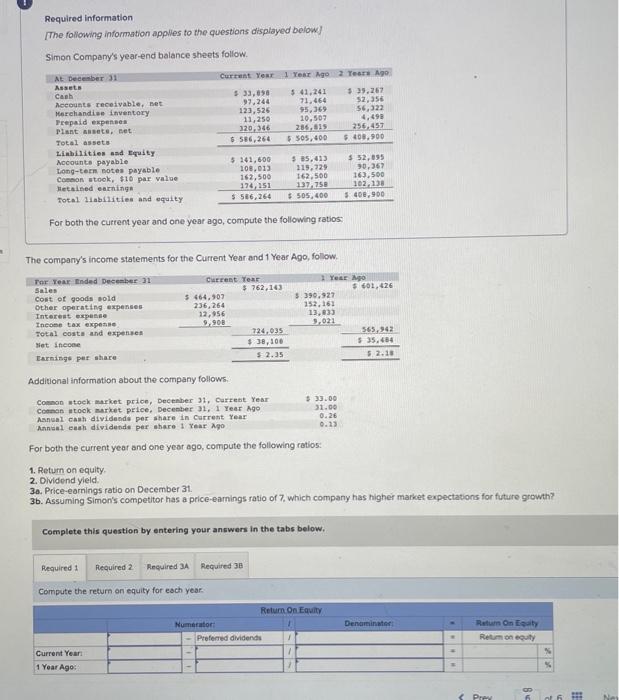

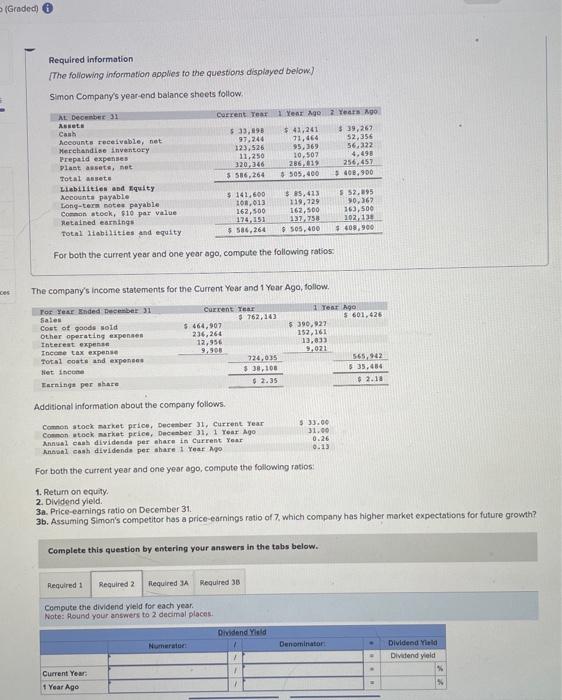

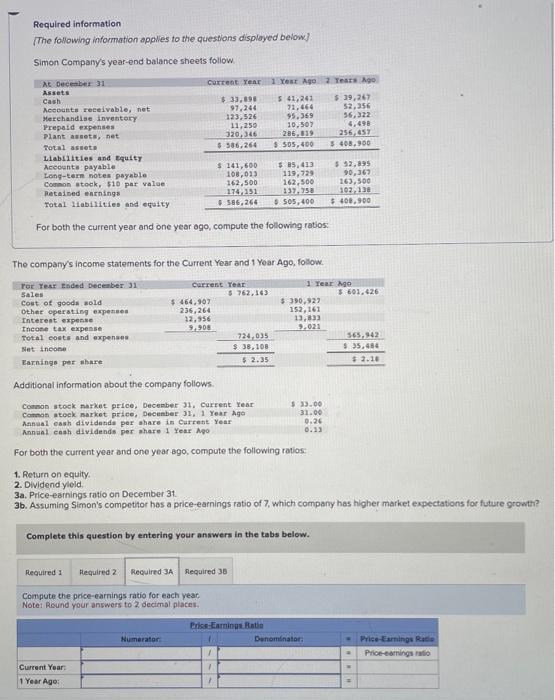

Required information [The following information applles to the questions displayed below] Simon Company's yearend balance sheets follow. For both the curtent year and one year ago, compute the following ratios: The company's income statements for the Current Year and 1 Year Ago, follow. For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield 3a. Price-earnings ratio on December 31 . 3b. Assuming Simon's competitor has a price-earnings ratio of 7 , which company has highei market expectations for future growth? Complete this question by entering your answers in the tabs below. Compute the retum on equity for each year. Required information [The following information applles to the questions disployed below] Simon Company/s year-end balance sheets follow For both the current year and one year ago, compute the following ratios: The company's income statements for the Current Year and 1 Yoar Ago, follow: Additional information about the company follows. Coanon stock narket price, Decenber 21 , Current Year Coman atock narket price, Decumber 31, i Year Ago Aansal cash dividesds per ahare in Curtent Year Annaal cash dividends per ahare 1 Year Ago For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yleid 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 7 , which company has higher market expectations for future growth? Complete this question by entering your answers in the tabs below. Compute the price-earnings ratio for each year. Note: Reund your answers to 2 decimal places. Required information [The following information applies to the questions displayed below] Simon Company's year-end balance sheets follow. For both the current year and one year ago, compute the following ratios: The company's income statements for the Current Year and 1 Yoar Ago, follow. Additional information about the company follows. For both the curtent year and one year ago, compute the following ratios: 1. Retum on equity. 2. Dividend yield. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 7, which company has higher market expectations for future growth? Complete this question by entering your answers in the tabs below. Cempute the dividend yild for each yesr. Note: Hound your ansmers to 2 decimal places