Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ch 4 p 2 According to the video, which of the following represents the ROE of a firm? Use the table to match the mathemasical

Ch 4 p 2

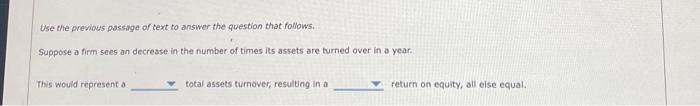

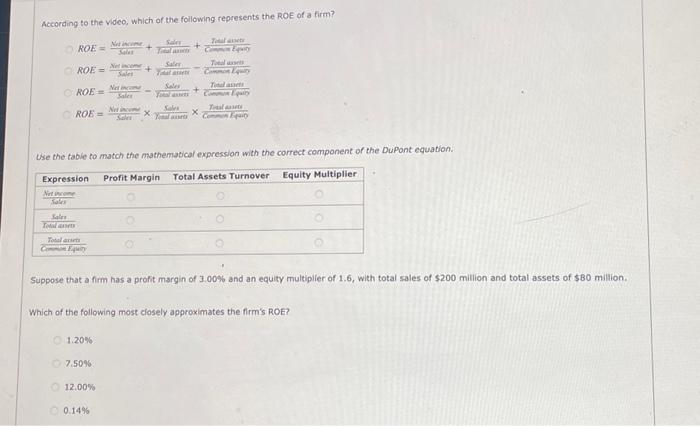

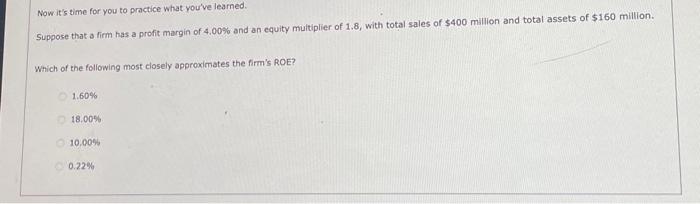

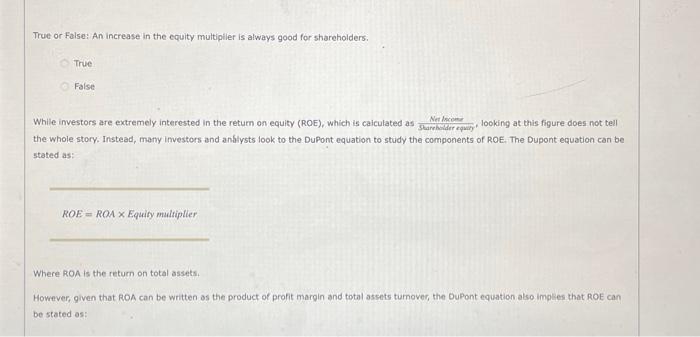

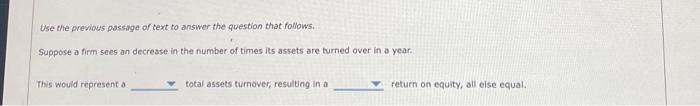

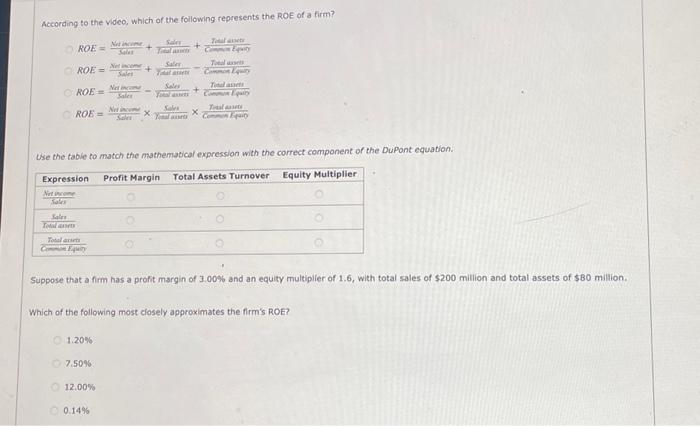

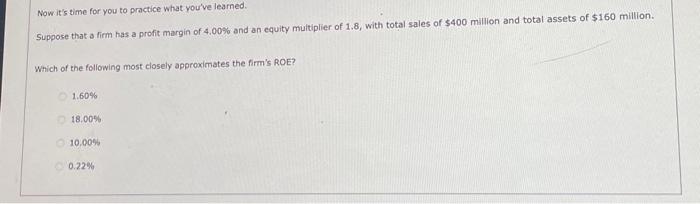

According to the video, which of the following represents the ROE of a firm? Use the table to match the mathemasical expression with the correct component of the DuPant equation. Suppose that a firm has a profit margin of 3.00% and an equity multiplier of 1.6 , with total sales of $200 million and total assets of $80 million. Which of the following most closely approximates the firm's ROE? 1.20% 7,50% 12.00% 0.14% Use the previous passage of text to answer the question that follows. Suppose a firm sees an decrease in the number of times its assets are turned over in a year. This would represent a total assets turnover, resulting in a return on equity, all else equal. Now it's time for you to practice what you've learned. Suppose that a firm has a profit margin of 4.00% and an equity muitiplier of 1.8 , with total sales of $400 million and total assets of $160 million. Which of the following most closely approximates the firm's ROE? 1.60% 18.00% 10,00% 0.22% True or False: An increase in the equity multipller is always good for shareholders. True Folse the whole story. Instead, many imvestors and anklysts look to the DuPont equation to study the components of RoE. The Dupont equation can be stated as: ROE=ROAEquitymultiplier Where ROA is the retum on total assets. However, given that ROA can be written as the product of profit margin and total assets tumover, the DuPont equation also implies that ROE can be stated as

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started