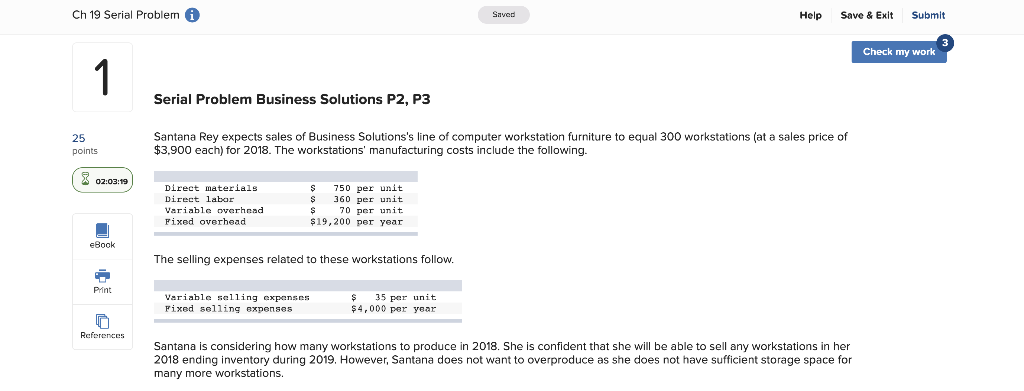

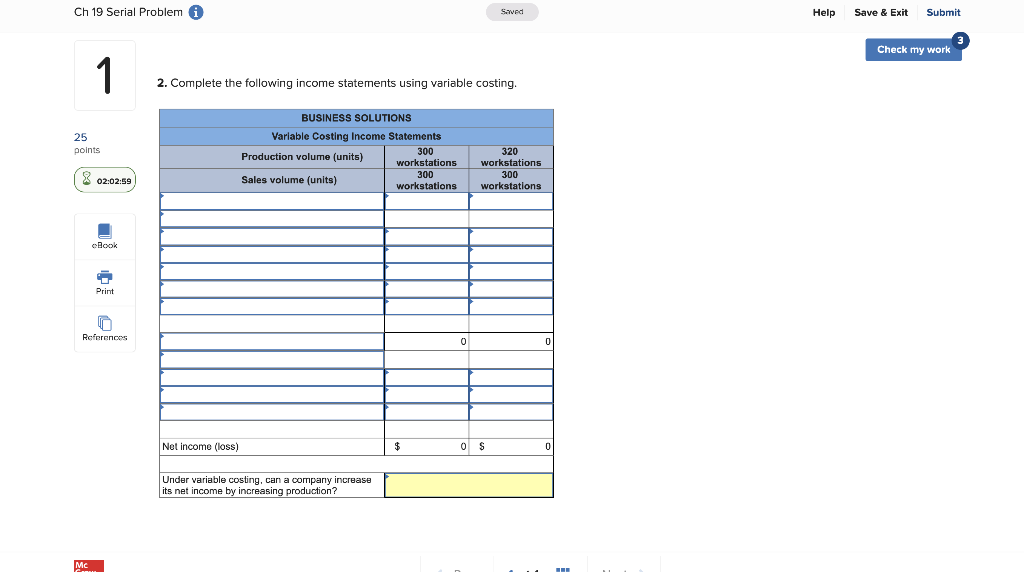

Ch 19 Serial Problem i Saved Help Save & Exit Submit Check my work 1 Serial Problem Business Solutions P2, P3 Santana Rey expects sales $3,900 each) for 2018. The workstations' manufacturing costs include the following. f Business Solutions's line f computer workstation furniture to equal 300 workstations (at a sales price of 25 points gz:03:19 Direct materials 750 per unit Direct labar 360 per unit Variable overhead Fixe per unit S19,200 per year overhead e8ock The selling expenses related to these workstations follow. Print Variable selling 35 per unit S4.000 per vear ses Fixed selling expenses Rcferences Santana is considering how many 2018 ending inventory during 2019, However, Santana does not want to overproduce as she does not have sufficient storage space for orkstations roduce in 2018. She is confident that she will be able to sell any workstations in her many more workstations Check my work 1 Required: Complete the following income statements using absorption costing. Production volume 25 30 320 Cost of goods sold: points workstations workstations Direct materials per unit 750 S 750 02:03:07 Direct labor per unit 360 360 Variable overhead per unit 70 70 Fixed overhead per unit 64 64 1,244 S Cost of goods sold per unit 1,244 eBook Number workstations sold 300 300 373.200 S Total cost of goods sold 373,200 Print BUSINESS SOLUTIONS Absorption Costing Income Statements References Production volume Sales volume -300 Workstations workstations workstations Sales 1,170,000s 1,700,000 Cost of goods sold (373,200) (373,200) Gross margin 1,326,800 796,800 Selling general and administrative expenses Net income (loss) 796,800 S 1,326,800 Under absorption costing, can the difference between production volume and sales volume affect the reported net income (loss)? Ch 19 Serial Problemi Saved Submit Help Save & Exit Check my work 1 2. Complete the following income statements using variable costing BUSINESS SOLUTIONS Variable Costing Income Statements 25 300 ooints 320 Production volume (units) work tations 00 wo Ions 200 Sales volume (units) 02:02:59 workstations workstations Book Prim References Net income (loss) its net income by increasing producfo ase