Answered step by step

Verified Expert Solution

Question

1 Approved Answer

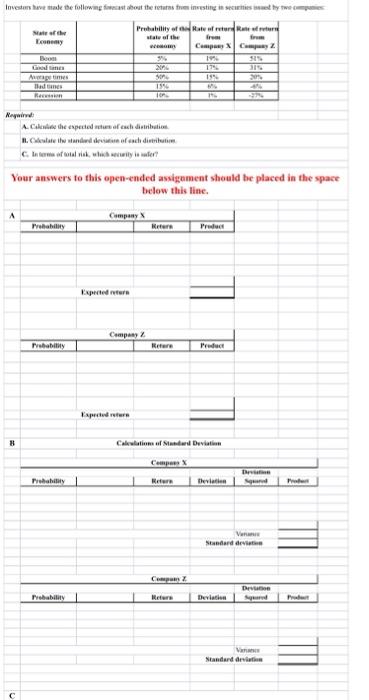

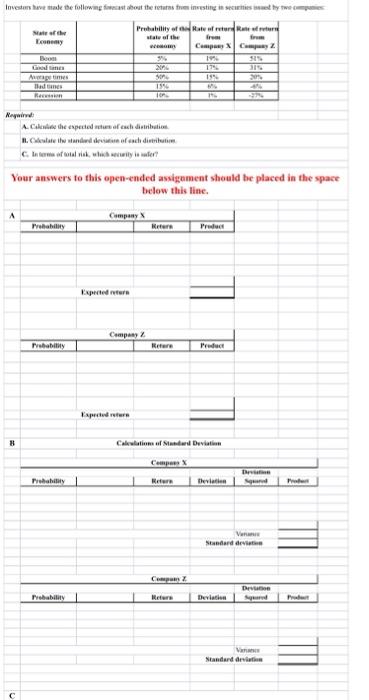

ch 8 open ended assignment Investors have made the following fast about the returns from investing in securities issued by two companies Probability of the

ch 8 open ended assignment

Investors have made the following fast about the returns from investing in securities issued by two companies Probability of the Rate of retur Rate of return state of the from comm Company XCompany Z 19% Required A Economy Boom Good times Average times Bad times Recession 8 A. Calle the expected return of each distribution B. Calelate the standard deviation of each distribution C. In terms of total risk, which it is? Your answers to this open-ended assignment should be placed in the space below this line. Probability Probability Probability Probability Company X Expected return 3% 205 509 155 Company Z Expected return Return Refere Compons X 19% 6% 196 Return Calculations of Standard deviation Company Z Product Product 51% 315 20% 45% Deviation Deviation Squand Verans Standard deviation Deviation Deviation Squared Standard deviation Prode Product Investors have made the following fast about the returns from investing in securities issued by two companies Probability of the Rate of retur Rate of return state of the from comm Company XCompany Z 19% Required A Economy Boom Good times Average times Bad times Recession 8 A. Calle the expected return of each distribution B. Calelate the standard deviation of each distribution C. In terms of total risk, which it is? Your answers to this open-ended assignment should be placed in the space below this line. Probability Probability Probability Probability Company X Expected return 3% 205 509 155 Company Z Expected return Return Refere Compons X 19% 6% 196 Return Calculations of Standard deviation Company Z Product Product 51% 315 20% 45% Deviation Deviation Squand Verans Standard deviation Deviation Deviation Squared Standard deviation Prode Product

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started