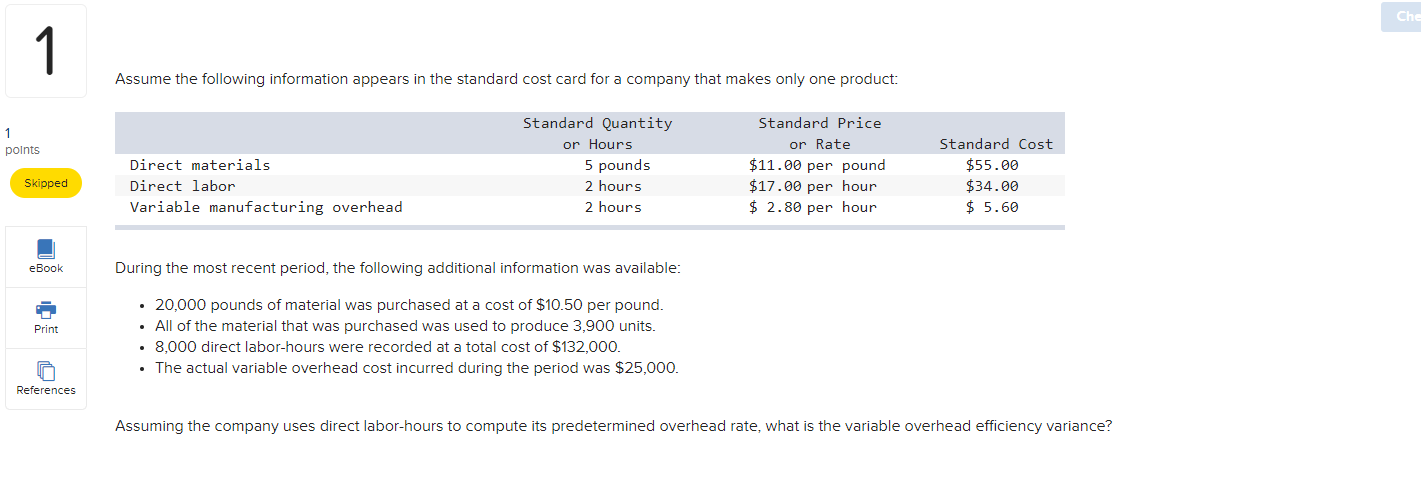

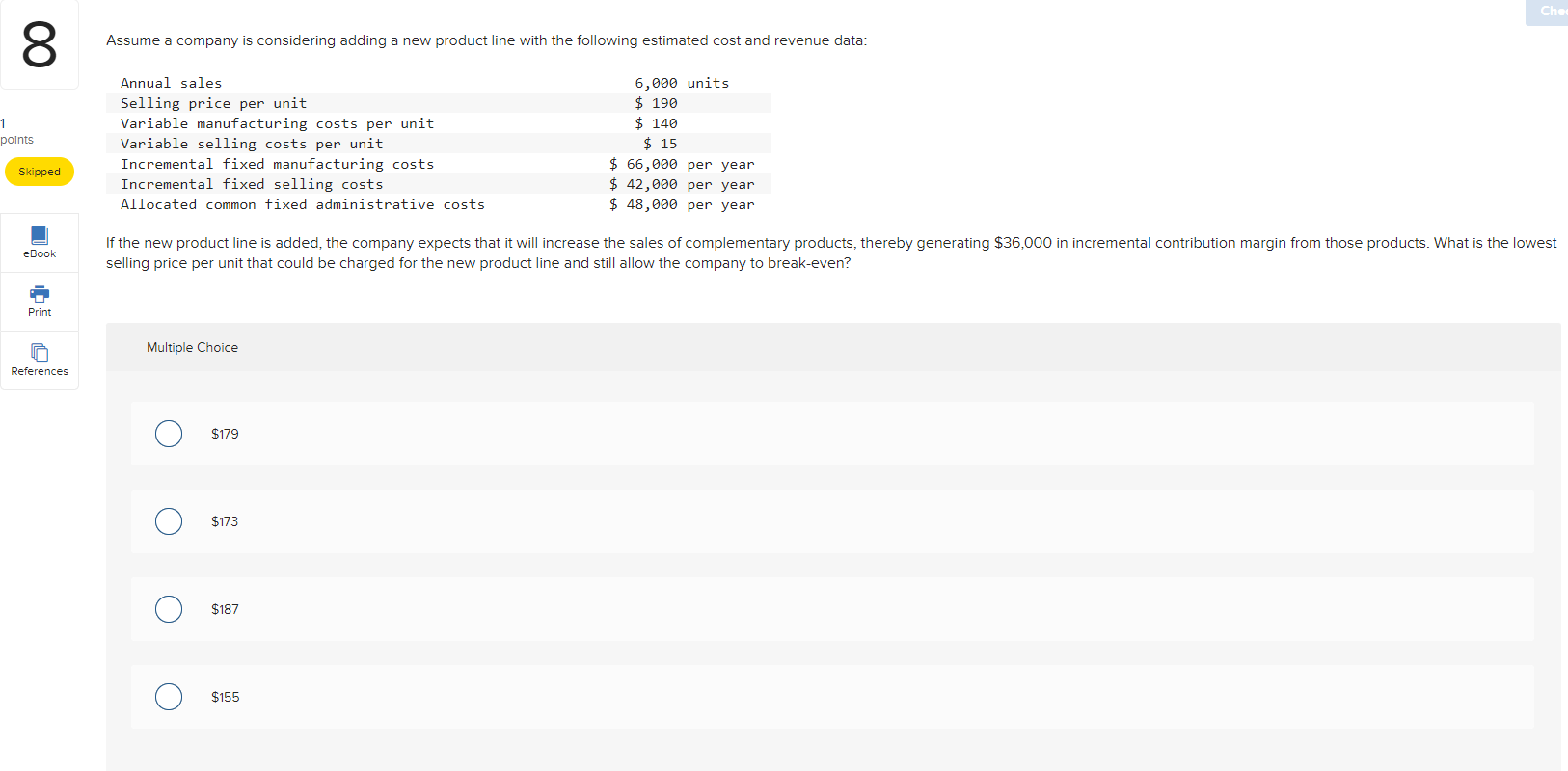

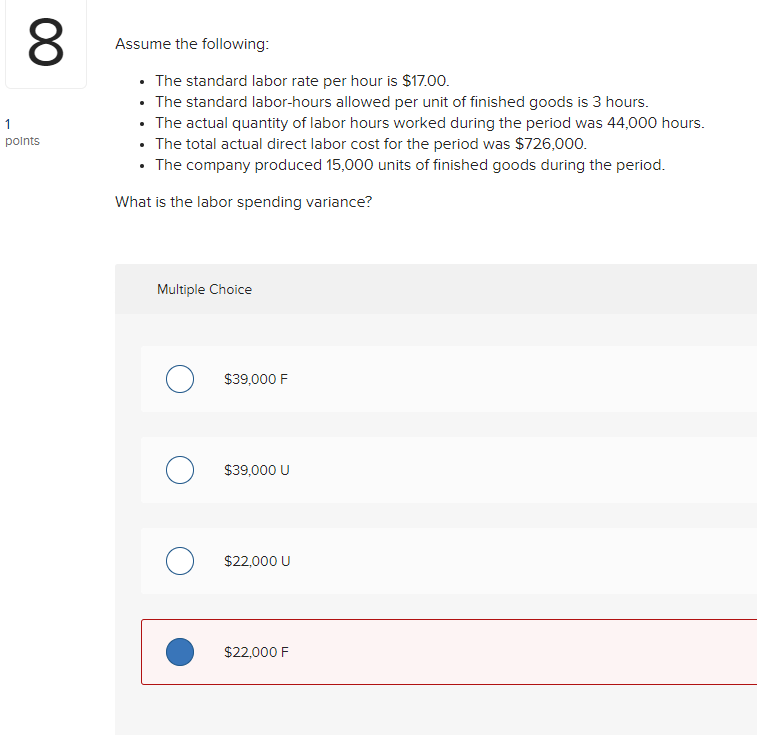

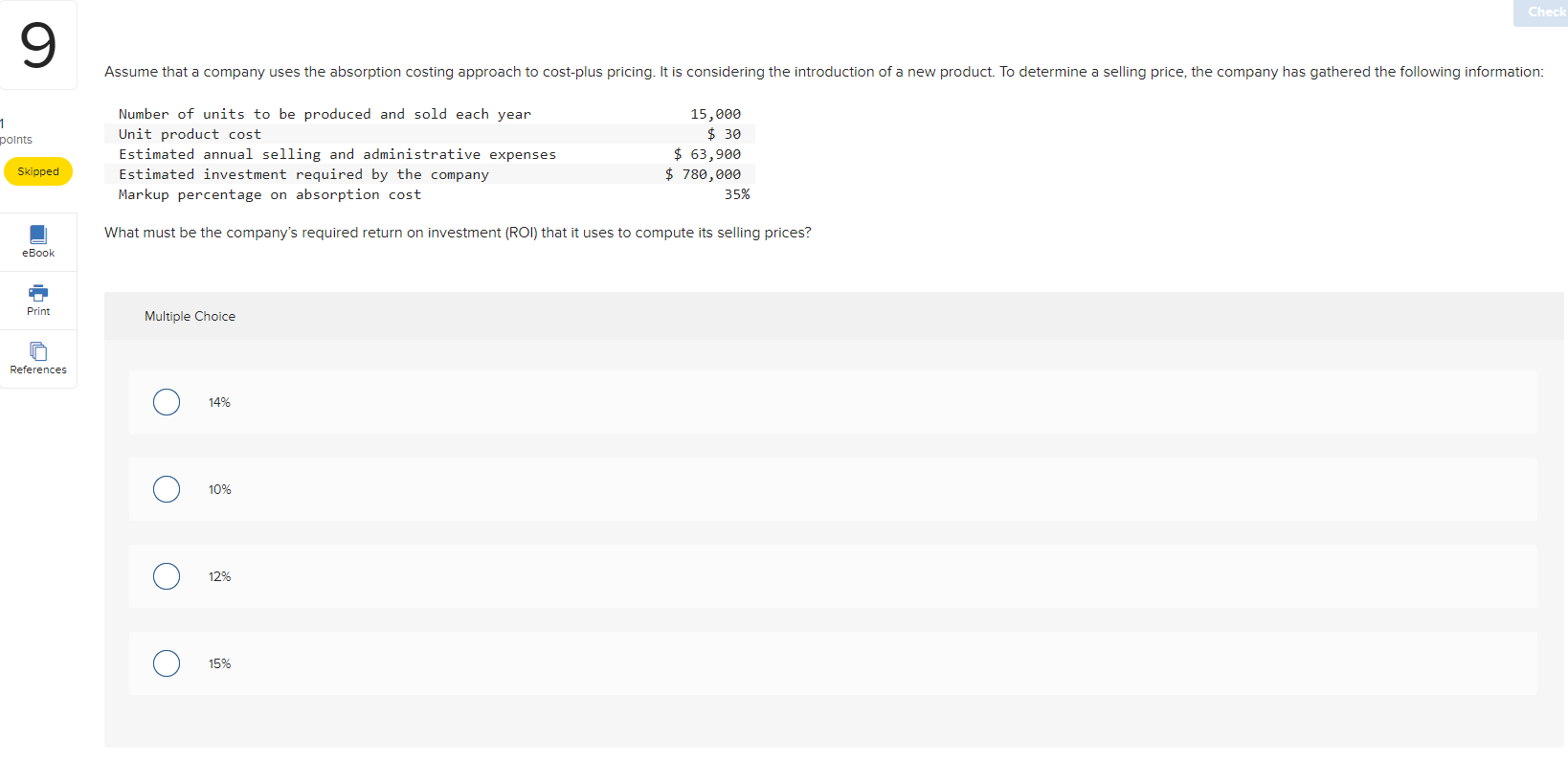

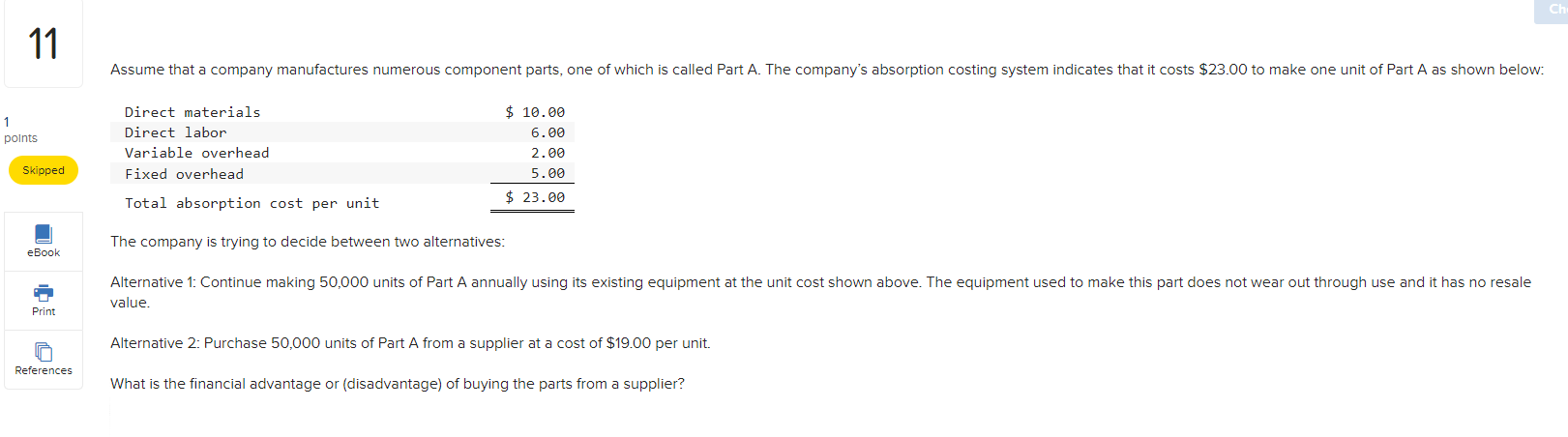

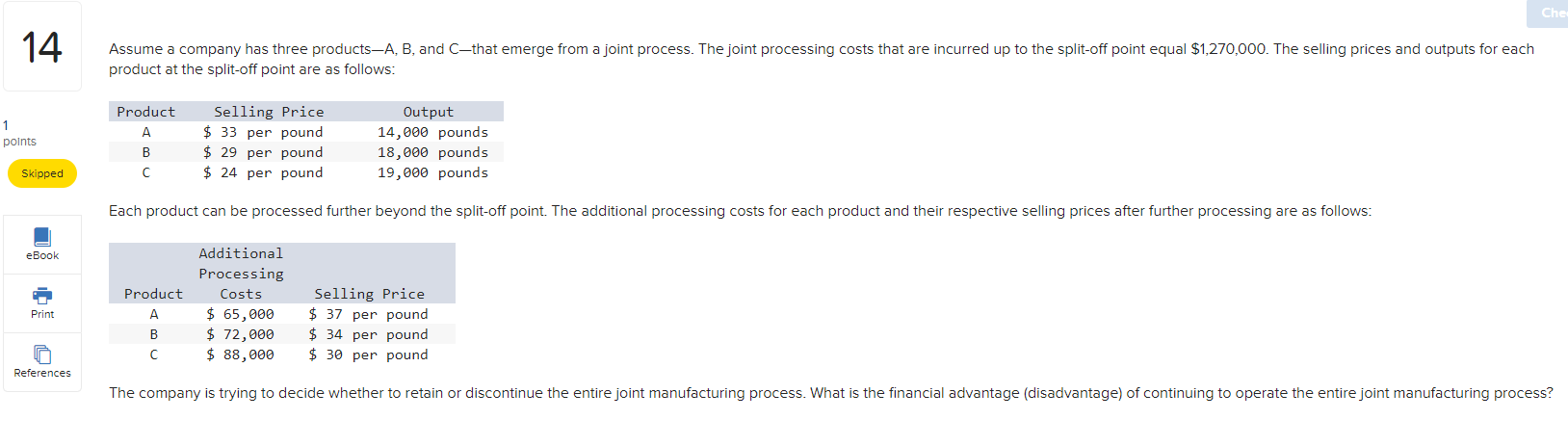

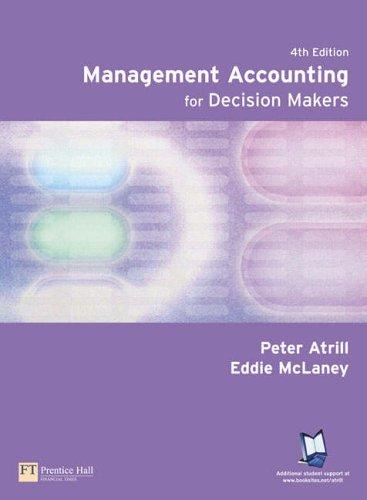

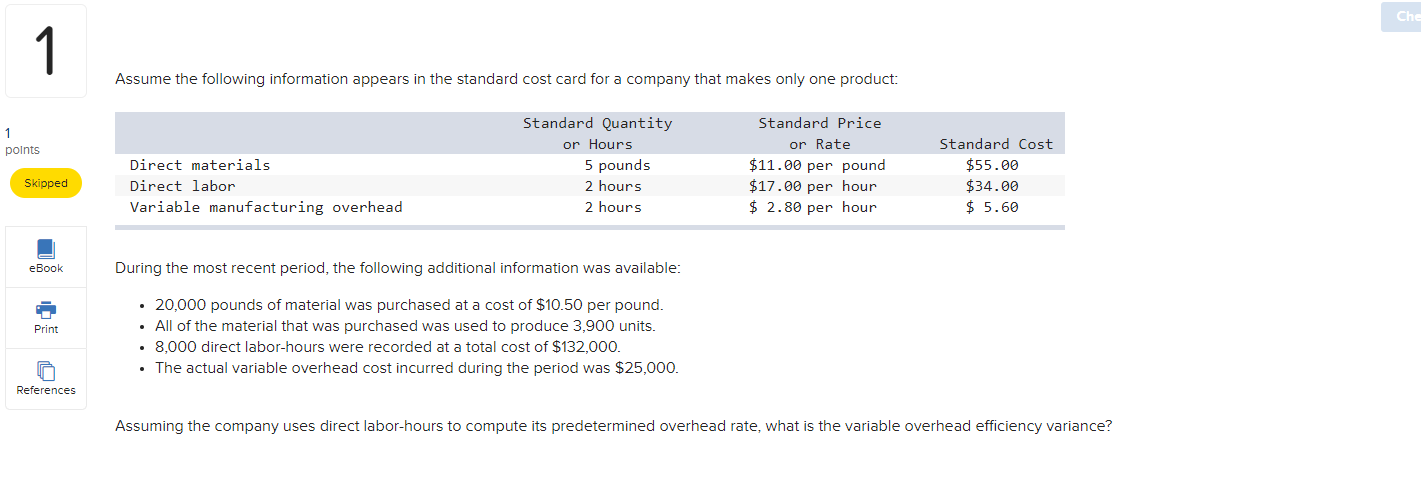

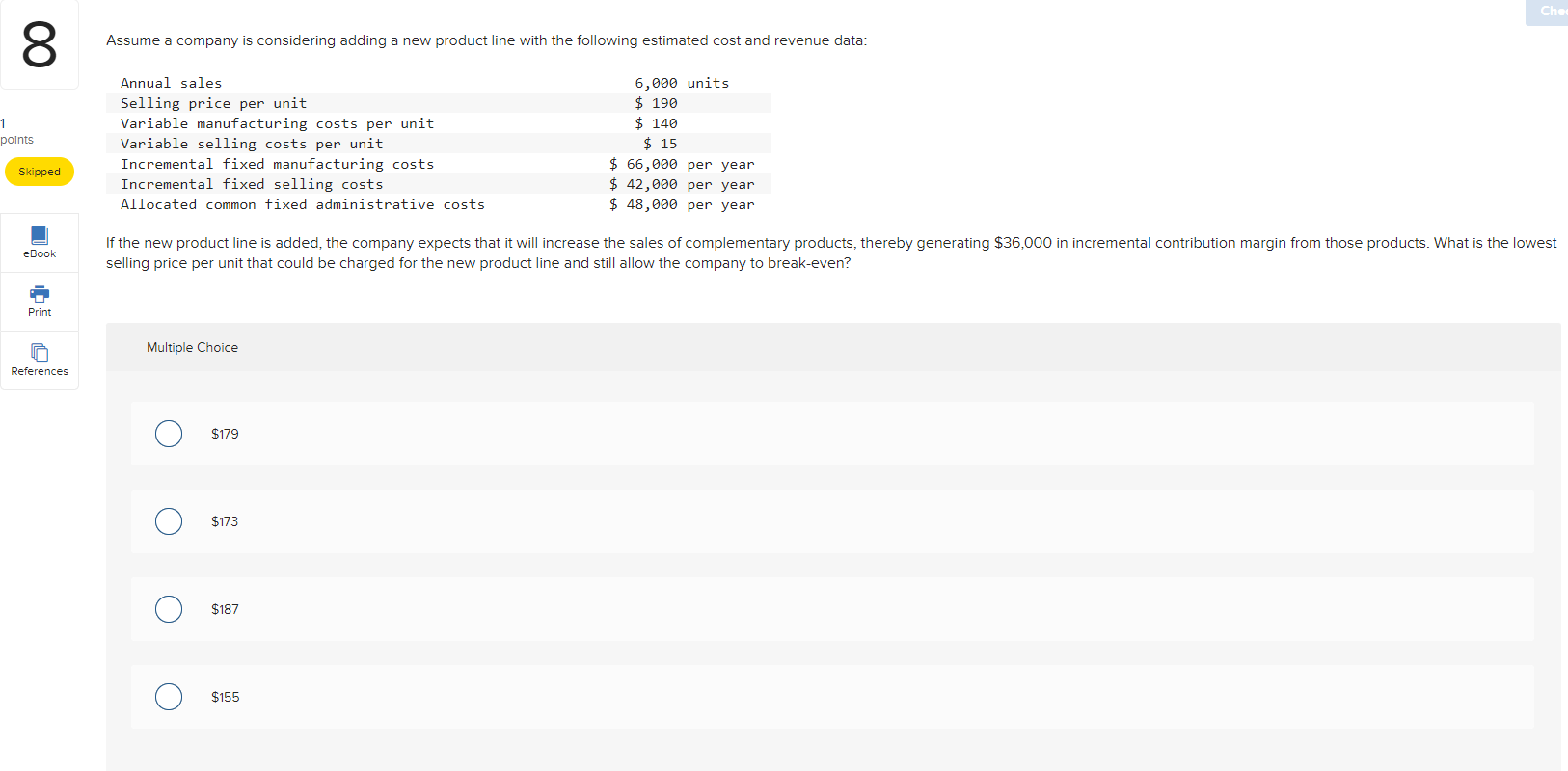

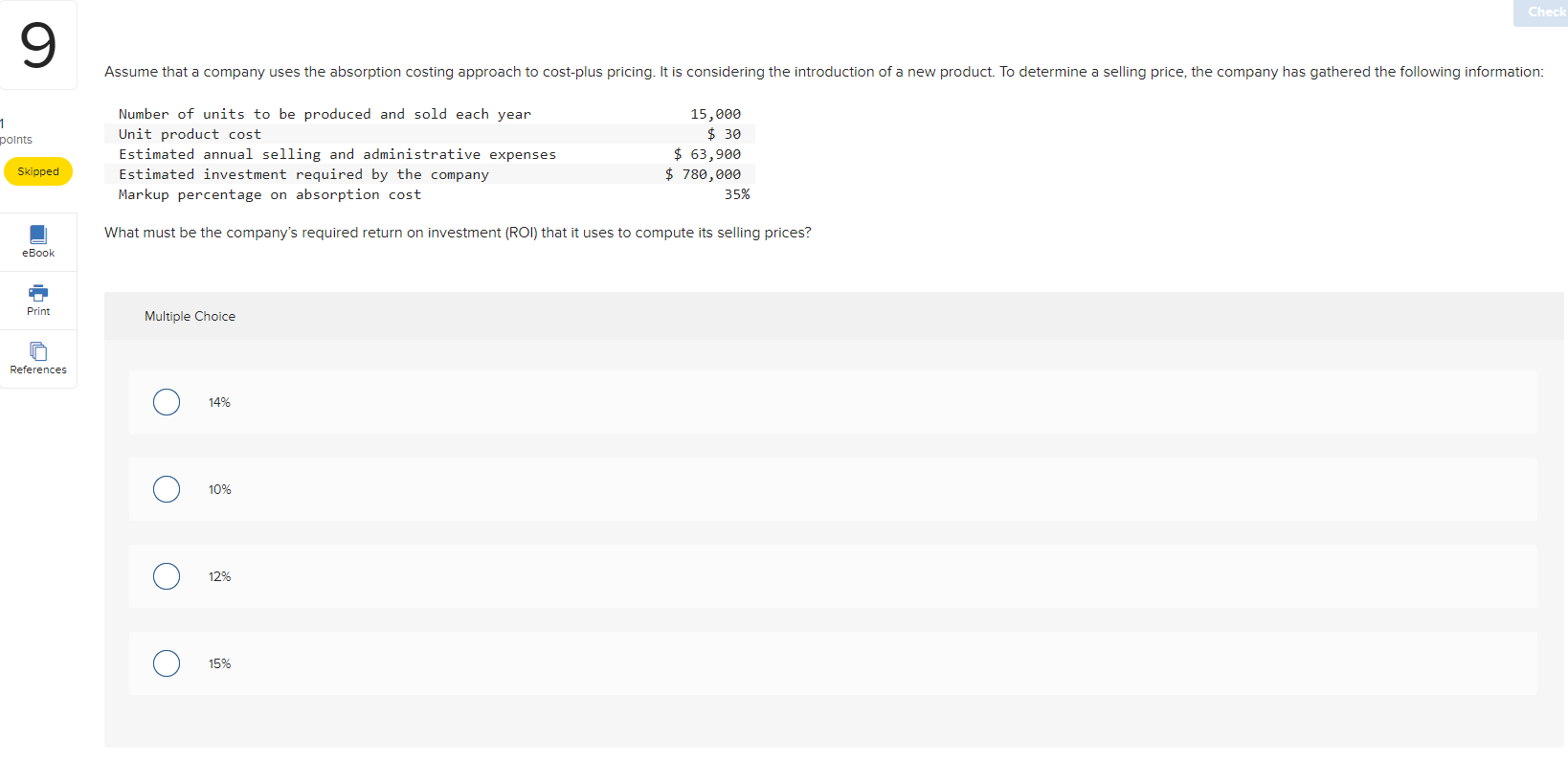

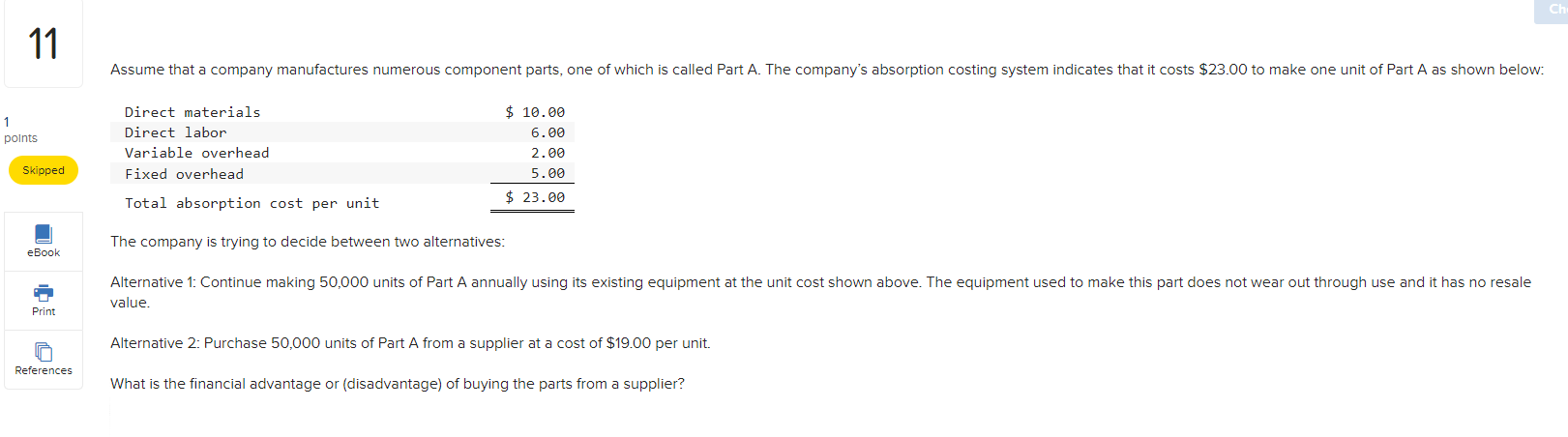

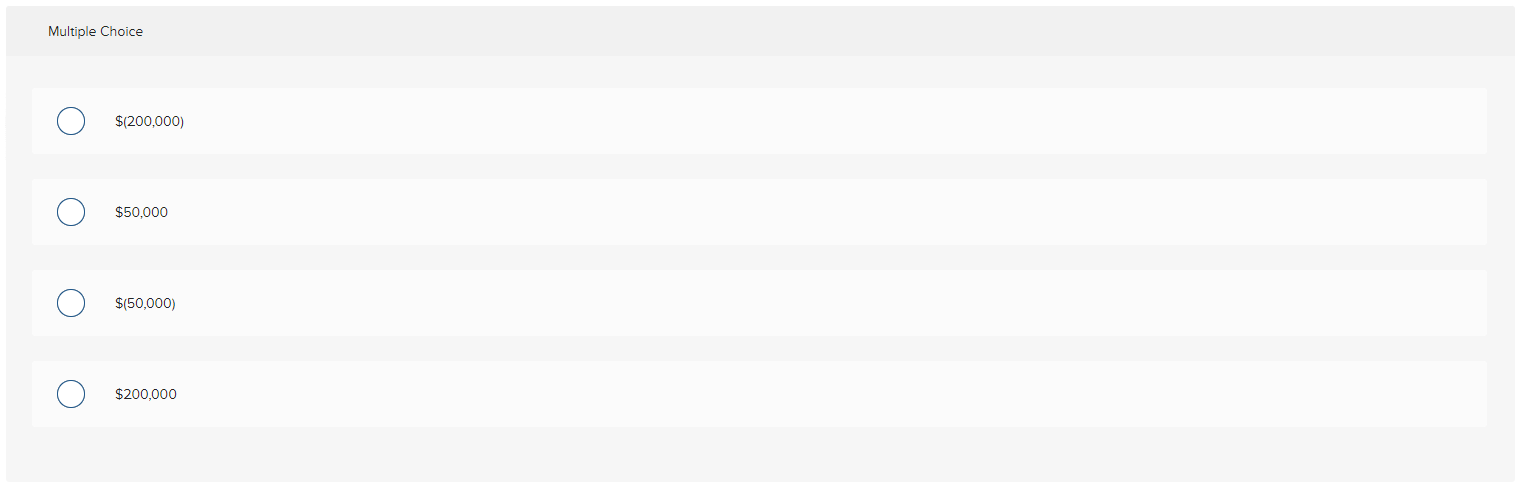

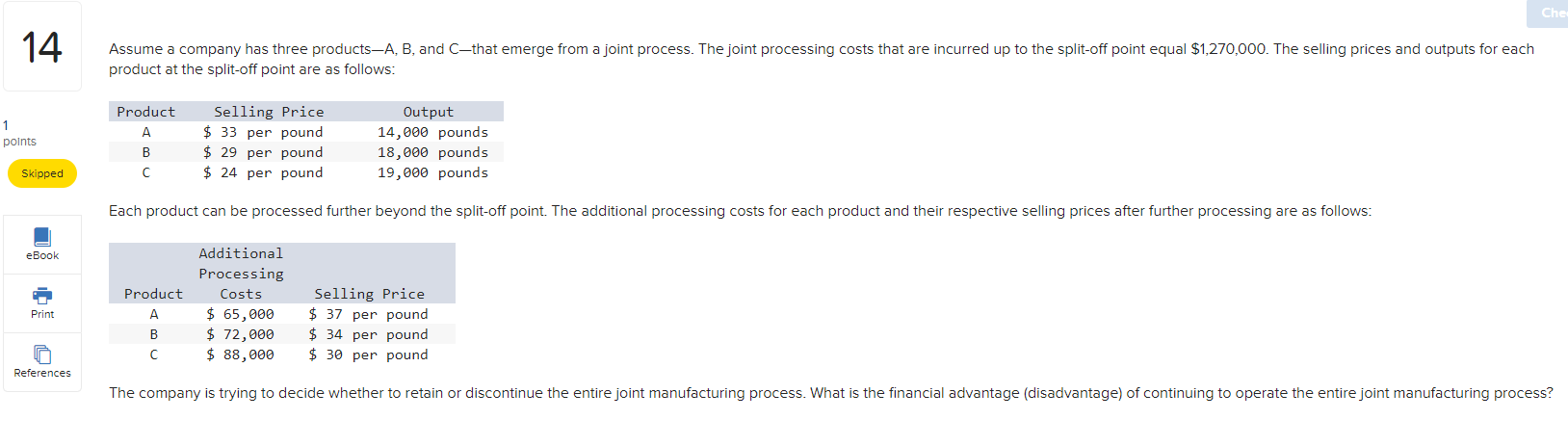

Ch 1 Assume the following information appears in the standard cost card for a company that makes only one product: 1 points Standard Quantity or Hours 5 pounds 2 hours 2 hours Direct materials Direct labor Variable manufacturing overhead Standard Price or Rate $11.00 per pound $17.00 per hour $ 2.80 per hour Standard Cost $55.00 $34.00 $ 5.60 Skipped eBook During the most recent period, the following additional information was available: Print 20,000 pounds of material was purchased at a cost of $10.50 per pound. All of the material that was purchased was used to produce 3,900 units. 8,000 direct labor-hours were recorded at a total cost of $132,000. The actual variable overhead cost incurred during the period was $25,000. References Assuming the company uses direct labor-hours to compute its predetermined overhead rate, what is the variable overhead efficiency variance? Multiple Choice $560 F $560 U O $585 U $585 F O Che 8 Assume a company is considering adding a new product line with the following estimated cost and revenue data: 1 points Annual sales Selling price per unit Variable manufacturing costs per unit Variable selling costs per unit Incremental fixed manufacturing costs Incremental fixed selling costs Allocated common fixed administrative costs 6,000 units $ 190 $ 140 $ 15 $ 66,000 per year $ 42,000 per year $ 48,000 per year Skipped eBook If the new product line is added, the company expects that it will increase the sales of complementary products, thereby generating $36,000 in incremental contribution margin from those products. What is the lowest selling price per unit that could be charged for the new product line and still allow the company to break-even? Print Multiple Choice References $179 O $173 O $187 O O $155 8 Assume the following: The standard labor rate per hour is $17.00. The standard labor-hours allowed per unit of finished goods is 3 hours. The actual quantity of labor hours worked during the period was 44,000 hours. The total actual direct labor cost for the period was $726,000. The company produced 15,000 units of finished goods during the period. 1 points What is the labor spending variance? Multiple Choice $39,000 F $39,000 U $22,000 U $22,000 F Check 9 Assume that a company uses the absorption costing approach to cost-plus pricing. It is considering the introduction of a new product. To determine a selling price, the company has gathered the following information: points Number of units to be produced and sold each year Unit product cost Estimated annual selling and administrative expenses Estimated investment required by the company Markup percentage on absorption cost 15,000 $ 30 $ 63,900 $ 780,000 35% Skipped What must be the company's required return on investment (ROI) that it uses to compute its selling prices? eBook Print Multiple Choice References O 14% O 10% O O 12% O 15% 11 Assume that a company manufactures numerous component parts, one of which is called Part A. The company's absorption costing system indicates that it costs $23.00 to make one unit of Part A as shown below: 1 points Direct materials Direct labor Variable overhead Fixed overhead $ 10.00 6.00 2.00 5.00 Skipped Total absorption cost per unit $ 23.00 eBook The company is trying to decide between two alternatives: Alternative 1: Continue making 50,000 units of Part A annually using its existing equipment at the unit cost shown above. The equipment used to make this part does not wear out through use and it has no resale value. Print Alternative 2: Purchase 50,000 units of Part A from a supplier at a cost of $19.00 per unit. References What is the financial advantage or (disadvantage) of buying the parts from a supplier? Multiple Choice $(200,000) $50,000 $(50,000) $200,000 O Che 14 Assume a company has three products-A, B, and Cthat emerge from a joint process. The joint processing costs that are incurred up to the split-off point equal $1,270,000. The selling prices and outputs for each product at the split-off point are as follows: 1 points Product Selling Price $ 33 per pound $ 29 per pound $ 24 per pound Output 14,000 pounds 18,000 pounds 19,000 pounds B Skipped Each product can be processed further beyond the split-off point. The additional processing costs for each product and their respective selling prices after further processing are as follows: eBook Additional Processing Costs $ 65,000 $ 72,000 $ 88,000 Product B C Print Selling Price $ 37 per pound $ 34 per pound $ 30 per pound References The company is trying to decide whether to retain or discontinue the entire joint manufacturing process. What is the financial advantage (disadvantage) of continuing to operate the entire joint manufacturing process? Multiple Choice $214.000 $205,000 O O $202.000 O $218,000