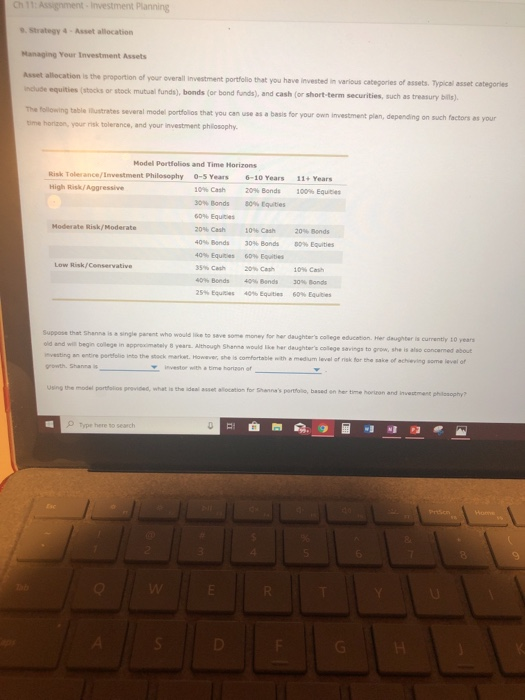

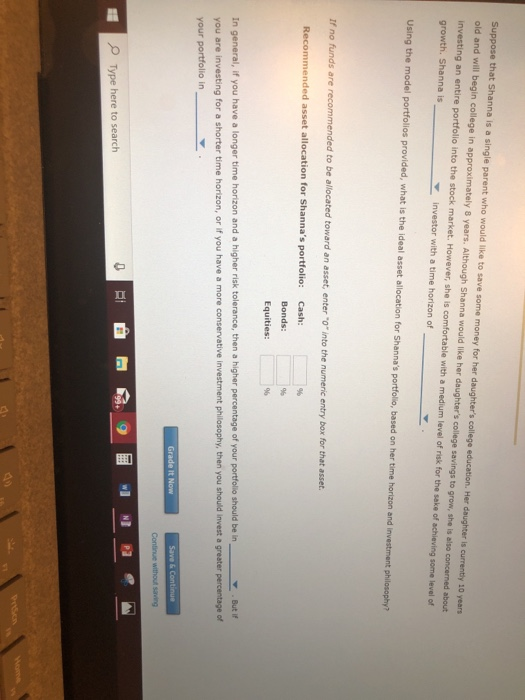

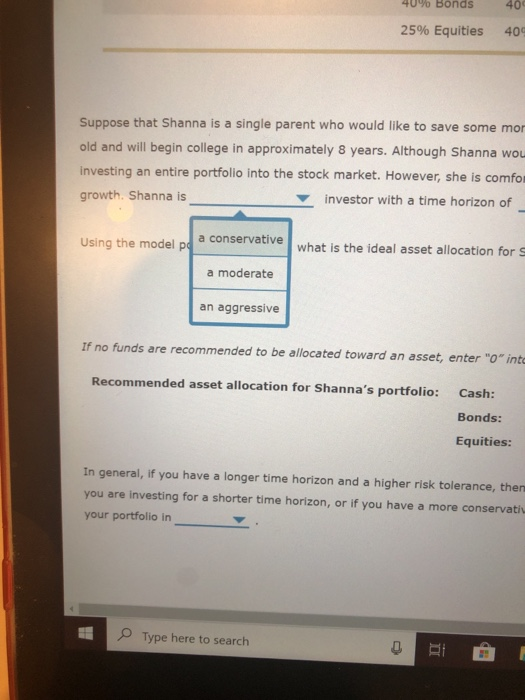

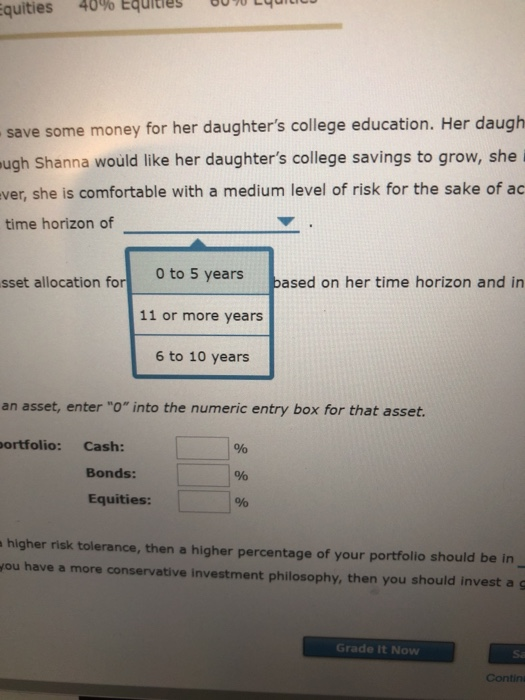

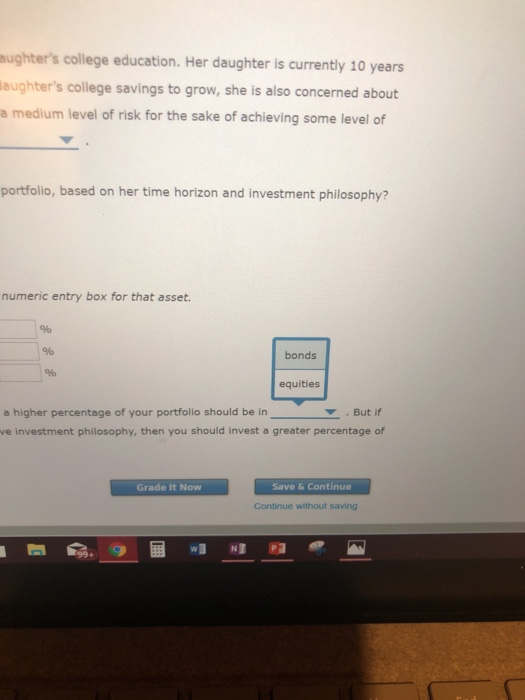

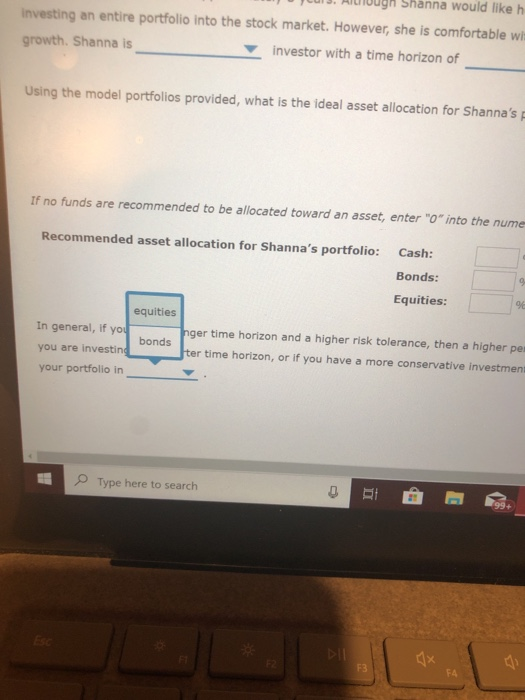

Ch 11: Assignment-Investment Planning 9 Strategy 4-Asset allocation Managing Your Investment Assets Asset allocation is the proportion of your overall investment portfollo that you have invested in various categories of assets. Typical asset categories include equities (stocks or stock mutual funds), bonds (or bond funds), and cash (or short-term securities, such as treasury bills) The following table ilustrates several model portfollos that you can use as a basis for your own investment plan, depending on such factors as your time horizon, your risk tolerance, and your investment philosophy Model Portfolios and Time Horizons Risk Tolerance/Investment Philosophy 0-5 Years 6-10 Years 11+ Years 20% Bonds High Risk/Aggressive 10% Cash 100% Equities 80% Equites 30% Bonds 60% Equities 10% Cash 20% Bonds Moderate Risk/Moderate 20% Cash Bo% Epuities 40% Bends 30% Bonds 40% Equities 60% Equities 10 % Cash 35% Cash Low Risk/Censervative 20% Cash 40% Bonds 30% Bonds 40% Bends 60% Equibes 40% Equities 25% Equtes Suppose that Shanna is a single parent who would le to save some money for her daughter's college educetion Her daughter is currently 10 years old and will begin college in appreximately 8 years Although Shanne would lke her daughter's college savings to grow, she is also concermed about investing an entire portfolie into the stock market However, she is comfortable with a medium level of risk for the sake of achieying some level of investor with a time horizon of growth. Shanna is usne the model portfolios previded, what is the ideal asset allocation for Shanna's portfolo, based on her time horion and investment philpapphy I P P roe here to search Priscn Home 6 W Tab G Suppose that Shanna is a single parent who would like to save some money for her daughter's college education. Her daughter is currently 10 years old and will begin college in approximately 8 years. Although Shanna would like her daughter's college savings to grow, she is also concermed about investing an entire portfolio into the stock market. However, she is comfortable with a medium level of risk for the sake of achieving some level of growth. Shanna is investor with a time horizon of Using the model portfolios provided, what is the ideal asset allocation for Shanna's portfolio, based on her time horizon and investment philosophy? If no funds are recommended to be allocated toward an asset, enter "0" into the numeric entry box for that asset. Recommended asset allocation for Shanna's portfolio: Cash: % Bonds: Equities But if In general, if you have a longer time horizon and a higher risk tolerance, then a higher percentage of your portfolo should be in you are investing for a shorter time horizon, or if you have a more conservative investment philosophy, then you should invest a greater percentage of your portfolio in Grade It Now Save & Continue Continue without saving NI Type here to search Wome Prtscn 40 4096 Bonds 25% Equities 40% single parent who would like to save some mor Suppose that Shanna is a old and will begin college in approximately 8 years. Although Shanna wou investing an entire portfolio into the stock market. However, she is comfor growth. Shanna is investor with a time horizon of a conservative Using the model p what is the ideal asset allocation for S a moderate an aggressive If no funds are recommended to be allocated toward an asset, enter "0" inte Recommended asset allocation for Shanna's portfolio: Cash: Bonds: Equities: In general, if you have a longer time horizon and a higher risk tolerance, then investing for a shorter time horizon, or if you have a more conservativ you are your portfolio in Type here to search Equities 40% Equities save some money for her daughter's college education. Her daugh ugh Shanna would like her daughter's college savings to grow, she ever, she is comfortable with a medium level of risk for the sake of ac time horizon of 0 to 5 years sset allocation for based on her time horizon and in 11 or more years 6 to 10 years an asset, enter "O" into the numeric entry box for that asset. ortfolio: Cash: % Bonds: Equities: a higher risk tolerance, then a higher percentage of your portfolio should be in wou have a re conservative investment philosophy, then you should invest a g Grade It Now Sa Contin mughter's college education. Her daughter is currently 10 years aughter's college savings to grow, she is also concerned about a medium level of risk for the sake of achieving some level of portfolio, based on her time horizon and investment philosophy? numeric entry box for that asset. bonds equities a higher percentage of your portfolio should be in But if ve investment philosophy, then you should invest a greater percentage of Save & Continue Grade It Now Continue without saving NP P3 99+ Shanna would like h investing an entire portfolio into the stock market. However, she is comfortable wi growth. Shanna is investor with a time horizon of Using the model portfolios provided, what is the ideal asset allocation for Shanna's If no funds are recommended to be allocated toward an asset, enter "0" into the nume Recommended asset allocation for Shanna's portfolio: Cash: Bonds: Equities: equities In general, if you nger time horizon and a higher risk tolerance, then a higher per bonds you are investin ter time horizon, or if you have a more conservative investment your portfolio in Type here to search 99+ Esc F3 F4