ch 9 q 7

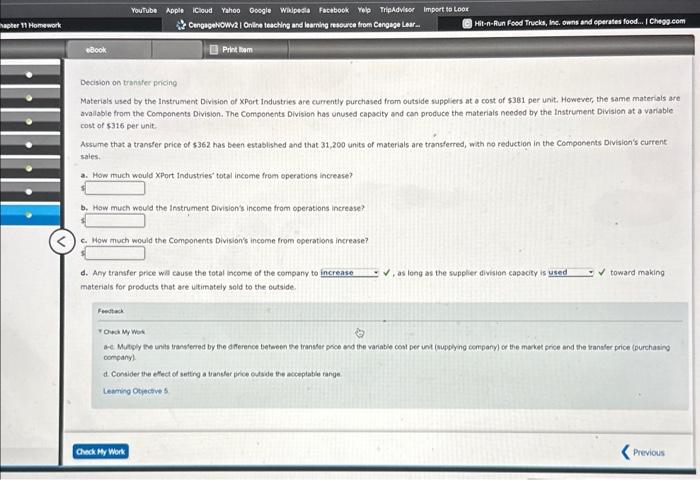

Materials used by the Instrument Division of Xport Industries are currently purchased from outside suppliers at a cost of 5381 per unit. However, the same materals are avalabie from the Components Division. The Components Division has unused capacity and can produce the materials needed by the Instrument Division at a variable cost of \\$316 per unit. Assume that a transfer price of \\( \\$ 362 \\) has been extablished and that 31,200 units of materials are transferred, wilh no reduction in the Components Division's current sales. a. How much would XPort industries' total inceme from operations increase? 1 b. How much would the Instrument Division's income from operations increase? 3 c. How much would the Components Division's income from operations increase? 1 d. Any transfer price wall cause the total income of the company to \\( \\checkmark \\), as long as the supplier division capboty is toward making materials for products that are ultimateiy sold to the outside. company). a. Consider the ethet d setting a vansler price catside the acceptable range Decision on transter oricing Materials used by the Instrument Division of XPort Industries are currently purchosed from outside suppliers at a cost of \\$361 per unit. Howeve, the same materiais are available from the Components Division. The Compenents Division has unused capacity and can produce the materials needed by the Instrument Divicion at a variable cost of \\( \\$ 316 \\) per unit. Assume that a transfer price of \\( \\$ 362 \\) has been established and that 31,200 units of materials are transferred, with po reduction in the Components Division's current sales. a. How much would XPort industries' total income from operations increase? b. How much would the Instrument Divisions income from operations increase? 1 d. Any transfer price will cavse the total income of the company to \\( \\checkmark \\), as long as the supplier division capacity is toward making materiols for products that are ultimateiy soid to the entside. Fenowar voles win wis. ompary) Materials used by the Instrument Division of Xport Industries are currently purchased from outside suppliers at a cost of 5381 per unit. However, the same materals are avalabie from the Components Division. The Components Division has unused capacity and can produce the materials needed by the Instrument Division at a variable cost of \\$316 per unit. Assume that a transfer price of \\( \\$ 362 \\) has been extablished and that 31,200 units of materials are transferred, wilh no reduction in the Components Division's current sales. a. How much would XPort industries' total inceme from operations increase? 1 b. How much would the Instrument Division's income from operations increase? 3 c. How much would the Components Division's income from operations increase? 1 d. Any transfer price wall cause the total income of the company to \\( \\checkmark \\), as long as the supplier division capboty is toward making materials for products that are ultimateiy sold to the outside. company). a. Consider the ethet d setting a vansler price catside the acceptable range Decision on transter oricing Materials used by the Instrument Division of XPort Industries are currently purchosed from outside suppliers at a cost of \\$361 per unit. Howeve, the same materiais are available from the Components Division. The Compenents Division has unused capacity and can produce the materials needed by the Instrument Divicion at a variable cost of \\( \\$ 316 \\) per unit. Assume that a transfer price of \\( \\$ 362 \\) has been established and that 31,200 units of materials are transferred, with po reduction in the Components Division's current sales. a. How much would XPort industries' total income from operations increase? b. How much would the Instrument Divisions income from operations increase? 1 d. Any transfer price will cavse the total income of the company to \\( \\checkmark \\), as long as the supplier division capacity is toward making materiols for products that are ultimateiy soid to the entside. Fenowar voles win wis. ompary)