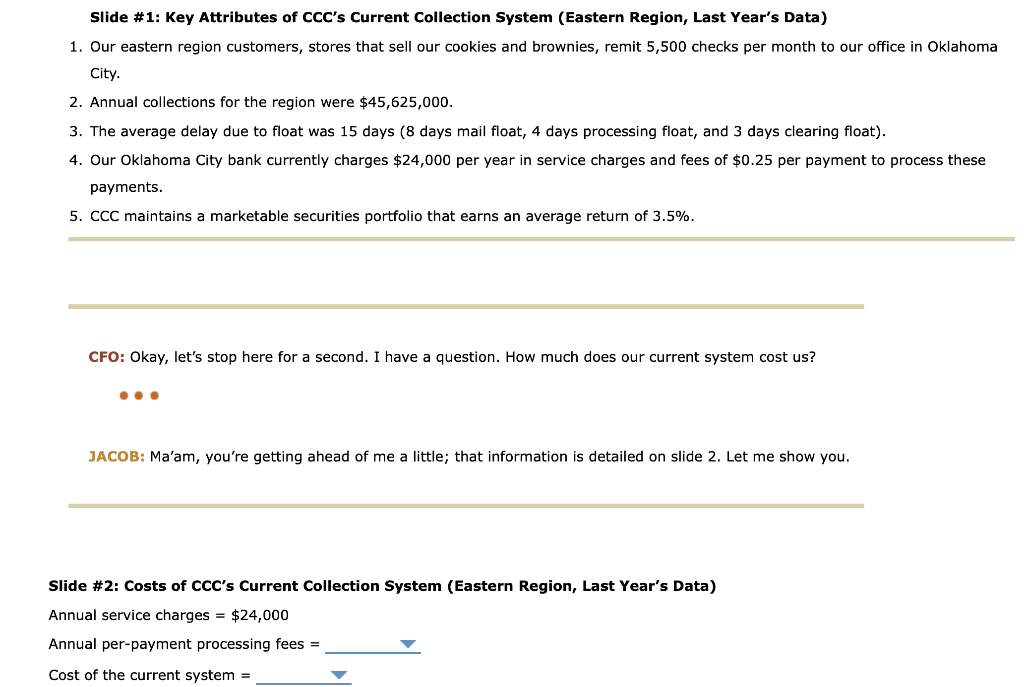

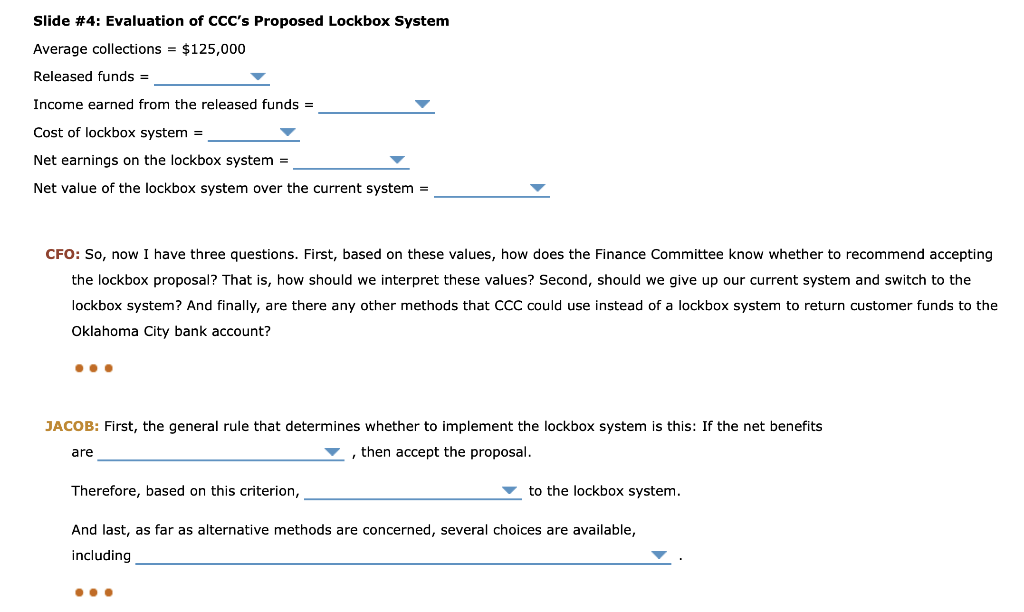

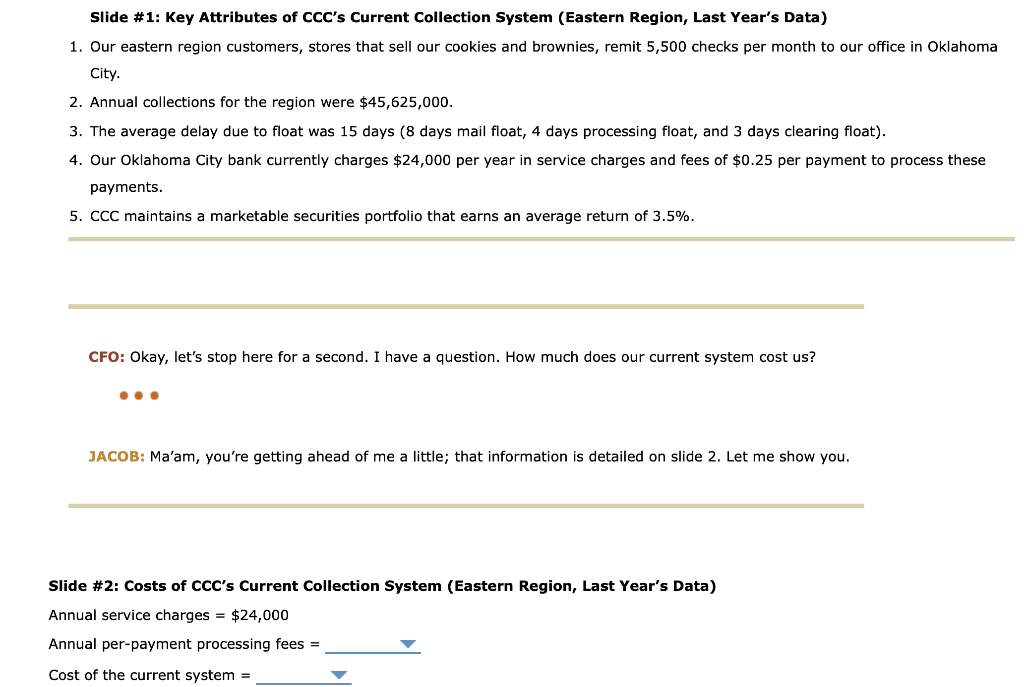

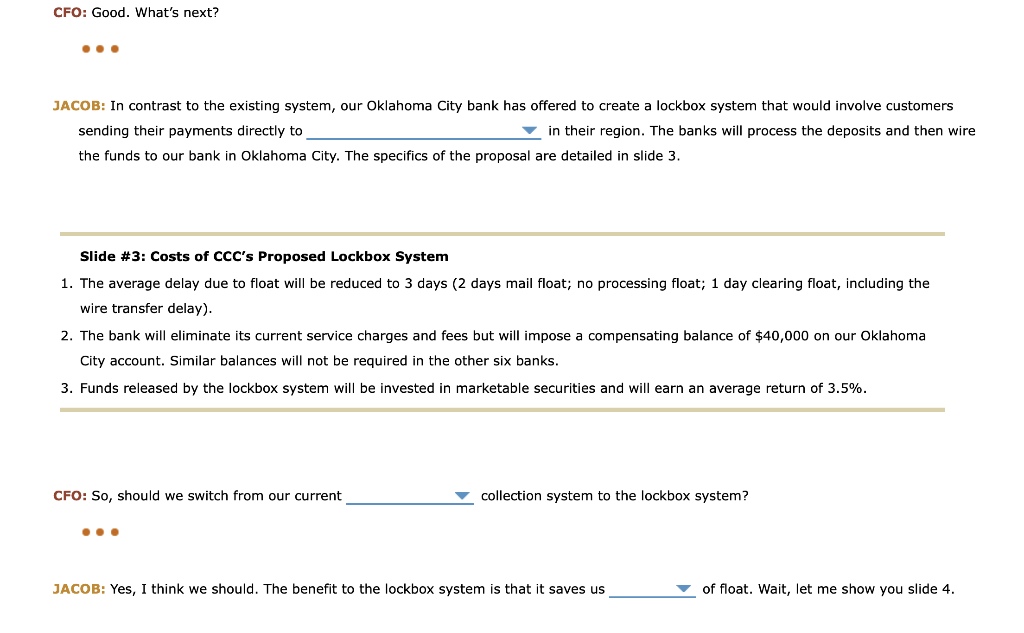

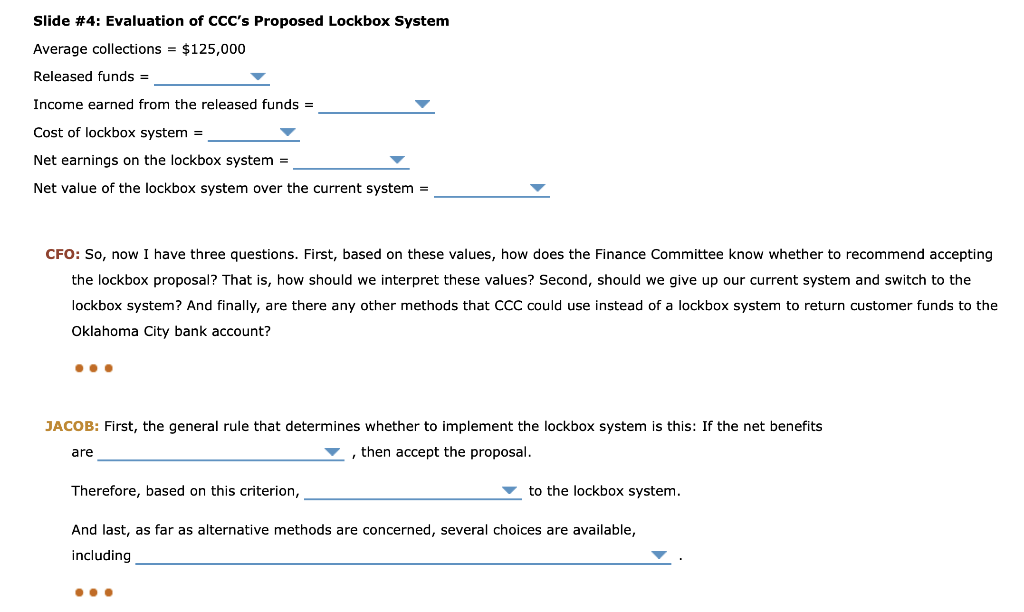

CFO: I'm a little anxious about your presentation to the Finance Committee on Thursday, so I'd like you to run through your comments and presentation slides with me. Because three board members, including the chair and the president, will be attending, I want you to make a very favorable impression. It could mean a great deal to your career with CCC. An upgrade in our receivables collection system could have a significant effect on both CCC's relationship and income stream. JACOB: Yes, I have my notes and the flash drive with my presentation right here. Let me get things organized and I'll begin. After a slight delay, Jacob begins his presentation: Good morning. I would like to present to you the findings of our recent evaluation of the system currently used to collect recies payments from our customers east of the Mississippi River. With our corporate headquarters in Oklahoma conducted an evaluation of a proposed lockbox system that would break down our customer base into six geographic suble being served by a lockbox collection center. These collection centers would then transfer the funds to our main concentration account here in Oklahoma City. Slide 1 shows you the key attributes of our current system. Slide # 1: Key Attributes of CCC's Current Collection System (Eastern Region, Last Year's Data) 1. Our eastern region customers, stores that sell our cookies and brownies, remit 5,500 checks per month to our office in Oklahoma City. 2. Annual collections for the region were $45,625,000. 3. The average delay due to float was 15 days ( 8 days mail float, 4 days processing float, and 3 days clearing float). 4. Our Oklahoma City bank currently charges $24,000 per year in service charges and fees of $0.25 per payment to process these payments. 5. CCC maintains a marketable securities portfolio that earns an average return of 3.5%. CFO: Okay, let's stop here for a second. I have a question. How much does our current system cost us? JACOB: Ma'am, you're getting ahead of me a little; that information is detailed on slide 2. Let me show you. Slide #2: Costs of CCC's Current Collection System (Eastern Region, Last Year's Data) Annual service charges =$24,000 Annual per-payment processing fees = Cost of the current system = JACOB: In contrast to the existing system, our Oklahoma City bank has offered to create a lockbox system that would involve customers sending their payments directly to in their region. The banks will process the deposits and then wire the funds to our bank in Oklahoma City. The specifics of the proposal are detailed in slide 3. Slide #3: Costs of CCC's Proposed Lockbox System 1. The average delay due to float will be reduced to 3 days (2 days mail float; no processing float; 1 day clearing float, including the wire transfer delay). 2. The bank will eliminate its current service charges and fees but will impose a compensating balance of $40,000 on our City account. Similar balances will not be required in the other six banks. 3. Funds released by the lockbox system will be invested in marketable securities and will earn an average return of 3.5%. CFO: So, should we switch from our current collection system to the lockbox system? JACOB: Yes, I think we should. The benefit to the lockbox system is that it saves us of float. Wait, let me show you slide 4. Slide #4: Evaluation of CCC's Proposed Lockbox System Average collections =$125,000 Released funds = Income earned from the released funds = Cost of lockbox system = Net earnings on the lockbox system = Net value of the lockbox system over the current system = CFO: So, now I have three questions. First, based on these values, how does the Finance Committee know whether to recomment accepting the lockbox proposal? That is, how should we interpret these values? Second, should we give un our current system and switch to the lockbox system? And finally, are there any other methods that CCC could use instead of a lockbox system to return customer funds to the Oklahoma City bank account? JACOB: First, the general rule that determines whether to implement the lockbox system is this: If the net benefits are , then accept the proposal. Therefore, based on this criterion, to the lockbox system. And last, as far as alternative methods are concerned, several choices are available, including CFO: I'm a little anxious about your presentation to the Finance Committee on Thursday, so I'd like you to run through your comments and presentation slides with me. Because three board members, including the chair and the president, will be attending, I want you to make a very favorable impression. It could mean a great deal to your career with CCC. An upgrade in our receivables collection system could have a significant effect on both CCC's relationship and income stream. JACOB: Yes, I have my notes and the flash drive with my presentation right here. Let me get things organized and I'll begin. After a slight delay, Jacob begins his presentation: Good morning. I would like to present to you the findings of our recent evaluation of the system currently used to collect recies payments from our customers east of the Mississippi River. With our corporate headquarters in Oklahoma conducted an evaluation of a proposed lockbox system that would break down our customer base into six geographic suble being served by a lockbox collection center. These collection centers would then transfer the funds to our main concentration account here in Oklahoma City. Slide 1 shows you the key attributes of our current system. Slide # 1: Key Attributes of CCC's Current Collection System (Eastern Region, Last Year's Data) 1. Our eastern region customers, stores that sell our cookies and brownies, remit 5,500 checks per month to our office in Oklahoma City. 2. Annual collections for the region were $45,625,000. 3. The average delay due to float was 15 days ( 8 days mail float, 4 days processing float, and 3 days clearing float). 4. Our Oklahoma City bank currently charges $24,000 per year in service charges and fees of $0.25 per payment to process these payments. 5. CCC maintains a marketable securities portfolio that earns an average return of 3.5%. CFO: Okay, let's stop here for a second. I have a question. How much does our current system cost us? JACOB: Ma'am, you're getting ahead of me a little; that information is detailed on slide 2. Let me show you. Slide #2: Costs of CCC's Current Collection System (Eastern Region, Last Year's Data) Annual service charges =$24,000 Annual per-payment processing fees = Cost of the current system = JACOB: In contrast to the existing system, our Oklahoma City bank has offered to create a lockbox system that would involve customers sending their payments directly to in their region. The banks will process the deposits and then wire the funds to our bank in Oklahoma City. The specifics of the proposal are detailed in slide 3. Slide #3: Costs of CCC's Proposed Lockbox System 1. The average delay due to float will be reduced to 3 days (2 days mail float; no processing float; 1 day clearing float, including the wire transfer delay). 2. The bank will eliminate its current service charges and fees but will impose a compensating balance of $40,000 on our City account. Similar balances will not be required in the other six banks. 3. Funds released by the lockbox system will be invested in marketable securities and will earn an average return of 3.5%. CFO: So, should we switch from our current collection system to the lockbox system? JACOB: Yes, I think we should. The benefit to the lockbox system is that it saves us of float. Wait, let me show you slide 4. Slide #4: Evaluation of CCC's Proposed Lockbox System Average collections =$125,000 Released funds = Income earned from the released funds = Cost of lockbox system = Net earnings on the lockbox system = Net value of the lockbox system over the current system = CFO: So, now I have three questions. First, based on these values, how does the Finance Committee know whether to recomment accepting the lockbox proposal? That is, how should we interpret these values? Second, should we give un our current system and switch to the lockbox system? And finally, are there any other methods that CCC could use instead of a lockbox system to return customer funds to the Oklahoma City bank account? JACOB: First, the general rule that determines whether to implement the lockbox system is this: If the net benefits are , then accept the proposal. Therefore, based on this criterion, to the lockbox system. And last, as far as alternative methods are concerned, several choices are available, including