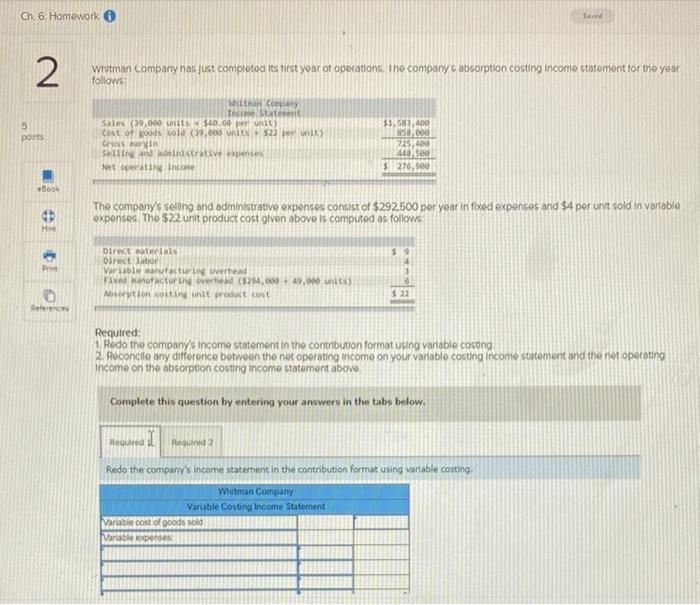

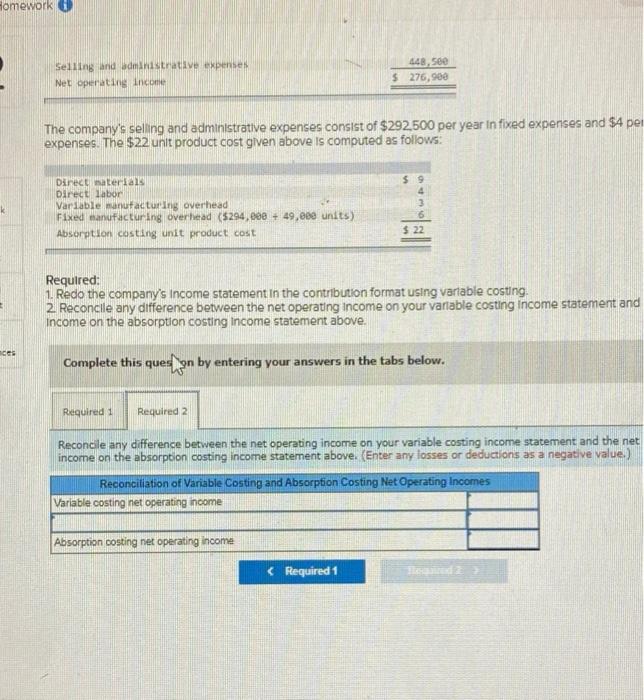

Ch 6. Homework 2 Whitman Company has just completed its first year of operations. The company absorption costing Income statement for the year follows points Com The Sun Sales (39.00 $40.60 Cost of Woods sold 9.00 units per unit) Gruss margin Selling drive expenses Net operating con $1,683,400 250.000 725,400 448.00 $ 276,900 eBook 40 The company's selling and administrative expenses consist of $292500 per year in fixed expenses and SA per unit sold in variable expenses The $22 unit product cost given above is computed as follows H 59 PV Directa Oirect labor Variable soufacturing overhead Fixed an tacturing overhad ($24,000 49.000 units) Absorption conting unit product cost $22 Defence Required: Redo the company's income statement in the contribution format using variable cosung 2. Reconcile any difference between the not operating income on your variable costing Income statement and the net operating Income on the absorption couting Income statement above Complete this question by entering your answers in the tabs be below. Requirea 1 Reginda Redo the company's income statement in the contribution format using variable costing, Whitman Company Variable Costing Income Statement Variable cost of goods sold Variable speses Homework Selling and administrative expenses Net operating Income 448,56 $ 276, see The company's selling and administrative expenses consist of $292,500 per year in fixed expenses and $4 per expenses. The $22 unit product cost glven above is computed as follows: $ 9 4 3 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead (5294,880 + 49,000 units) Absorption costing unit product cost $ 22 Required: 1. Redo the company's Income statement in the contribution format using variable costing 2. Reconcile any difference between the net operating income on your variable costing Income statement and Income on the absorption costing Income statement above. ces Complete this ques yn by entering your answers in the tabs below. Required 1 Required 2 Reconcile any difference between the net operating income on your variable costing income statement and the net income on the absorption costing income statement above. (Enter any losses or deductions as a negative value.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Variable costing net operating income Absorption costing net operating income