Question

Certain transactions and procedures relating to federal and state unemployment taxes follow for Robins Nest LLC, a retail store owned by Robin Roberts. The firms

Certain transactions and procedures relating to federal and state unemployment taxes follow for Robins Nest LLC, a retail store owned by Robin Roberts. The firms address is 2007 Lovely Lane, Dallas, TX 75268-0967. The firms phone number is 972-456-1200.The employers federal and state identification numbers are 75-9462315 and 37-9462315, respectively. Carry out the procedures as instructed in each of the following steps.

Problem 11.5A (Algo) Computing and recording unemployment taxes; completing Form 940. LO 11-6, 11-7

| Quarter Ended | Total Wages Paid | Wages Paid in Excess of $7,000 | State Unemployment Tax Paid | |||||||||

| Mar. | 31 | $ | 24,663.00 | -0- | $ | 419.27 | ||||||

| June | 30 | 62,400.00 | 3,880.00 | 994.84 | ||||||||

| Sept. | 30 | 35,100.00 | 21,770.00 | 226.61 | ||||||||

| Dec. | 31 | 38,800.00 | 33,960.00 | 82.28 | ||||||||

| Totals | $ | 160,963.00 | $ | 59,610.00 | $ | 1,723.00 | ||||||

Required:

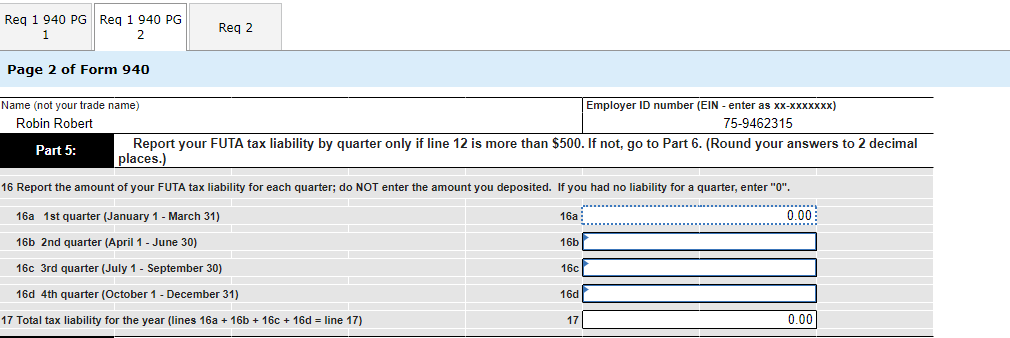

Complete Form 940, the Employers Annual Federal Unemployment Tax Return. Assume that all wages have been paid and that all quarterly payments have been submitted to the state as required. The payroll information for 20X1 appears above. The federal tax deposits were submitted as follows: a deposit of $147.98 on April 21, a deposit of $351.12 on July 22, and a deposit of $79.98 on October 21. Date the unemployment tax return January 28, 20X2. A check for the balance due as per line 14, Part 4, will be sent with Form 940.

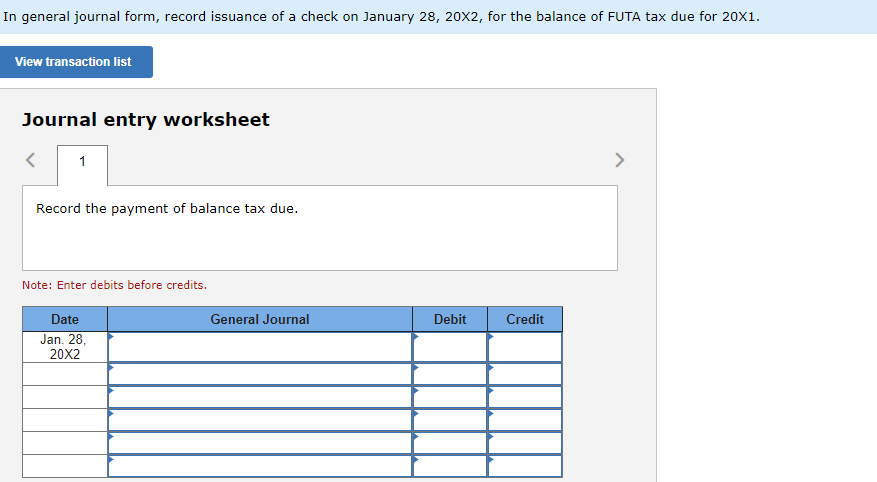

In general journal form, record issuance of a check on January 28, 20X2, for the balance of FUTA tax due for 20X1.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started