Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ch 07 ex 7-17 Ch 08 Ex 8-2 Kayak Co. budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding

Ch 07 ex 7-17

Ch 08 Ex 8-2

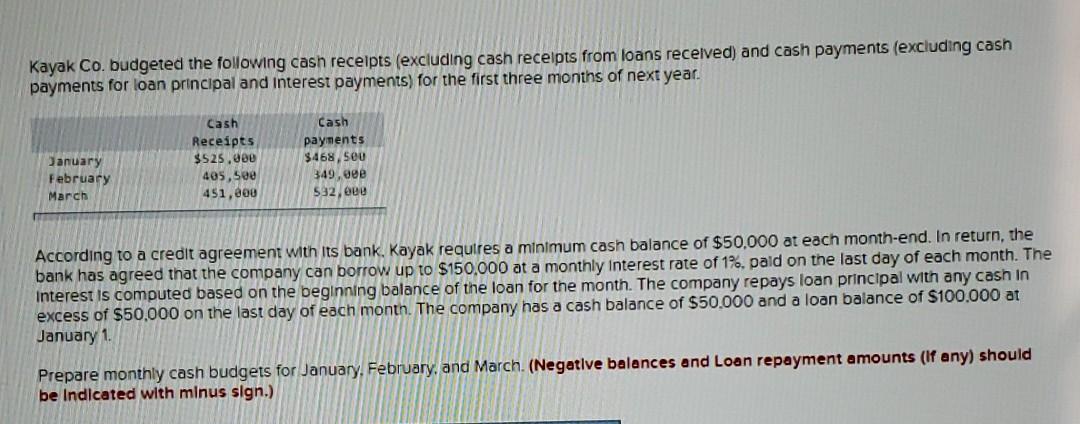

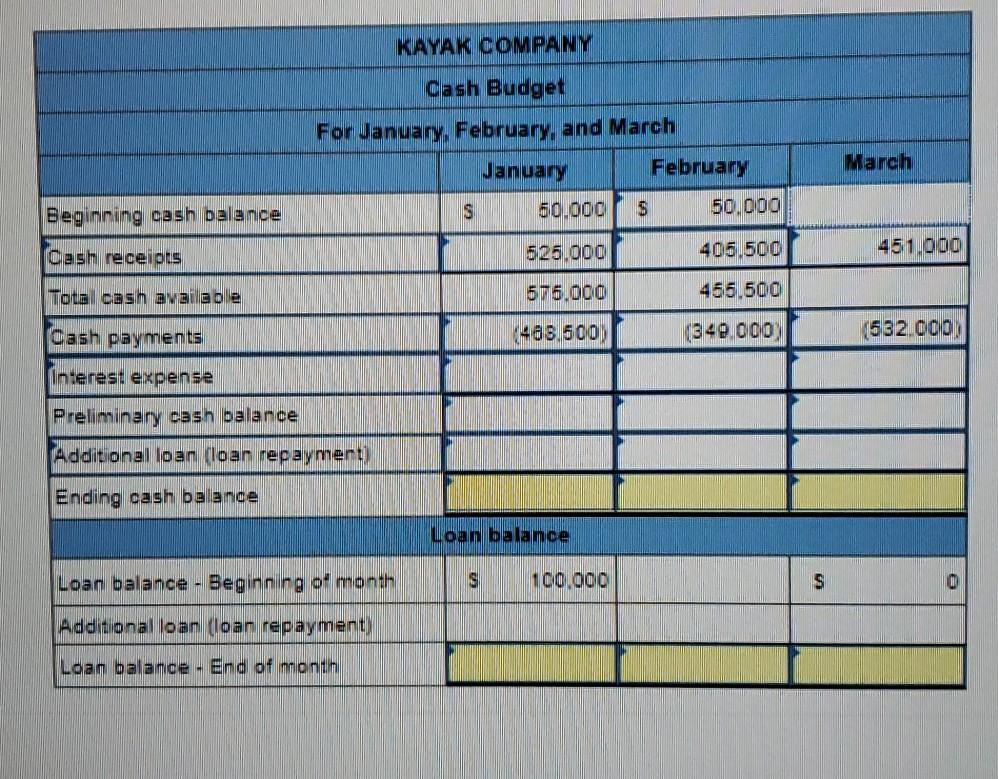

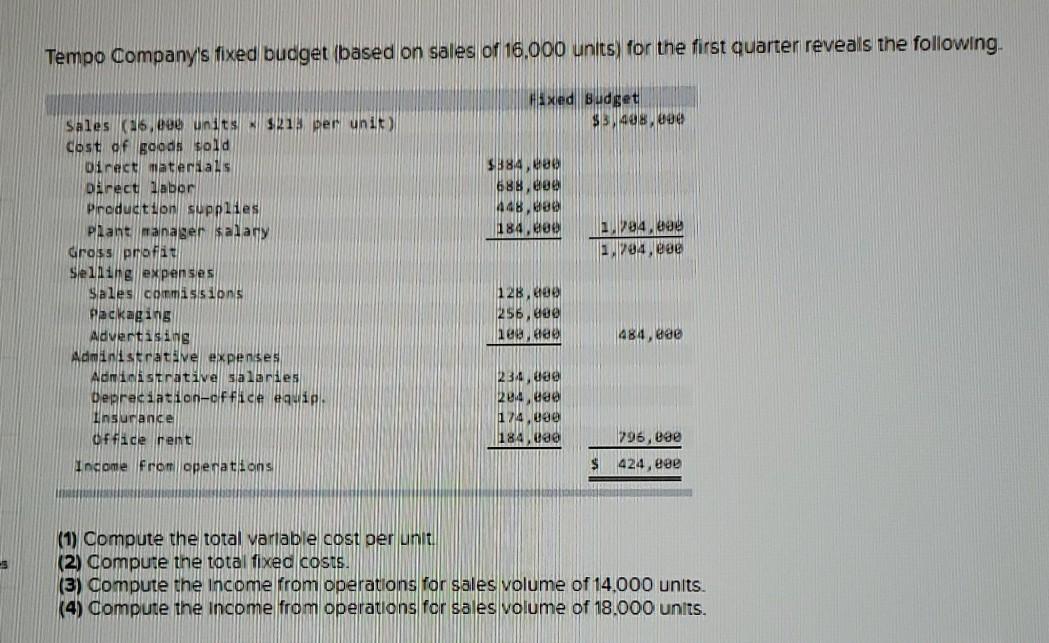

Kayak Co. budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and Interest payments) for the first three months of next year. January February March Cash Receipts $525.000 405,500 451,800 Cash payments $68 500 349,00 592,000 According to a credit agreement with its bank, Kayak requtres a minimum cash balance of $50,000 at each month-end. In return, the bank has agreed that the company can borrow up to $150,000 at a monthly Interest rate of 1%, paid on the last day of each month. The Interest is computed based on the beginning balance of the loan for the month. The company repays loan principal with any cash in excess of $50,000 on the last day of each month. The company has a cash balance of $50.000 and a loan balance of $100.000 at January 1 Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be Indicated with minus slgn.) KAYAK COMPANY Cash Budget For January, February, and March January February S 50.000 S 50.000 March Beginning cash balance Cash receipts 525.000 405,500 451.000 Tota cash available 575.000 455.500 Cash payments (488.500 (340,000 (532.000 Interest expense Preliminary cash balance Additional loan (loan repayment) Ending cash be ance Loan balance Loan balance - Beginn ng of month 100.000 S Additional loan (loan repayment) Loan balance - End of month Tempo Company's fixed budget (based on sales of 16,000 units) for the first quarter reveals the following. faxed Budget $40, we $384. 688.ee 448.18 184,800 284.00 1294.000 Sales 16.00 units $215 per unit cost of goods sold Direct materials Direct labor Production supplies Plant manager salary Gross profit Selling expenses Sales commissions Packaging Advertising Administrative expenses Administrative salaries Depreciation-office equip Insurance Office rent 128. De 256, tee 100.ee 484, de 234.ee 24.ee 174,00 | 184, vad 296, eae $ 424, eee Income from operations -5 (1) Compute the total variable cost per unit (2) Compute the total fixed costs. (3) Compute the income from operations for sales volume of 14.000 units. (4) Compute the income from operations for sales volume of 18.000 units. Required 1 Required 2 Required 3 Required 4 Compute the total variable cost per unit. Vanable cosi per un Required 2 > Required 1 Required 2 Required 3 Required 4 Compute the total fipced costs. Tola foxed costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started