Answered step by step

Verified Expert Solution

Question

1 Approved Answer

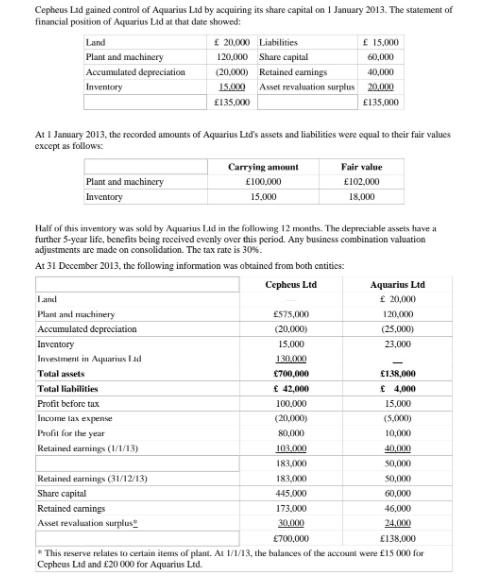

Cepheus Lad gained control of Aquarius Lid by acquiring its share capital on 1 January 2013. The statement of financial position of Aquarius Lid

Cepheus Lad gained control of Aquarius Lid by acquiring its share capital on 1 January 2013. The statement of financial position of Aquarius Lid at that date showed: Land Plant and machinery Accumulated depreciation Inventory Plant and machinery Inventory At 1 January 2013, the recorded amounts of Aquarius Ltd's assets and liabilities were equal to their fair values except as follows: Land Plant and machinery Accumulated depreciation Inventory Investment in Aquarius Lad 20,000 Liabilities 120,000 Share capital (20,000) Retained earnings 15.000 Asset revaluation surplus 135,000 Total assets Total liabilities Profit before tax Income tax expense Profit for the year Retained earnings (1/1/13) Retained earnings (31/12/13) Share capital Retained earnings Asset revaluation surplus 15,000 60,000 40,000 20.000 135,000 Carrying amount 100,000 15,000 Half of this inventory was sold by Aquarius Lid in the following 12 months. The depreciable assets have a further 5-year life, benefits being received evenly over this period. Any business combination valuation adjustments are made on consolidation. The tax rate is 30%. At 31 December 2013, the following information was obtained from both entities: Cepheus Ltd Fair value 102,000 18,000 $75,000 (20,000) 15,000 130.000 700,000 42,000 100,000 15,000 (20,000) (5,000) 80,000 10,000 103,000 40,000 183,000 50,000 183,000 50,000 445.000 60,000 173.000 46,000 30,000 24,000 700,000 138,000 *This reserve relates to certain items of plant. At 1/1/13, the balances of the account were 15 000 for Cepheus Ltd and 20 000 for Aquarius Ltd. Aquarius Ltd 20,000 120,000 (25,000) 23,000 138,000 4,000 Required 1. Prepare the consolidated financial statements (Statement of profit and loss and other comprehensive income & Statement of financial position) for Cepheus Ltd at 31 December 2013. 2. Prepare the valuation and pre-acquisition entries at 31 December 2017.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Consolidated Statement of Profit and Loss and Other Comprehensive Income Amount Sales Revenue 165000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started