Question

CH 25-6 Capital Rationing Decision for a Service Company Involving Four Proposals Renaissance Capital Group is considering allocating a limited amount of capital investment funds

CH 25-6

Capital Rationing Decision for a Service Company Involving Four Proposals

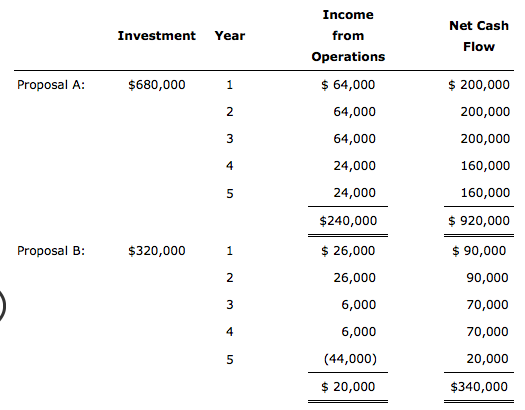

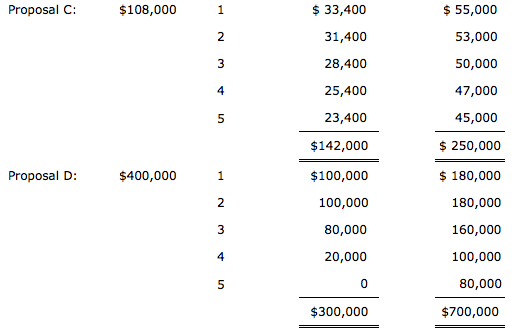

Renaissance Capital Group is considering allocating a limited amount of capital investment funds among four proposals. The amount of proposed investment, estimated income from operations, and net cash flow for each proposal are as follows:

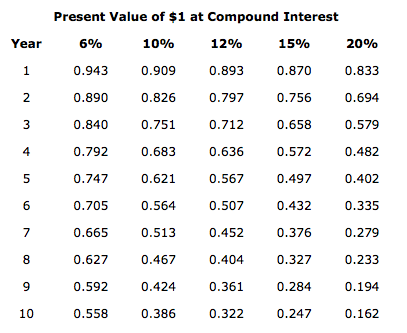

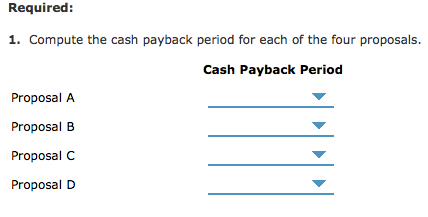

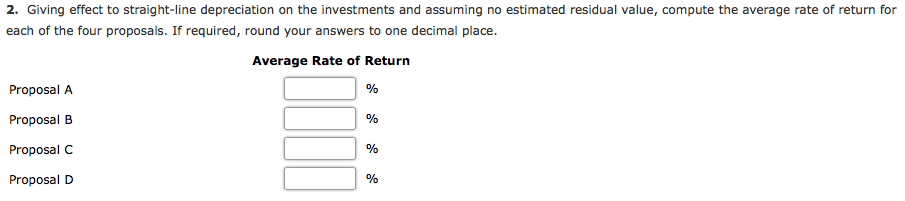

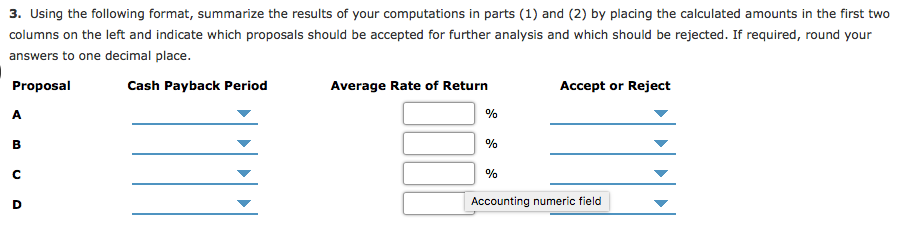

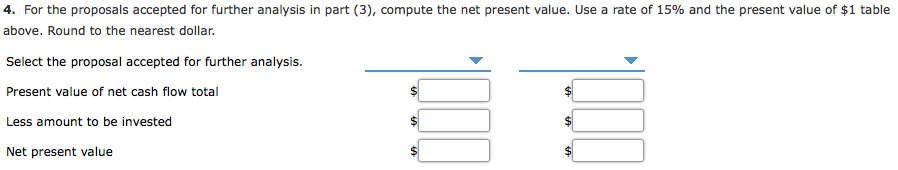

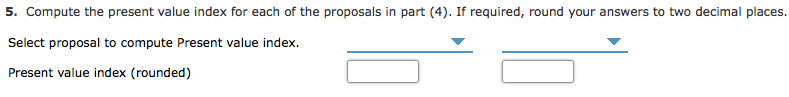

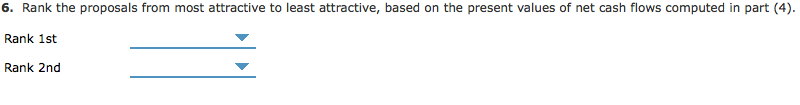

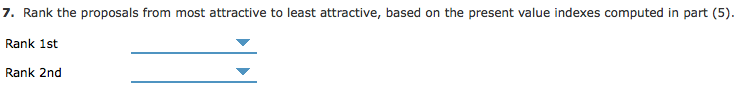

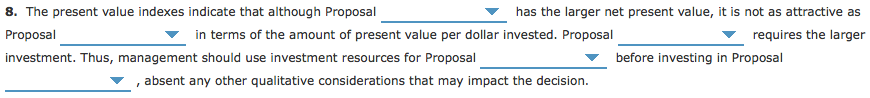

The company's capital rationing policy requires a maximum cash payback period of three years. In addition, a minimum average rate of return of 12% is required on all projects. If the preceding standards are met, the net present value method and present value indexes are used to rank the remaining proposals.

The company's capital rationing policy requires a maximum cash payback period of three years. In addition, a minimum average rate of return of 12% is required on all projects. If the preceding standards are met, the net present value method and present value indexes are used to rank the remaining proposals.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started