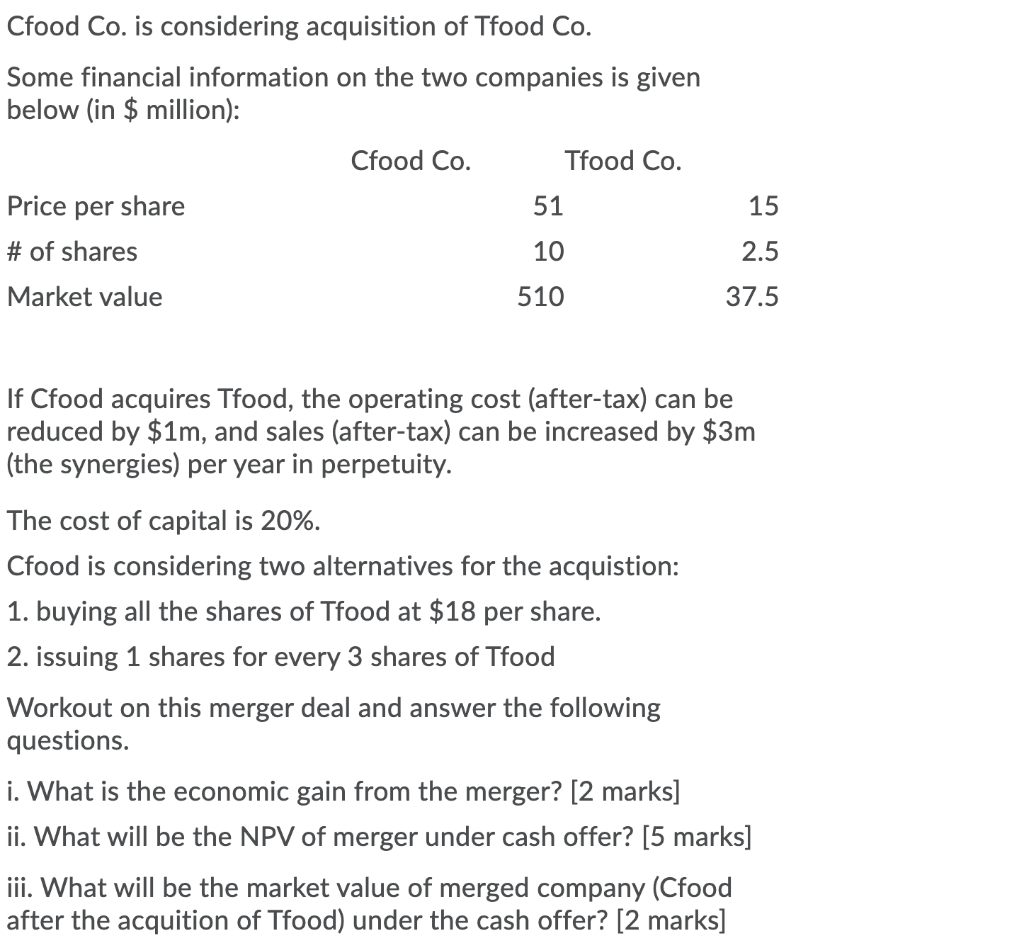

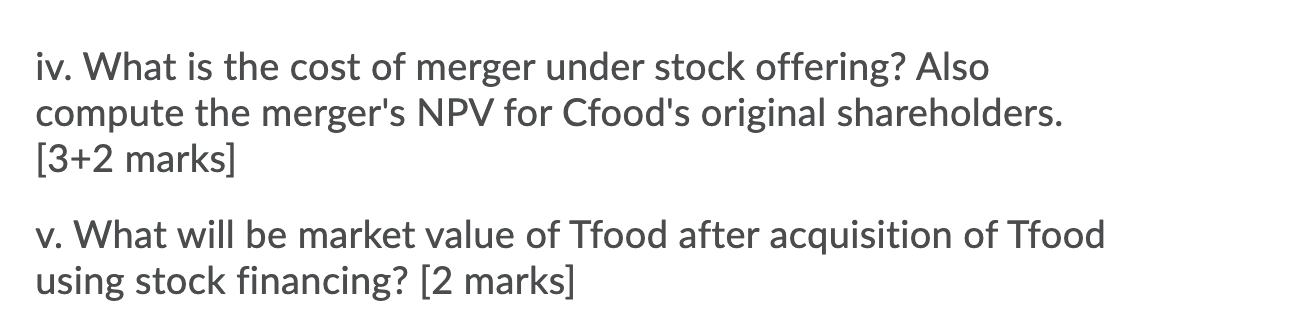

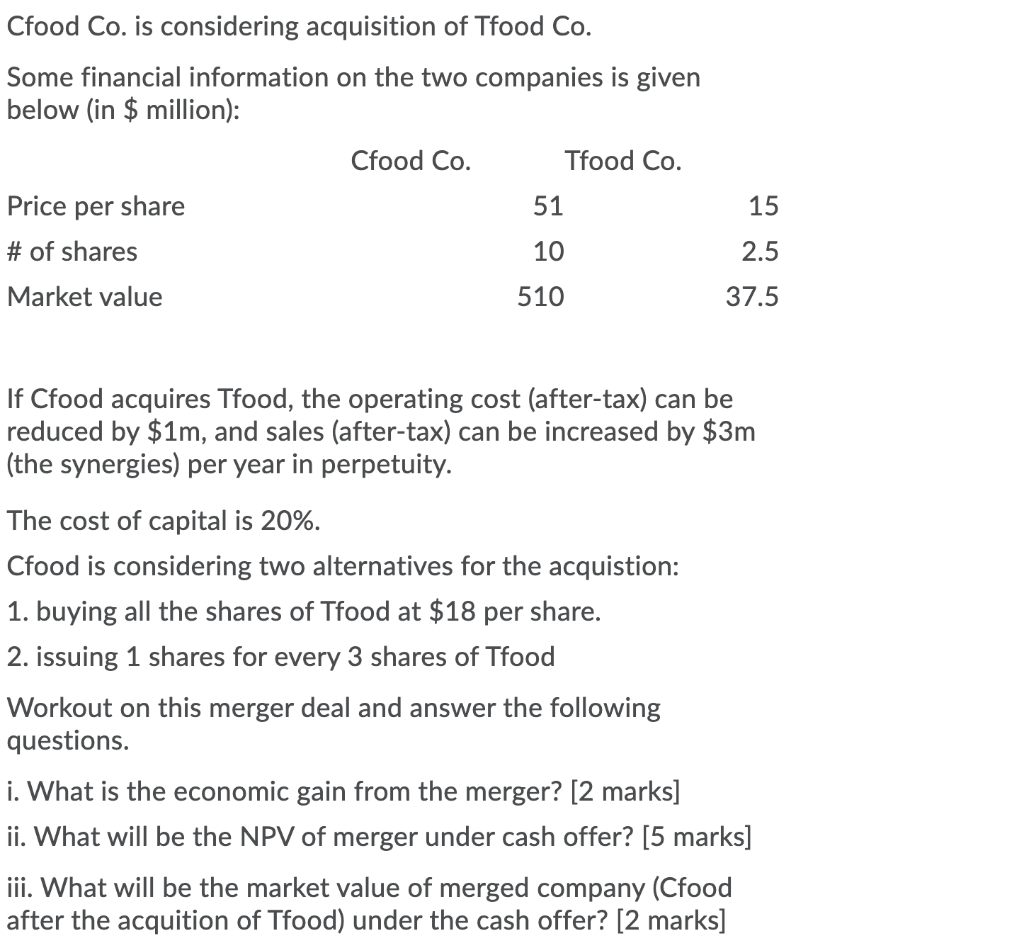

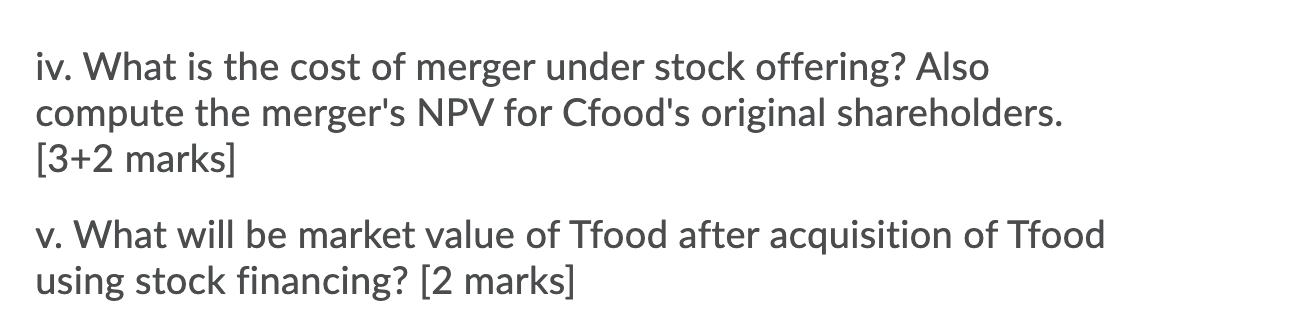

Cfood Co. is considering acquisition of Tfood Co. Some financial information on the two companies is given below (in $ million): Cfood Co. Tfood Co. 51 15 Price per share # of shares Market value 10 2.5 510 37.5 If Cfood acquires Tfood, the operating cost (after-tax) can be reduced by $1m, and sales (after-tax) can be increased by $3m (the synergies) per year in perpetuity. The cost of capital is 20%. Cfood is considering two alternatives for the acquistion: 1. buying all the shares of Tfood at $18 per share. 2. issuing 1 shares for every 3 shares of Tfood Workout on this merger deal and answer the following questions. i. What is the economic gain from the merger? [2 marks] ii. What will be the NPV of merger under cash offer? [5 marks] iii. What will be the market value of merged company (Cfood after the acquition of Tfood) under the cash offer? [2 marks] iv. What is the cost of merger under stock offering? Also compute the merger's NPV for Cfood's original shareholders. [3+2 marks] v. What will be market value of Tfood after acquisition of Tfood using stock financing? [2 marks] Cfood Co. is considering acquisition of Tfood Co. Some financial information on the two companies is given below (in $ million): Cfood Co. Tfood Co. 51 15 Price per share # of shares Market value 10 2.5 510 37.5 If Cfood acquires Tfood, the operating cost (after-tax) can be reduced by $1m, and sales (after-tax) can be increased by $3m (the synergies) per year in perpetuity. The cost of capital is 20%. Cfood is considering two alternatives for the acquistion: 1. buying all the shares of Tfood at $18 per share. 2. issuing 1 shares for every 3 shares of Tfood Workout on this merger deal and answer the following questions. i. What is the economic gain from the merger? [2 marks] ii. What will be the NPV of merger under cash offer? [5 marks] iii. What will be the market value of merged company (Cfood after the acquition of Tfood) under the cash offer? [2 marks] iv. What is the cost of merger under stock offering? Also compute the merger's NPV for Cfood's original shareholders. [3+2 marks] v. What will be market value of Tfood after acquisition of Tfood using stock financing? [2 marks]