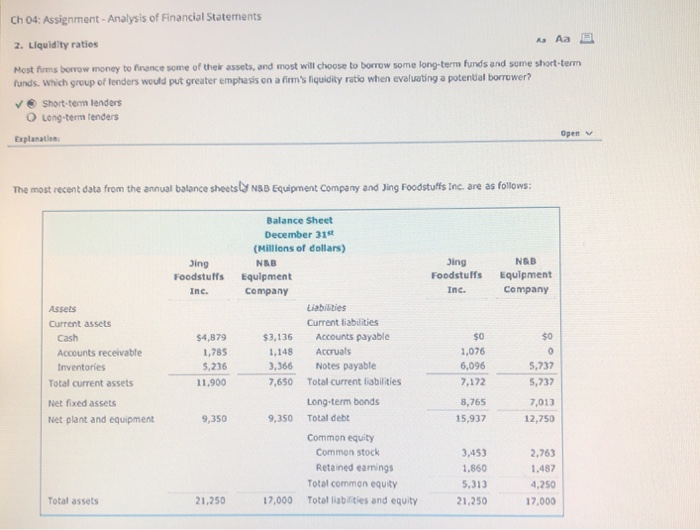

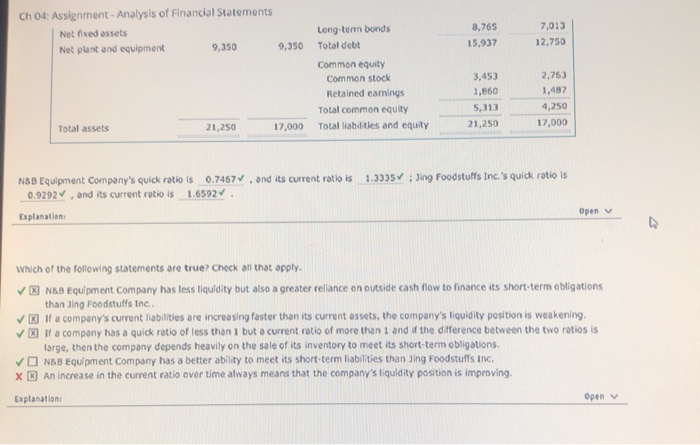

Ch 04: Assignment-Analysis of Financial Statements As Aa Liquidity raties 2. Most fims bornrow money to finance some of their assets, and most will choose to borrow some long-term funds and some short-term funds. Which group of tenders would put greater emphasis on a fim's liquidity ratio when evaluating a potenal borrower? veShort-tem lenders O Long-term lenders Open Explanation bolance sheets and Jing Foodstuffs Inc. are as follows NSB Equipment Company The most recent data from the annual Balance Sheet December 31t (Millions of dollars) NSB ing Sing Foodstuffs Equipment Foodstuffs Equipment Inc. company Inc. company Liabilities Assets Current liabilities Current assets Accounts payable $0 $0 Cash $4,879 $3,136 Accruals 1,076 1,785 1,148 Accounts receivable Notes payable 6,096 5,737 Inventories 5,236 3,366 7,650 Total current liabilities 7,172 5,737 Total current assets 11,900 Long-term bonds 8,765 Net fixed assets 7,013 Total debt 9,350 9,350 15,937 12,750 Net plant and equipment Common equity Common stock 3,453 2,763 Retained eamings 1,860 1,487 Total common equity 5,313 4,250 Total liablities and equity 17,000 Total assets 21,250 21,250 17,000 Ch 04: Assignment-Analysis of Financial Statements 7,013 8,765 Long-term bonds Net fixed assets 12,750 15,937 Total debt 9,350 9,350 Net plant and equipment Common equity 3,453 2,763 Common stock 1,860 1,487 Retained eamings 4,250 5,313 Total common equity 17,000 21,250 Total liabilities and equity 21,250 17,000 Total assets 1.3335 Jing Foodstuffs Inc.'s quick ratio is NSB Equipment Company's quick ratio is 0.9292,and its current ratio is 0.7467,and its current ratio is 1.6592. Open Explanation Which of the following statements are true? Check all that apply. N&B Equipment Company has less liquidity but also a greater reliance on outside cash flow to finance its short-term obligations than Jing Foodstuffs Inc. If a company's current liabilities are increasing faster than its current assets, the company's liquidity position is weakening. If a company has a quick ratio of less than 1 but a current ratio of more than 1 and if the difference between the two ratios is large, then the company depends heavily on the sale of its inventory to meet its short-term obligations. N&B Equ/pment Company has a better ability to meet its short-term liabilities than Jing Foodstuffs Inc. An increase in the current ratio over time always means that the company's liquidity position is improving. Explanation Open