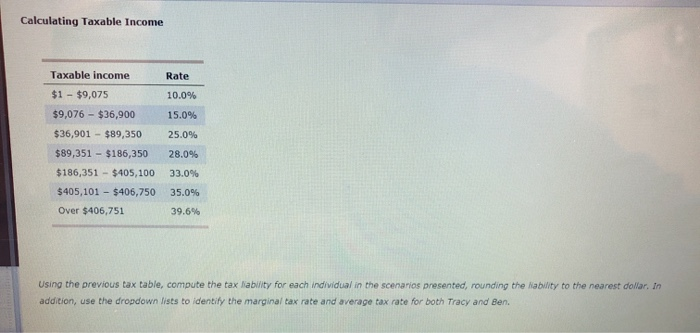

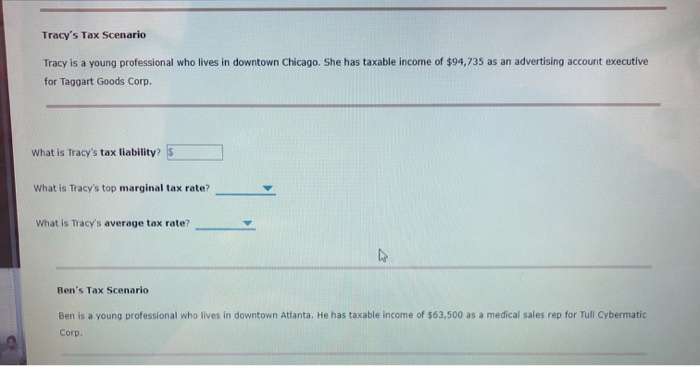

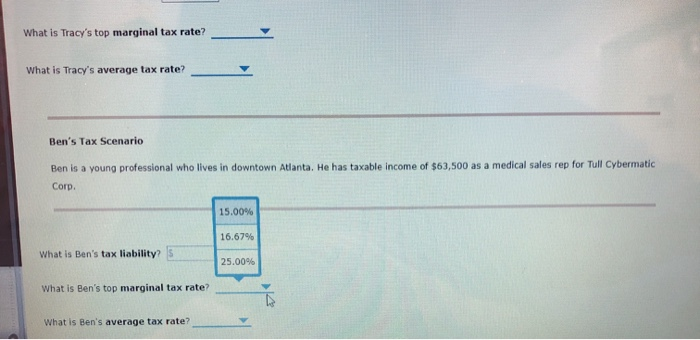

Ch 03: Assignment - Preparing Your Taxes What are the Economics of Income Taxes? Income taxes are taxes collected by federal, state, and local governments. Within the United States, we have a defined tax structure Answer the following questions regarding the U.S. tax structure. A tax structure in which additional taxable income is taxed at a higher rate is referred to as a The tax paid on the next dollar of taxable income is referred to as the tax rate The overall rate at which income is taxed, determined by dividing the tax liability by the taxable income, is referred to as the rate In addition to understanding how the tax system is structured, knowing your individual filing status is important because it determines deductions and other considerations that should be taken into account when preparing your tax return. Indicate the correct filing status for each of the definitions provided A person whose spouse died within two years of the tax year and who supports a dependent child: A person who is unmarried or legally separated from a spouse by either a separation or final divorce decree: A person who is unmarried or considered unmarried and pays more than half of the cost of keeping up a home for himself/herself and an eligible dependent child or relative: A couple in which each spouse files his or her own return; Spouses who combine the income and allowable deductions: Calculating Taxable income Rate Taxable income $1 - $9,075 $9,076 - $36,900 10.0% $36,901 - $89,350 $89,351 - $186,350 $186,351 - $405,100 $405,101 - $406,750 Over $406,751 15.0% 25.0% 28.0% 33.0% 35.0% 39.6% Using the previous tax table, compute the tax lability for each individual in the scenarios presented, rounding the ability to the nearest dollar. In addition, use the dropdown lists to identify the marginal tax rate and average tax rate for both Tracy and Ben. Tracy's Tax Scenario Tracy is a young professional who lives in downtown Chicago. She has taxable income of $94,735 as an advertising account executive for Taggart Goods Corp. What is Tracy's tax liability? What is Tracy's top marginal tax rate? What is Tracy's average tax rate? Ben's Tax Scenario Ben is a young professional who lives in downtown Atlanta. He has taxable income of $63,500 as a medical sales rep for Tull Cybermatic Corp. What is Tracy's top marginal tax rate? What is Tracy's average tax rate? Ben's Tax Scenario Ben is a young professional who lives in downtown Atlanta. He has taxable income of $63,500 as a medical sales rep for Tull Cybermatic Corp. 15.00% 16.67% What is Ben's tax liability? S 25.00% What is Ben's top marginal tax rate? What is Ben's average tax rate