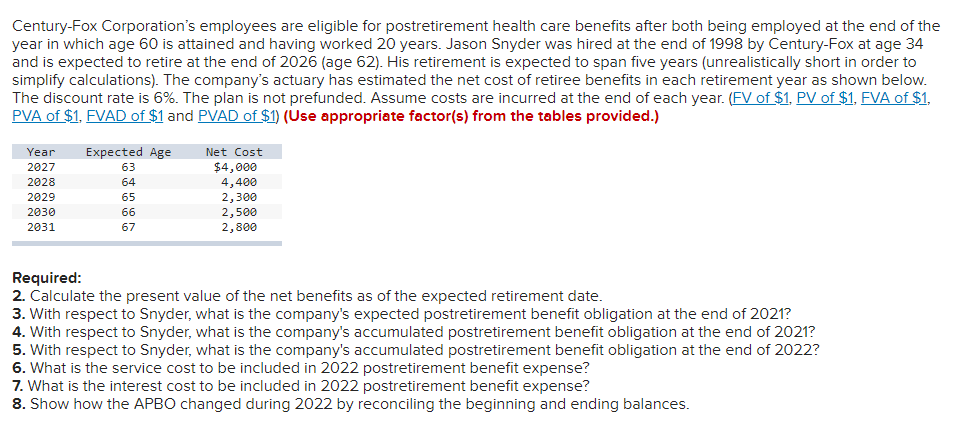

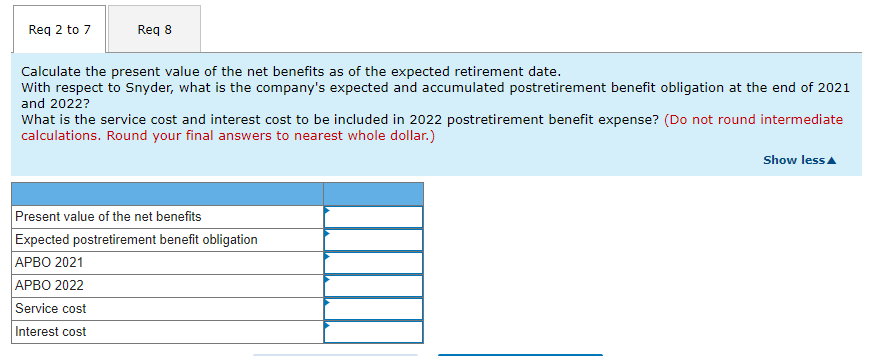

Century-Fox Corporation's employees are eligible for postretirement health care benefits after both being employed at the end of the year in which age 60 is attained and having worked 20 years. Jason Snyder was hired at the end of 1998 by Century-Fox at age 34 and is expected to retire at the end of 2026 (age 62). His retirement is expected to span five years (unrealistically short in order to simplify calculations). The company's actuary has estimated the net cost of retiree benefits in each retirement year as shown below. The discount rate is 6%. The plan is not prefunded. Assume costs are incurred at the end of each year. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 ) (Use appropriate factor(s) from the tables provided.) Required: 2. Calculate the present value of the net benefits as of the expected retirement date. 3. With respect to Snyder, what is the company's expected postretirement benefit obligation at the end of 2021 ? 4. With respect to Snyder, what is the company's accumulated postretirement benefit obligation at the end of 2021? 5. With respect to Snyder, what is the company's accumulated postretirement benefit obligation at the end of 2022 ? 6. What is the service cost to be included in 2022 postretirement benefit expense? 7. What is the interest cost to be included in 2022 postretirement benefit expense? 8. Show how the APBO changed during 2022 by reconciling the beginning and ending balances. Calculate the present value of the net benefits as of the expected retirement date. With respect to Snyder, what is the company's expected and accumulated postretirement benefit obligation at the end of 2021 and 2022 ? What is the service cost and interest cost to be included in 2022 postretirement benefit expense? (Do not round intermediate calculations. Round your final answers to nearest whole dollar.) Century-Fox Corporation's employees are eligible for postretirement health care benefits after both being employed at the end of the year in which age 60 is attained and having worked 20 years. Jason Snyder was hired at the end of 1998 by Century-Fox at age 34 and is expected to retire at the end of 2026 (age 62). His retirement is expected to span five years (unrealistically short in order to simplify calculations). The company's actuary has estimated the net cost of retiree benefits in each retirement year as shown below. The discount rate is 6%. The plan is not prefunded. Assume costs are incurred at the end of each year. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 ) (Use appropriate factor(s) from the tables provided.) Required: 2. Calculate the present value of the net benefits as of the expected retirement date. 3. With respect to Snyder, what is the company's expected postretirement benefit obligation at the end of 2021 ? 4. With respect to Snyder, what is the company's accumulated postretirement benefit obligation at the end of 2021? 5. With respect to Snyder, what is the company's accumulated postretirement benefit obligation at the end of 2022 ? 6. What is the service cost to be included in 2022 postretirement benefit expense? 7. What is the interest cost to be included in 2022 postretirement benefit expense? 8. Show how the APBO changed during 2022 by reconciling the beginning and ending balances. Calculate the present value of the net benefits as of the expected retirement date. With respect to Snyder, what is the company's expected and accumulated postretirement benefit obligation at the end of 2021 and 2022 ? What is the service cost and interest cost to be included in 2022 postretirement benefit expense? (Do not round intermediate calculations. Round your final answers to nearest whole dollar.)