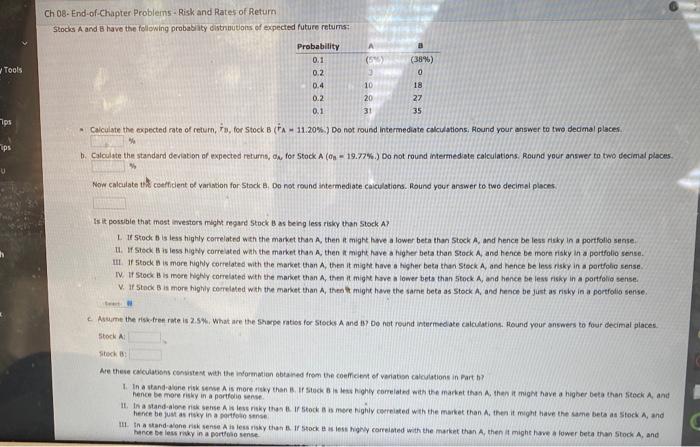

Ch 08- End-of-Chapter Problems - Risk and Rates of Return Stods A and B have the felowing probablity distnnution of expected future returns: Calculate the expected rate of return, T3, for stock B ( PA=11.20% ) Do not round intermediate calculations, Hound your answer to two decimal places. b. Calculate the standard deration of expected returns, N for StockA(n=19.77%. Do not round intermedate calculations. Round your answer to two decimal places. Now calculate thi coeffident of variwbon for Stock B. Do not round tatermediate caiculotians. Round your arswer to two decimal places. Is it possible that mest investers might regard Stock B as being less risky than stock A? L. It stock B is less highly correlatrd with the market than A, then a might hwe a lower beta than Stock A, and hence be less risky in a portfollo sense. 14. If Steck B is less highy correlated wah the market than A, then at might have a higher beta than Stock A, and hence be more risky in a portfolio sense. III. If 5 tock 8 is more highly correlated with the market than A, then it might have a higher beta than stock A, and hence be less nisky in a partfolio sense. IV. If Stook B is morn highly correlated with the market than A, then it migNe hyve a lower bets than 5 tock A, and hence be lest risky in a portfolio sense. V. If 5tock is more highly correleted with the market than A, then ht might have the same beta as Stock A, and hence be just as rishy in a portfolio sense. c. Asume the Hsk-free rate is 2.5\%, What are the Sharpe ratios for Stocks A and tB? Do nat round intermediate calcilations, Hound your answers to four decimal places. Stock Ai Titerk 8) Are these coiculatisns consistest with the information obtarte from the coeffient of veriatos caloulations in Fart h? hence be more rishy in a portfolio sense. herite be fust as risky in a portfoto sense thance be less miky in a portiosio sense. Is it possible that most investors might regard Stock B as being less risky than Stock A? I. If Stodk B is less highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less nisky in a portfollo sense; If. If 5tockB is less highly comelated with the market than A, then it might have a higher beta than stock A, and hence be more risky in a portfolio sense, III. I Stock B is more highiy correlated with the market than A, then it might have a higher beta than 5 tock A, and hence be less risky in a portfollo sense, IN. If Stock B is more highily correlated with the market than A, then it might have a lower beta than 5tock A, and hence be less hisky in a portfolio sense. V. It Stock B is more highly correlated with the market than A, then it might have the same beta as Steck A, and hence be liart as risky in a portfolio serice. c. Assume the rish free rate is 2.5%. What are the Sharpe ratios for Stocks A and B ? Do not round intermeciate calciations. Round your answers to four decimal nlaces 5tock A. Stock, B: Are these caloutations consitent with the informabien cotanied from the coetficient of variation calculations in Part b? 1. In a stand-alone rivk sense A is more riaky than B. If 5 tock a is less highly correlated with the market thas A, then it might have a figher beta than stock Ay, and nence be more risky in a portiolio sense. 11. In a stand-alone risk sense A is iess risky than B. U Stook B is mere highiy correlated wath the market than A, then it might nove the same beta as stock A, and hence be yuit as risky in a portfoilo sense. hence be juit as risky in a portfoilo sense. 1i1. In a wand-alone nwk sense A is less risky than B. If stock B is less Nighy correlated with the market than A, then of might Move a lower beta than steck A, and W. In a stand-alone rivk sense A is leas risky tran B, If 5tock B is less highly conrelated with the market than A, then it might have a higher beta thes stock A, and thence be mare risky in a portfolia sense. tence be lews ritky in a pentolia senar