Question

ch 20 part 5 Dozier Industries Inc. manufactures only one product. For the year ended December 31, the contribution margin increased by $47,190 from the

ch 20 part 5

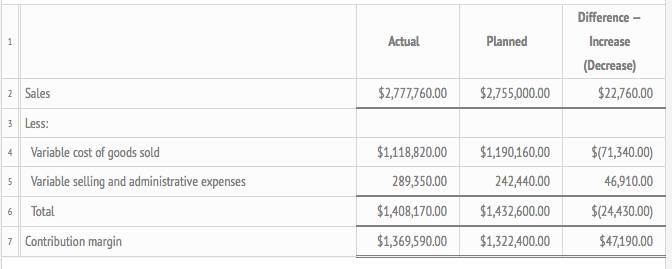

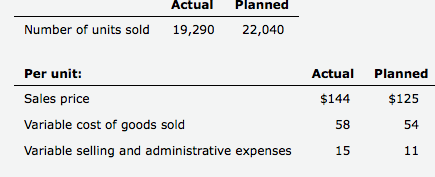

Dozier Industries Inc. manufactures only one product. For the year ended December 31, the contribution margin increased by $47,190 from the planned level of $1,322,400. The president of Dozier Industries Inc. has expressed some concern about such a small increase and has requested a follow-up report.

The following data have been gathered from the accounting records for the year ended December 31:

| Labels | |

| Effect of changes in sales | |

| Effect of changes in variable selling and administrative expenses | |

| Effect of changes in variable cost of goods sold | |

| For the Year Ended December 31 | |

| Amount Descriptions | |

| Actual contribution margin | |

| Contribution margin ratio | |

| Gross profit | |

| Planned contribution margin | |

| Sales mix | |

| Sales quantity factor | |

| Total effect of changes in sales | |

| Total effect of changes in variable selling and administrative expenses | |

| Total effect of changes in variable cost of goods sold | |

| Unit cost factor | |

| Unit price factor | |

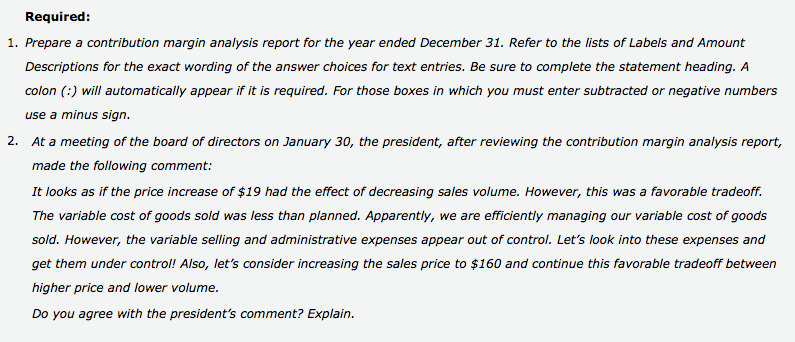

| Variable cost quantity factor 1. Prepare a contribution margin analysis report for the year ended December 31. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. A colon (:) will automatically appear if it is required. For those boxes in which you must enter subtracted or negative numbers use a minus sign.

2. At a meeting of the board of directors on January 30, the president, after reviewing the contribution margin analysis report, made the following comment: It looks as if the price increase of $19 had the effect of decreasing sales volume. However, this was a favorable tradeoff. The variable cost of goods sold was less than planned. Apparently, we are efficiently managing our variable cost of goods sold. However, the variable selling and administrative expenses appear out of control. Lets look into these expenses and get them under control! Also, lets consider increasing the sales price to $160 and continue this favorable tradeoff between higher price and lower volume. Do you agree with the presidents comment? Explain. ( )Agree with the president because the total effect of change in sales is greater than the total effect of changes in variable cost of goods sold, making an additional price raise attractive for more profits. ( )Agree with the president because the majority of the decrease in the variable cost of goods sold was due to the sales price factor, as well as an increase in the variable selling and administrative expenses as a percentage of sales, making an additional price raise attractive for more profits. ( )Disagree with the president because the majority of the decrease in the variable cost of goods sold was due to the variable cost quantity factor and the increased variable selling and administrative expenses are probably a result of additional selling efforts needed to be competitive at higher prices. ( )Disagree with the president because the contribution margin as a percentage of sales is greater for the planned sales level than the actual sales level, making his concern about variable selling and administrative expenses unwarranted. ( )Agree with the president because the unit cost factor for the variable selling and administrative cost is greater than the unit cost factor for the variable cost of goods sold, making an investigation necessary. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started