ch 11 question 8

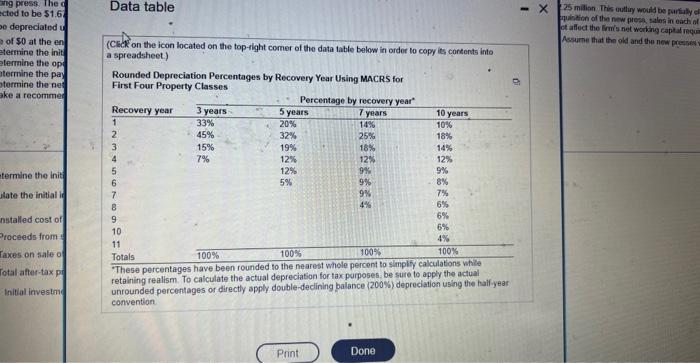

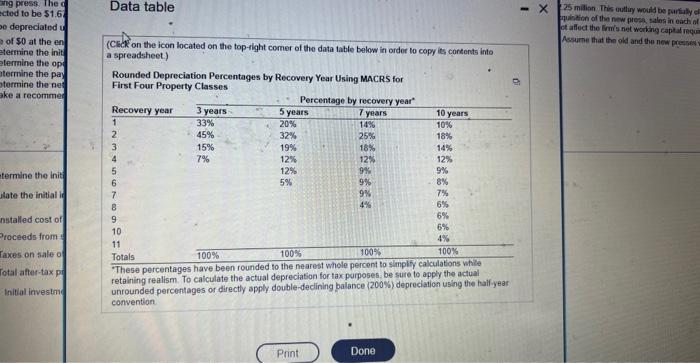

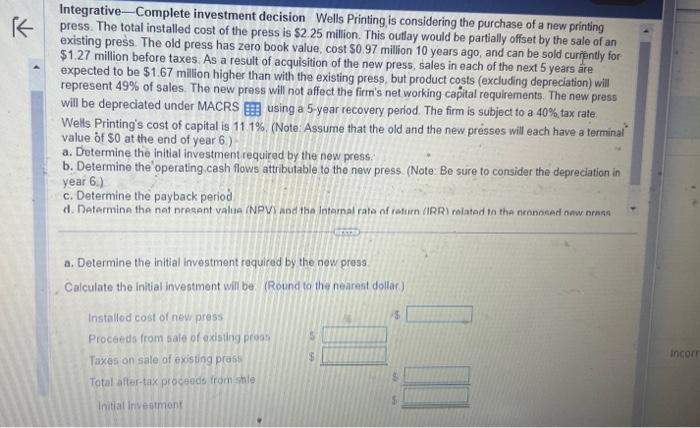

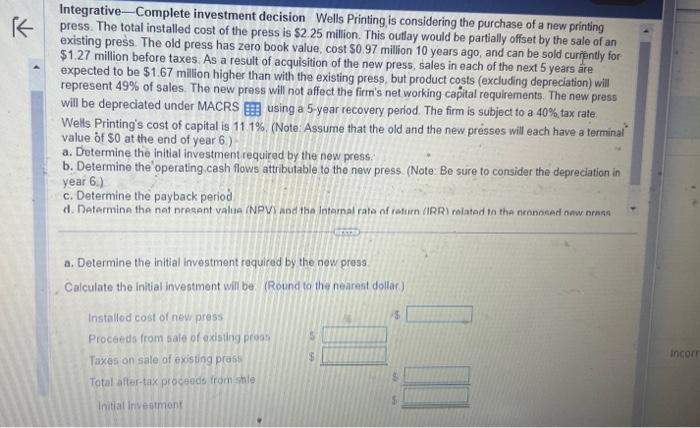

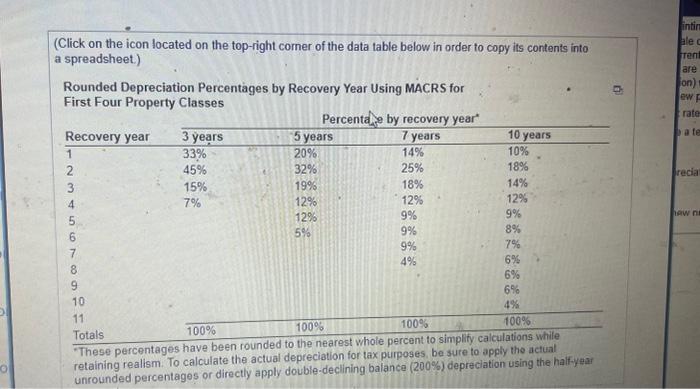

value of 50 at the end of year 6 ) a. Determine the initial itvestresent required by the new press b. Detormine the operathing cash flows attributable to the new press (NNote: Be wre to conilder the depeoclation in year 6) c. Dotermine the payback period d. Detarmine the net present value (NPV) and the inemal rate of coturs (IRR) celated to the proppoted now presa e. Make a recommendation to accept or reject the new press, and justily your ariwer. a. Determine the hitial imestenent requied by the few press Cakculate the inifial kwetemert will be (Round so the fevest dollar) Data table (Cick on the icon located on the top-right comer of the data lable below in order to copy its contents into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes These percentages have been rounded.to the nearest wnore percent so sampry cascuauns muny retaining realism. To calculate the actual depreciation for tax porposes be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the haifyear convention Integrative - Complete investment decision. Wells Printing, is considering the purchase of a new printing press. The total installed cost of the press is $2.25 million. This outlay would be partially offset by the sale of an existing press. The old press has zero book value, cost $0.97 million 10 years ago, and can be sold curiently for $1.27 million before taxes. As a result of acquisition of the new press, sales in each of the next 5 years are expected to be $1.67 million higher than with the existing press, but product costs (excluding depreciation) will represent 49% of sales. The new press will not affect the firm's net working capital requirements. The new press will be depreciated under MACRS using a 5-year recovery period. The firm is subject to a 40% tax rate Wells Printing's cost of capital is 111%. (Note: Assume that the old and the new presses will each have a terminal value of $0 at the end of year 6 .) a. Determine the initial investmentrequired by the new press. b. Determine the 'operating cash flows attributable to the new press. (Note: Be sure to consider the depreciation in year 6.) c. Determine the payback period d. Datermina the nat nresant valua (NPV) and the intamal rata of rafum (IRR) malatad th the neannsed now nrnsa a. Determine the initial investment required by the new press Calculate the initial investment will be (Round to the nearest dollar) (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes These percentages have been rounded to the nearest whure peicuns be sure to apply the actual retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the halfyear value of 50 at the end of year 6 ) a. Determine the initial itvestresent required by the new press b. Detormine the operathing cash flows attributable to the new press (NNote: Be wre to conilder the depeoclation in year 6) c. Dotermine the payback period d. Detarmine the net present value (NPV) and the inemal rate of coturs (IRR) celated to the proppoted now presa e. Make a recommendation to accept or reject the new press, and justily your ariwer. a. Determine the hitial imestenent requied by the few press Cakculate the inifial kwetemert will be (Round so the fevest dollar) Data table (Cick on the icon located on the top-right comer of the data lable below in order to copy its contents into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes These percentages have been rounded.to the nearest wnore percent so sampry cascuauns muny retaining realism. To calculate the actual depreciation for tax porposes be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the haifyear convention Integrative - Complete investment decision. Wells Printing, is considering the purchase of a new printing press. The total installed cost of the press is $2.25 million. This outlay would be partially offset by the sale of an existing press. The old press has zero book value, cost $0.97 million 10 years ago, and can be sold curiently for $1.27 million before taxes. As a result of acquisition of the new press, sales in each of the next 5 years are expected to be $1.67 million higher than with the existing press, but product costs (excluding depreciation) will represent 49% of sales. The new press will not affect the firm's net working capital requirements. The new press will be depreciated under MACRS using a 5-year recovery period. The firm is subject to a 40% tax rate Wells Printing's cost of capital is 111%. (Note: Assume that the old and the new presses will each have a terminal value of $0 at the end of year 6 .) a. Determine the initial investmentrequired by the new press. b. Determine the 'operating cash flows attributable to the new press. (Note: Be sure to consider the depreciation in year 6.) c. Determine the payback period d. Datermina the nat nresant valua (NPV) and the intamal rata of rafum (IRR) malatad th the neannsed now nrnsa a. Determine the initial investment required by the new press Calculate the initial investment will be (Round to the nearest dollar) (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes These percentages have been rounded to the nearest whure peicuns be sure to apply the actual retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the halfyear