Answered step by step

Verified Expert Solution

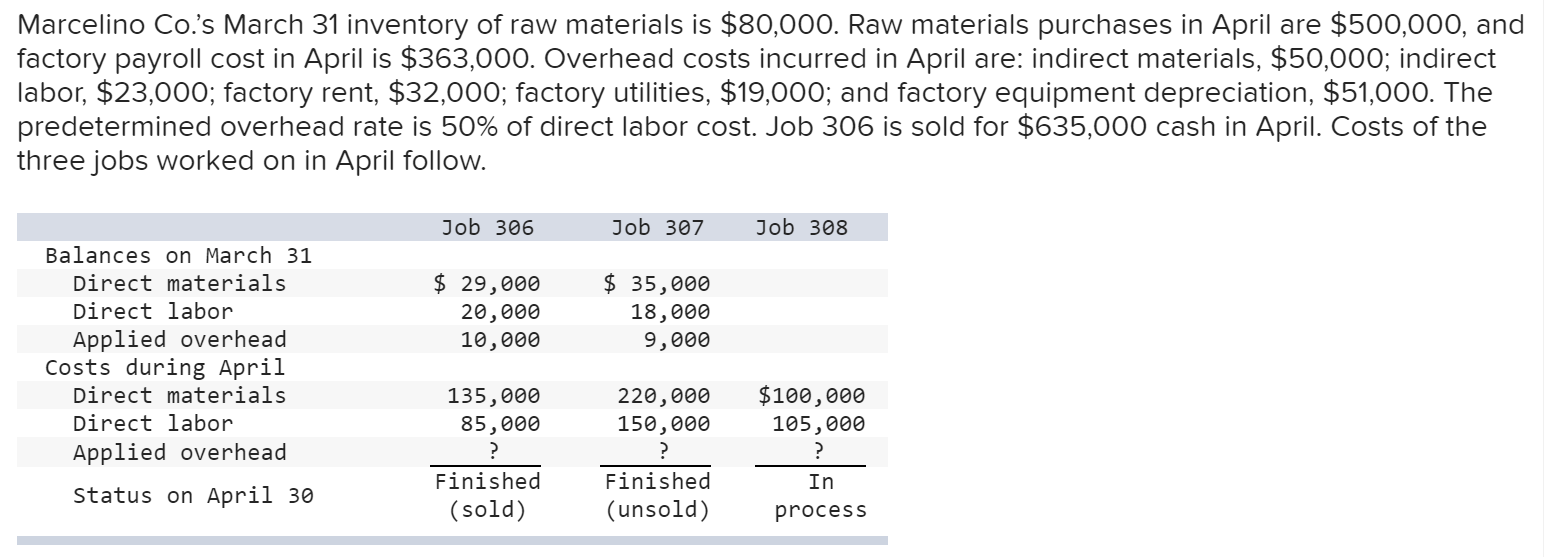

Question

1 Approved Answer

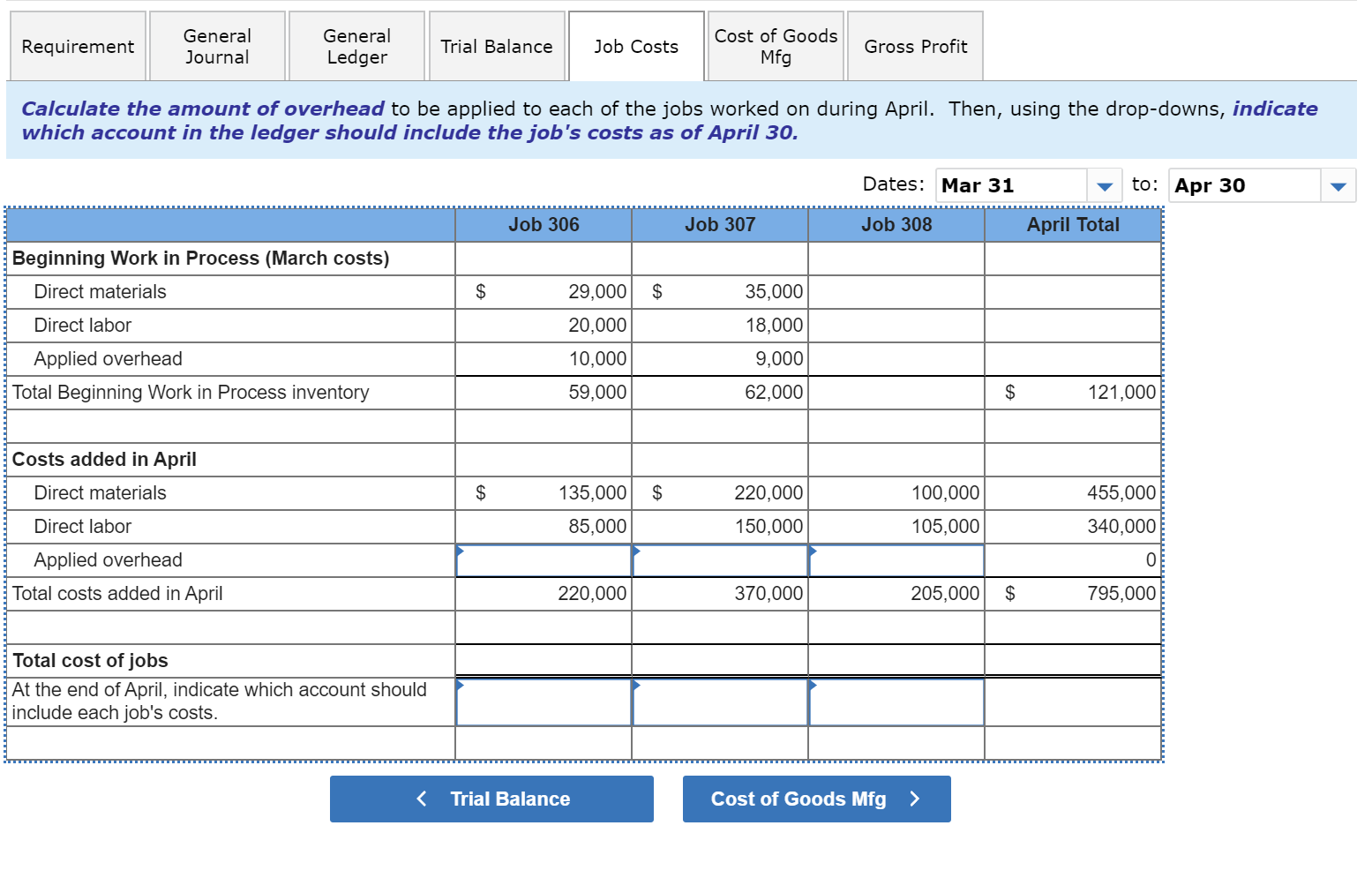

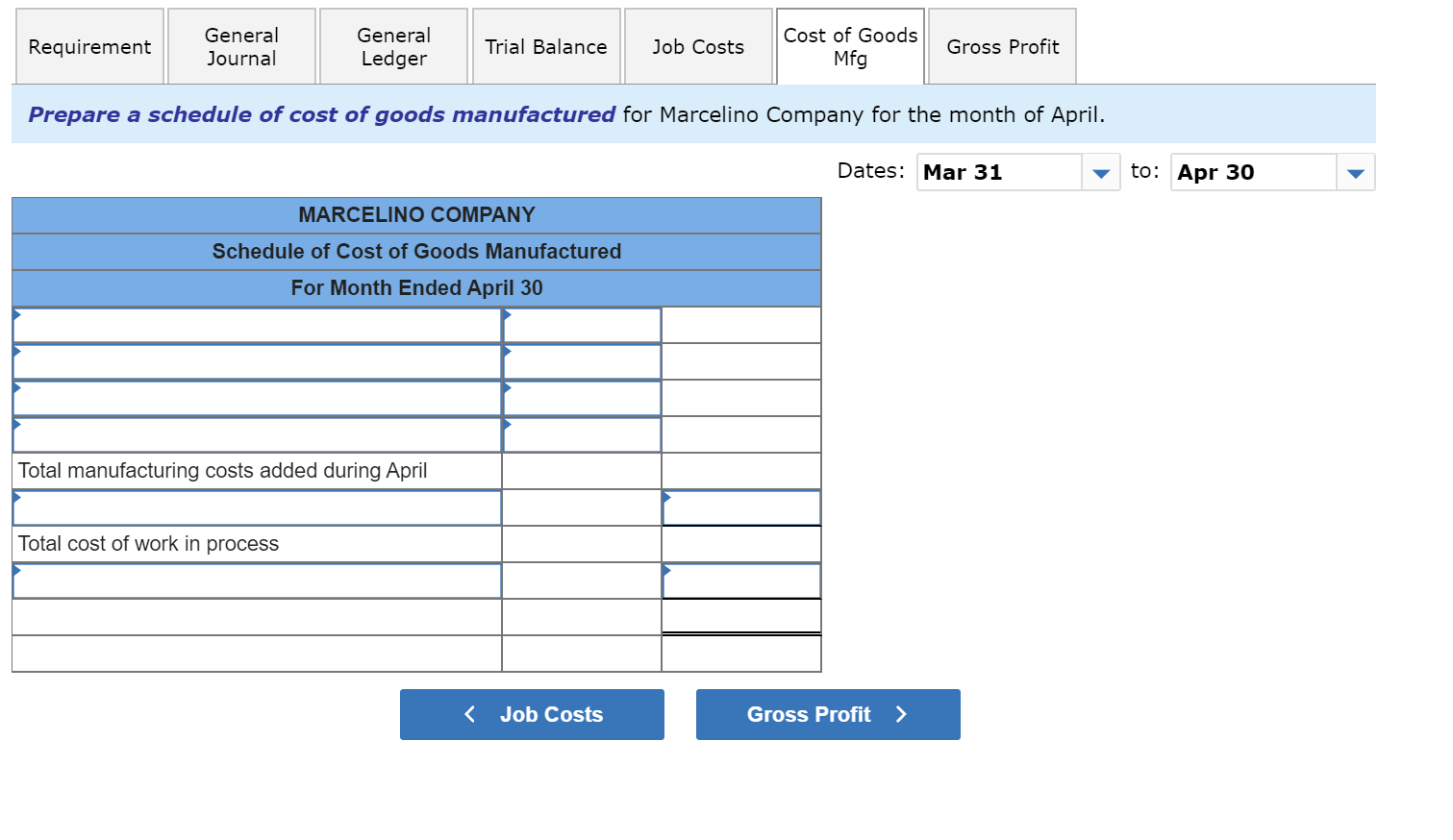

Ch 02 GL P2-1a a. Record the purchase of materials (on credit). b. Record direct materials used in production. c. Record direct labor paid and

Ch 02 GL P2-1a

a. Record the purchase of materials (on credit).

b. Record direct materials used in production.

- c. Record direct labor paid and assigned to Work in Process Inventory.

- d. Record indirect labor paid and assigned to Factory Overhead.

- e. Record overhead costs applied to Work in Process Inventory.

- f1. Record the cost of indirect materials used.

- f2. Record the cost of factory utilities paid in cash.

- f3. Record the depreciation on factory equipment.

- f4. Record the cost of factory rent, paid in cash.

- g. Record the transfer of Jobs 306 and 307 to Finished Goods Inventory.

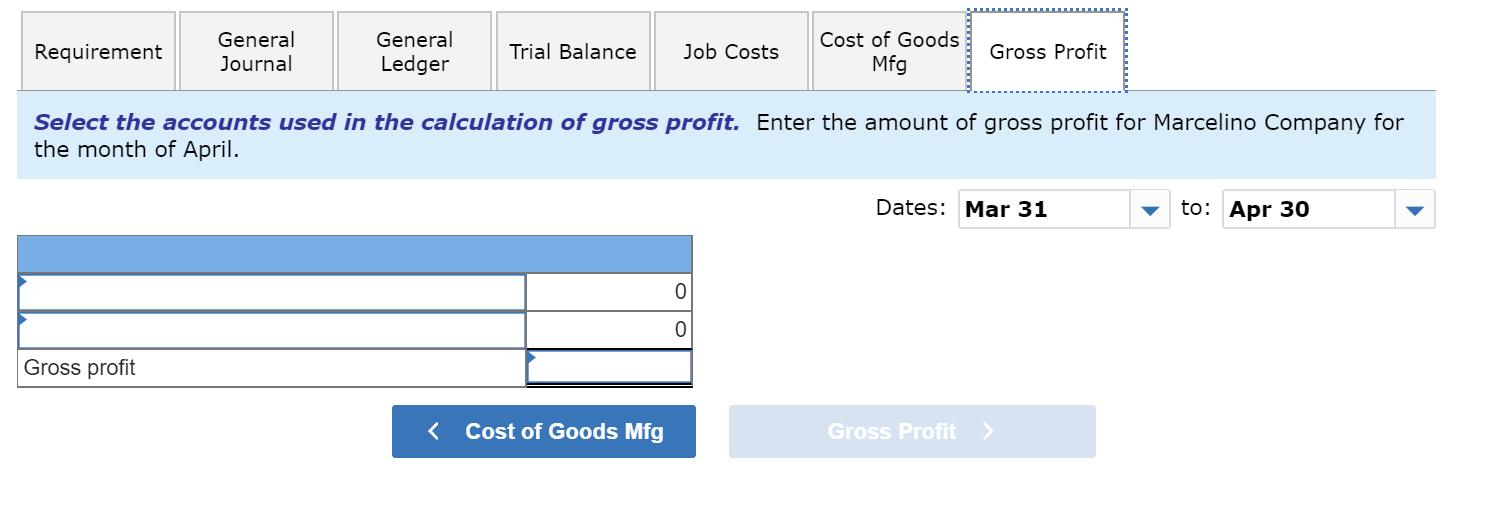

- h. Record the cost of goods sold for Job 306.

- i. Record the revenue from the cash sale of Job 306.

- j. Record the assignment of any underapplied or overapplied overhead to the Cost of Goods Sold account. (The amount is not material.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started