Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CH 14F - Please respond to the following question(s) with a thoughtful response. Be sure to support your answer with reason and logic based

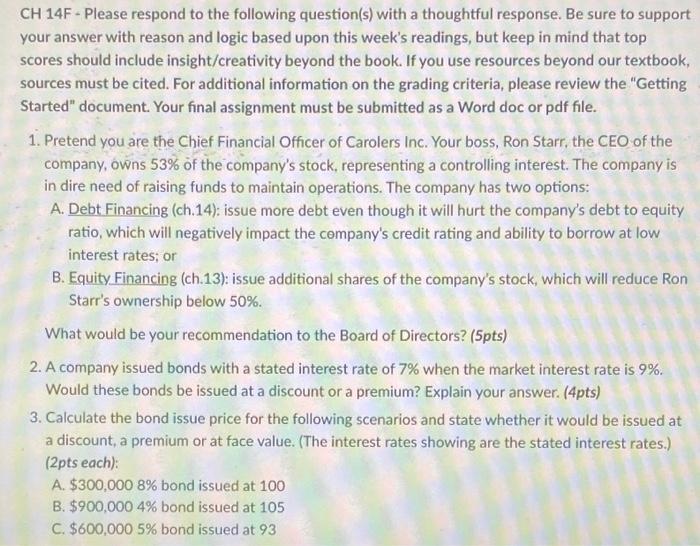

CH 14F - Please respond to the following question(s) with a thoughtful response. Be sure to support your answer with reason and logic based upon this week's readings, but keep in mind that top scores should include insight/creativity beyond the book. If you use resources beyond our textbook, sources must be cited. For additional information on the grading criteria, please review the "Getting Started" document. Your final assignment must be submitted as a Word doc or pdf file. 1. Pretend you are the Chief Financial Officer of Carolers Inc. Your boss, Ron Starr, the CEO of the company, owns 53% of the company's stock, representing a controlling interest. The company is in dire need of raising funds to maintain operations. The company has two options: A. Debt Financing (ch.14): issue more debt even though it will hurt the company's debt to equity ratio, which will negatively impact the company's credit rating and ability to borrow at low interest rates; or B. Equity Financing (ch.13): issue additional shares of the company's stock, which will reduce Ron Starr's ownership below 50%. What would be your recommendation to the Board of Directors? (5pts) 2. A company issued bonds with a stated interest rate of 7% when the market interest rate is 9%. Would these bonds be issued at a discount or a premium? Explain your answer. (4pts) 3. Calculate the bond issue price for the following scenarios and state whether it would be issued at a discount, a premium or at face value. (The interest rates showing are the stated interest rates.) (2pts each): A. $300,000 8% bond issued at 100 B. $900,000 4% bond issued at 105 C. $600,000 5% bond issued at 93

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 Recommendation to the Board of Directors As the Chief Financial Officer of Carolers Inc faced with the decision between debt financing and equity financing my recommendation to the Board of Director...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started