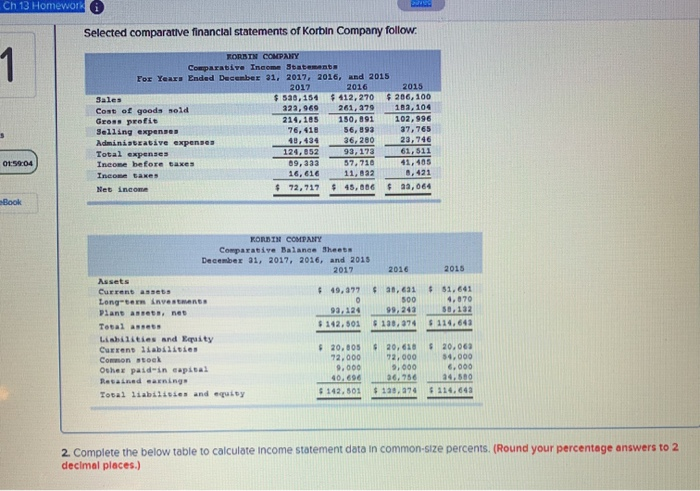

Ch 13 Homework Selected comparative financial statements of Korbin Company follow. KORSTN COMPANY Comparative Income Statements For Year Ended December 31, 2017, 2016, and 2015 2017 2016 sales $ 538,154 $ 412,270 206, 100 Cost of goods sold 323,969 261, 379 103, 104 Gross profie 214.105150, 891 102,996 Selling expenses 56,893 37,765 Administrative expenses 48,434 36,280 23,746 Total expenses 124,652 93,173 61.511 Ineome before taxes 09, aaa 57,710 41, 405 Income taxes 16.816 11.022 8,421 Net Income $ 72,717 $ 45,086 $ 23,064 76, 418 01:59:04 Rook KORDIN COMPANY Comparative Balance sheets December 31, 2017, 2016, and 2015 2017 49,377 30, 631 $ 51.641 4.07 93,124 $ 142.501 $ 138,374 $ 114.643 Current assets Long-term investments Plant anneta, nes Total assets Liabilities and arity Current liabilities Common stock Other paid in capisal Resained sarnings Total liabilities and equity $20.005 72.000 20.610 92.000 $ 20.06 34.000 6.000 $ 142.501 $ 193.274 190.374 114.643 2. Complete the below table to calculate income statement data in common-size percents. (Round your percentage answers to 2 decimal places.) Ch 13 Homework Selected comparative financial statements of Korbin Company follow. KORSTN COMPANY Comparative Income Statements For Year Ended December 31, 2017, 2016, and 2015 2017 2016 sales $ 538,154 $ 412,270 206, 100 Cost of goods sold 323,969 261, 379 103, 104 Gross profie 214.105150, 891 102,996 Selling expenses 56,893 37,765 Administrative expenses 48,434 36,280 23,746 Total expenses 124,652 93,173 61.511 Ineome before taxes 09, aaa 57,710 41, 405 Income taxes 16.816 11.022 8,421 Net Income $ 72,717 $ 45,086 $ 23,064 76, 418 01:59:04 Rook KORDIN COMPANY Comparative Balance sheets December 31, 2017, 2016, and 2015 2017 49,377 30, 631 $ 51.641 4.07 93,124 $ 142.501 $ 138,374 $ 114.643 Current assets Long-term investments Plant anneta, nes Total assets Liabilities and arity Current liabilities Common stock Other paid in capisal Resained sarnings Total liabilities and equity $20.005 72.000 20.610 92.000 $ 20.06 34.000 6.000 $ 142.501 $ 193.274 190.374 114.643 2. Complete the below table to calculate income statement data in common-size percents. (Round your percentage answers to 2 decimal places.)