Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ch 3 Exercises Part 1 of 3 3 points q , eBook Print References ! Required information [ The following information applies to the questions

Ch Exercises

Part of

points

eBook

Print

References

Required information

The following information applies to the questions displayed below.

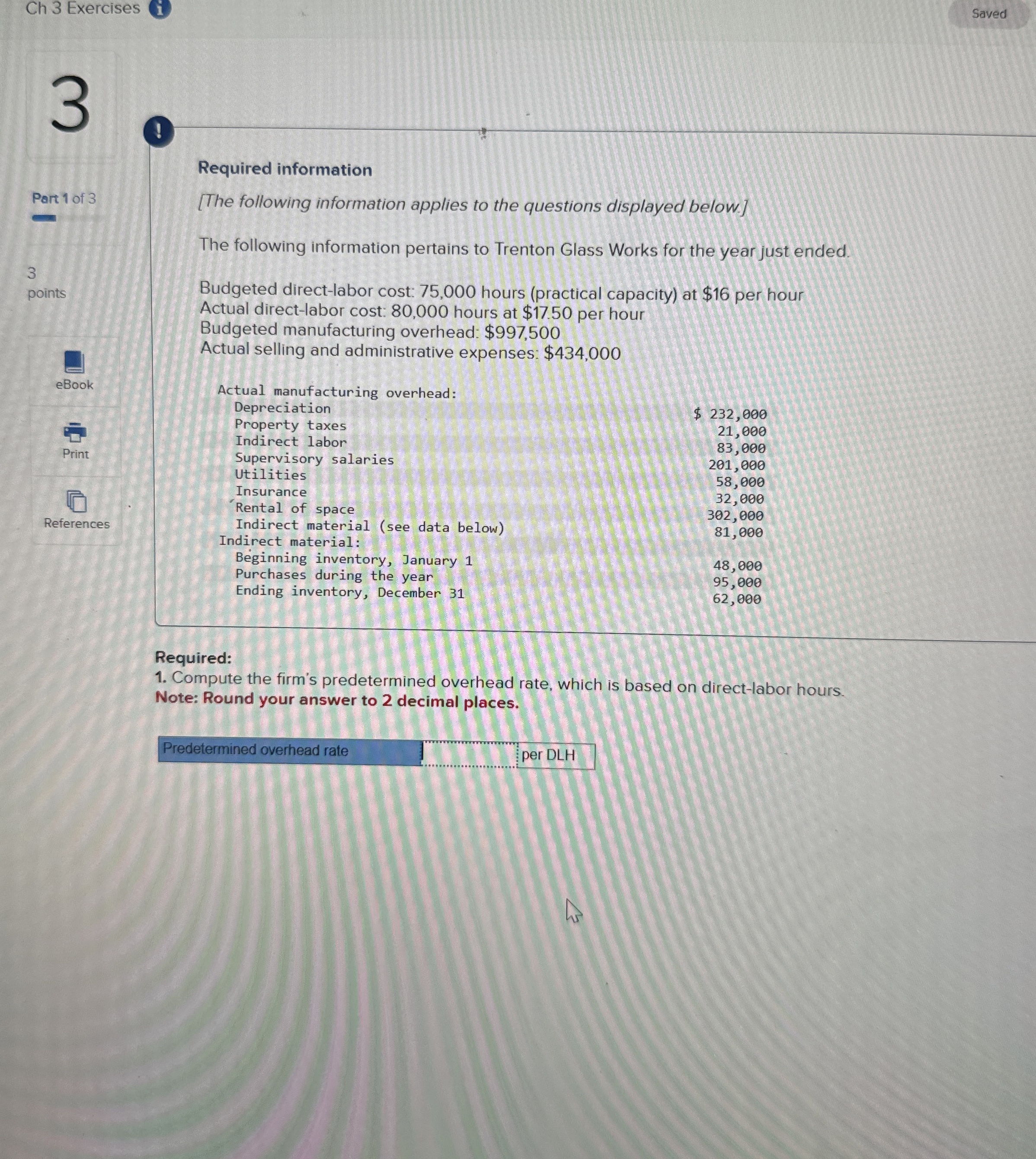

The following information pertains to Trenton Glass Works for the year just ended.

Budgeted directlabor cost: hours practical capacity at $ per hour Actual directlabor cost: hours at $ per hour

Budgeted manufacturing overhead: $

Actual selling and administrative expenses: $

Actual manufacturing overhead:

Depreciation

Property taxes

$

Indirect labor

Supervisory salaries

Utilities

Insurance

Rental of space see data below

Indirect material:

Beginning inventory, January

Purchases during the year

Ending inventory, December

Required:

Compute the firm's predetermined overhead rate, which is based on directlabor hours.

Note: Round your answer to decimal places.

Predetermined overhead rate

per DLH

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started