Question

Ch 04- Assignment - Analysis of Financial Statements Back to Assignment Attempts Average / 4 4. Debt (or leverage) management ratios Companies have the opportunity

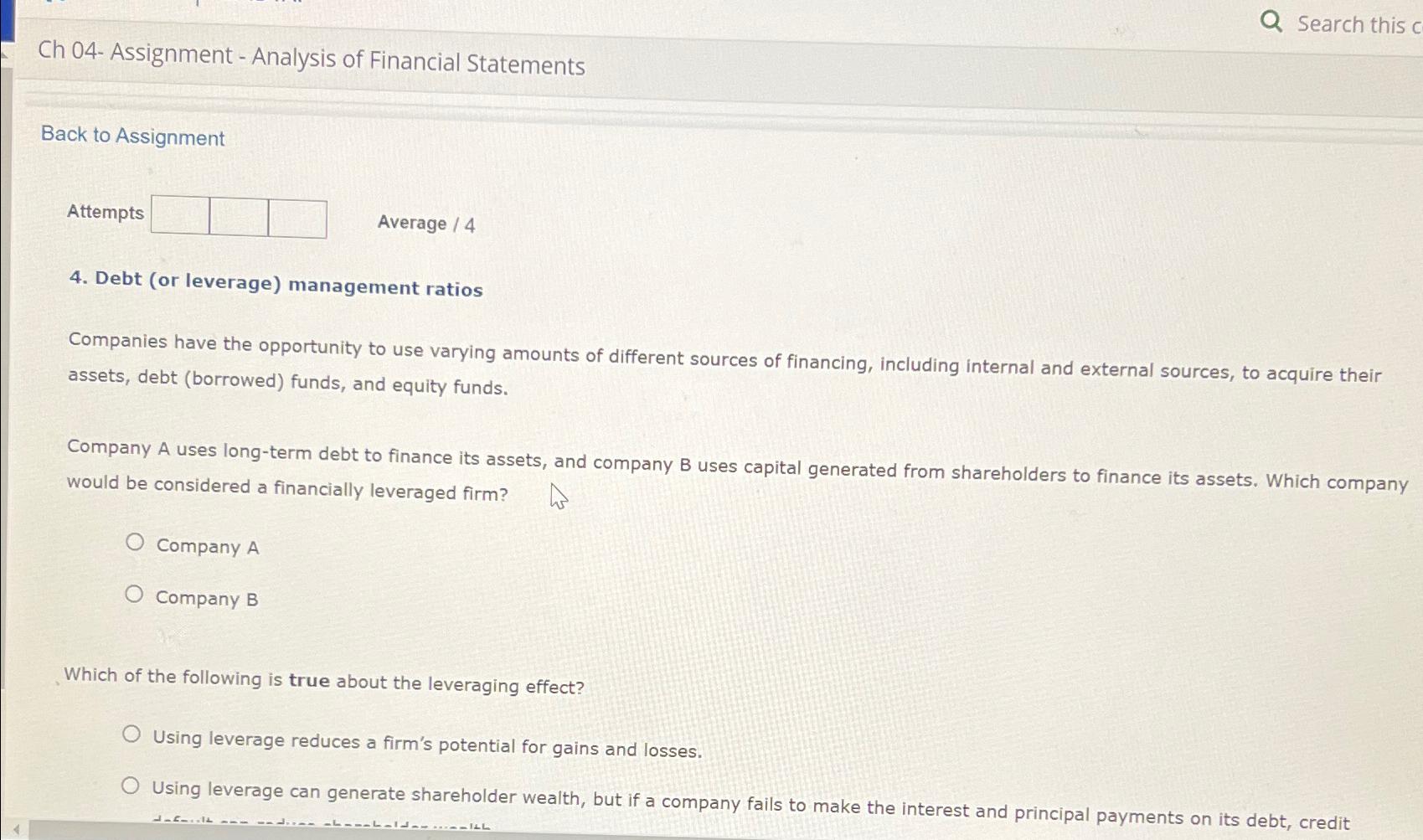

Ch 04- Assignment - Analysis of Financial Statements\ Back to Assignment\ Attempts\ Average / 4\ 4. Debt (or leverage) management ratios\ Companies have the opportunity to use varying amounts of different sources of financing, including internal and external sources, to acquire their assets, debt (borrowed) funds, and equity funds.\ Company A uses long-term debt to finance its assets, and company B uses capital generated from shareholders to finance its assets. Which company would be considered a financially leveraged firm?\ Company A\ Company B\ Which of the following is true about the leveraging effect?\ Using leverage reduces a firm's potential for gains and losses.\ Using leverage can generate shareholder wealth, but if a company fails to make the interest and principal payments on its debt, credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started