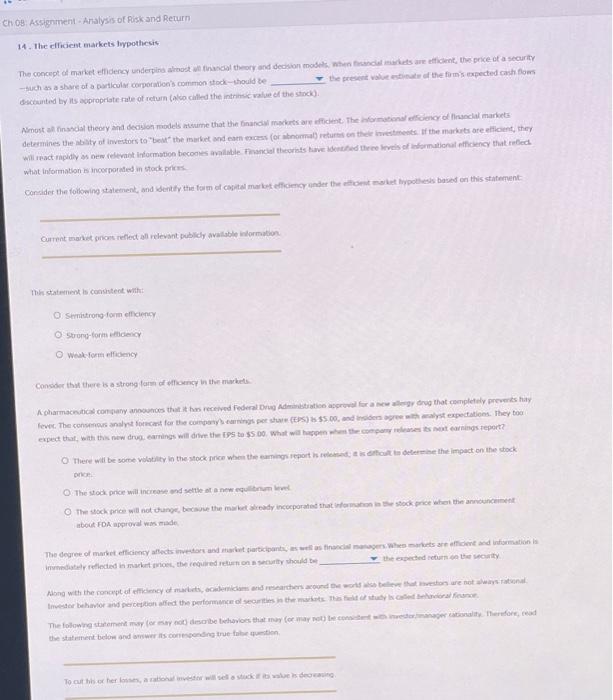

Ch : Assignment Analysis of Risk and Return 14. The efficient markets hypothesis The concept of marketidency underpina rostlinancial theory and decision models when an efficient, the price et a security -uch as a share of a particolor corporation's common stok-should be the the forms xpected cash flows decounted by its apropriate rate of return falco called the intrinsic value of the stock) Almost all tinandal theory and decision models are that the band markets are oftent. The formationalency of ancial markets determines the best of investors to be the market and an excess (or abnormal returns on the investments of the markets are licent, they will act pidly sew relevant information becomes avencial theorists have the themes of wormational efficiency that relied what Informations incorporated in stock prices Contudes the following statement, and dently the form of capital marketing under the test market hypothesis based on this statemunt Current market prom recta velevant pubidy available information Semtrong form efficiency Strong-tomcy Westforency Consider that there is a strong for fancy in the market A pharmaceutical company and that it has received Federal de provocanrug that completely preveri hay fever. The cores analystocant for the company camins per sh(ES) $5.00 days expectations. They too expect that with this new drug carings will drive the sto 300 What will happen when the company esteringsreport? There will be some volatility in the stock price when the case is to the the impact on the stock De The stock price will increase and see twee The stock price will not change, because the market ready incorporated that for stock price when the announcement about FDA approval was made The degree of market efficiency afects mors and market participants financial managers whers are fit and information y reflected in maraton, the required remonty should be the expected return on the security Along with the concept of ency of scademics and researchers and to rent ways to Indehavior and perceptionalled the performance at the the for The following statement for de behaviors that may or may not be convertitore, cea the statement below and its contending truetan To cut to her will be down