000 CENTURY COMPANY Comparative Statements of Income For the Two Years Ended December 31, 2020 and December 31, 2019 2020 Net sales 7,080,000 Cost of sales - 1,000,000 Gross profit on sales 3,080,000 Operating expenses - 1,050,000 Operating income 2,030,000 Other items Interest revenue 70,000 Gain on sale of plant 130,000 Loss due to flood damage - 420,000 -550,000 1,720,000 10,000 -220,000 10,000 1,810,000 1,760,000 -724,000 -704,000 1,086,000 1,056,000 -318,000 X -252,000 X Total other items Income from continuing operations before income taxes Less provision for income taxes Income from continuing operations Discontinued Operations Loss from operations of discontinued office equipment division Less applicable income tax credit Net loss on discontinued operations Gain on sale of office equipment division Less applicable income taxes Net gain on sale of discontinued division Net Income 0 X 0 x -318.000 -252,000 384,000 X OX 384,000 1,152,000 804,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started