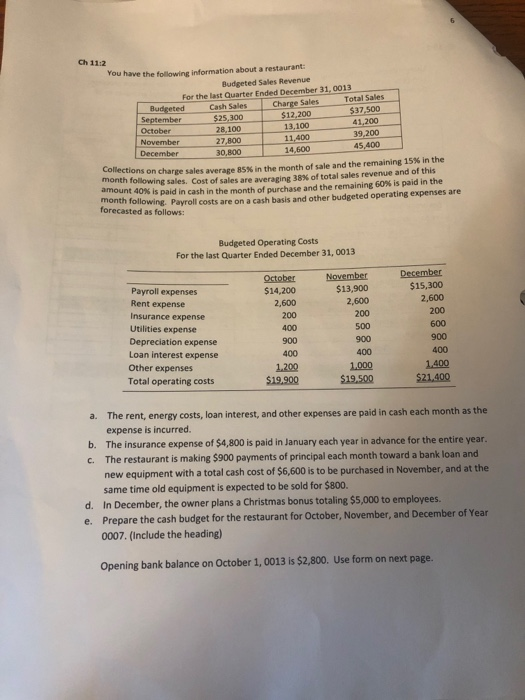

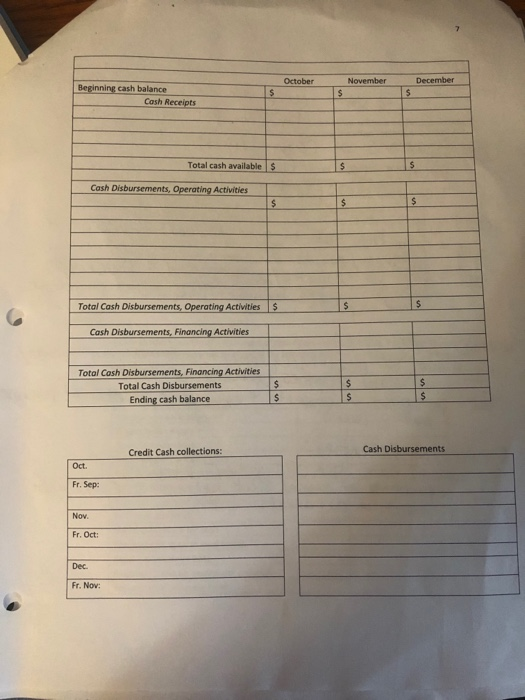

Ch 11:2 $37.500 You have the following information about a restaurant: Budgeted Sales Revenue For the last Quarter Ended December 31, 0013 Budgeted Cash Sales Charge Sales Total Sales September $25,300 $12,200 October 28.100 13,100 41.200 November 27,800 11,400 39,200 December 30,800 14.600 45.400 collections on charge sales average BSX in the month of sale and the remaining 15% in the month following sales. Cost of sales are averaging 38% of total sales revenue and of this amount 40% is paid in cash in the month of purchase and the remaining 60% is paid in the month following. Payroll costs are on a cash basis and other budgeted operating expenses are forecasted as follows: Budgeted Operating costs For the last Quarter Ended December 31, 0013 Rent expense Insurance expense Utilities expense Depreciation expense Loan interest expense Other expenses Total operating costs October $14,200 2,600 200 400 900 400 1.200 $19,900 November $13,900 2,600 200 500 900 December $15,300 2,600 200 600 900 400 1.400 $21.400 400 1.000 $19,500 a. The rent, energy costs, loan interest, and other expenses are paid in cash each month as the expense is incurred. b. The insurance expense of $4,800 is paid in January each year in advance for the entire year. c. The restaurant is making $900 payments of principal each month toward a bank loan and new equipment with a total cash cost of $6,600 is to be purchased in November, and at the same time old equipment is expected to be sold for $800. d. In December, the owner plans a Christmas bonus totaling $5,000 to employees e. Prepare the cash budget for the restaurant for October, November, and December of Year 0007. (Include the heading) Opening bank balance on October 1, 0013 is $2,800. Use form on next page. October November December Beginning cash balance Cash Receipts $ $ Total cash available $ Cash Disbursements, Operating Activities $ $ $ Total Cash Disbursements, Operating Activities S S S Cash Disbursements, Financing Activities Total Cash Disbursements, Financing Activities Total Cash Disbursements Ending cash balance $ $ $ S SS Credit Cash collections: Cash Disbursements Oct. Fr. Sep: Nov. Fr. Oct: Dec. Fr. Nov