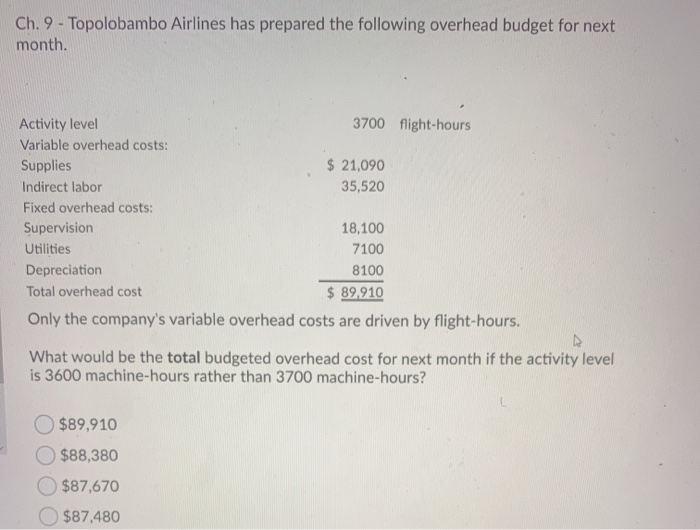

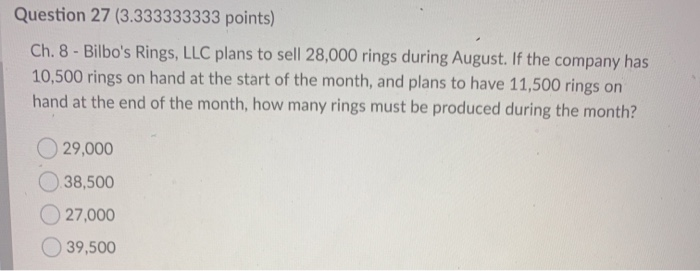

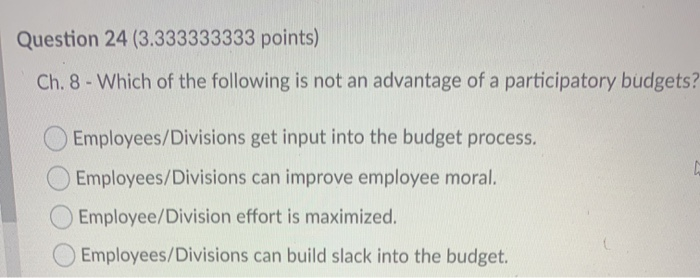

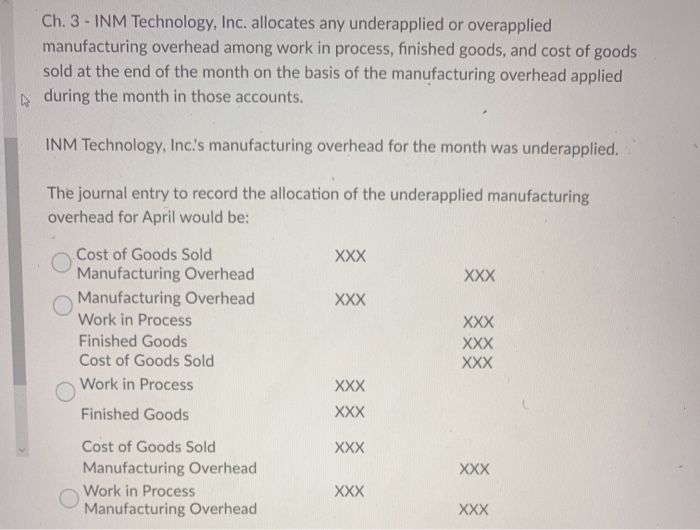

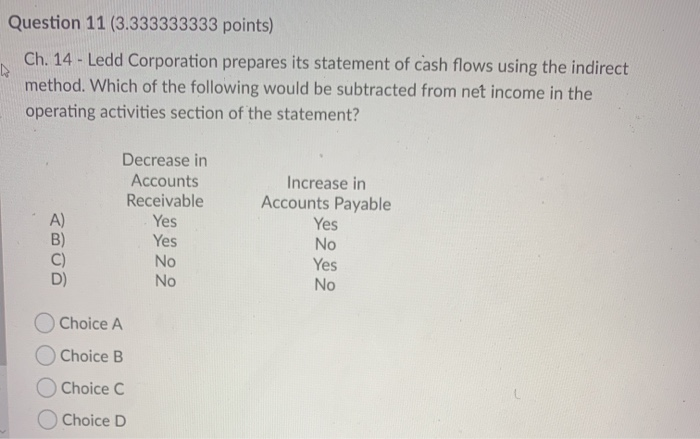

Ch. 9 - Topolobambo Airlines has prepared the following overhead budget for next month. Activity level 3700 flight hours Variable overhead costs: Supplies $ 21,090 Indirect labor 35,520 Fixed overhead costs: Supervision 18,100 Utilities 7100 Depreciation 8100 Total overhead cost $ 89.910 Only the company's variable overhead costs are driven by flight-hours. A What would be the total budgeted overhead cost for next month if the activity level is 3600 machine-hours rather than 3700 machine-hours? $89,910 $88,380 $87,670 $87.480 Question 27 (3.333333333 points) Ch. 8 - Bilbo's Rings, LLC plans to sell 28,000 rings during August. If the company has 10,500 rings on hand at the start of the month, and plans to have 11,500 rings on hand at the end of the month, how many rings must be produced during the month? 29,000 38,500 27,000 O 39,500 Question 24 (3.333333333 points) Ch. 8 - Which of the following is not an advantage of a participatory budgets? Employees/Divisions get input into the budget process. Employees/Divisions can improve employee moral. Employee/Division effort is maximized. Employees/Divisions can build slack into the budget. Ch. 3 - INM Technology, Inc. allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the manufacturing overhead applied during the month in those accounts. INM Technology, Inc.'s manufacturing overhead for the month was underapplied. The journal entry to record the allocation of the underapplied manufacturing overhead for April would be: XXX XXX XXX XXX XXX XXX Cost of Goods Sold Manufacturing Overhead Manufacturing Overhead Work in Process Finished Goods Cost of Goods Sold Work in Process Finished Goods Cost of Goods Sold Manufacturing Overhead Work in Process Manufacturing Overhead XXX XXX XXX XXX XXX XXX Question 11 (3.333333333 points) Ch. 14 - Ledd Corporation prepares its statement of cash flows using the indirect method. Which of the following would be subtracted from net income in the operating activities section of the statement? A) Decrease in Accounts Receivable Yes Yes No No Increase in Accounts Payable Yes No Yes No Choice A O Choice B Choice C Choice D