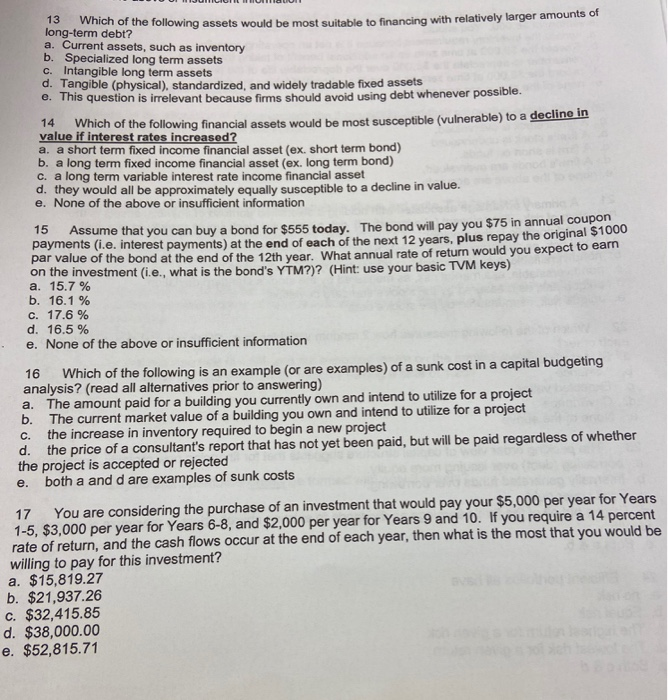

ch of the following assets would be most suitable to financing with relatively larger amounts of long-term debt? a. Current assets, such as inventory b. Specialized long term assets c. Intangible long term assets d. Tangible (physical), standardized, and widely tradable fixed assets e. This question is irrelevant because firms should avoid using debt whenever possible. 14 Which of the following financial assets would be most susceptible (vulnerable to a decu value if interest rates increased? a, a short term fixed income financial asset (ex. short term bond) b. a long term fixed income financial asset (ex. long term bond) c. a long term variable interest rate income financial asset d. they would all be approximately equally susceptible to a decline in value. e. None of the above or insufficient information 15 Assume that you can buy a bond for $555 today. The bond will pay you $75 in annual coupon payments (.e. interest payments) at the end of each of the next 12 years, plus repay the original par value of the bond at the end of the 12th vear. What annual rate of return would you expect to eam on the investment (i.e., what is the bond's YTM?)? (Hint: use your basic TVM keys) a. 15.7 % b. 16.1 % c. 17.6 % d. 16.5% e. None of the above or insufficient information 16 Which of the following is an example (or are examples) of a sunk cost in a capital budgeting analysis? (read all alternatives prior to answering) a. The amount paid for a building you currently own and intend to utilize for a project b. The current market value of a building you own and intend to utilize for a project c. the increase in inventory required to begin a new project d. the price of a consultant's report that has not yet been paid, but will be paid regardless of whether the project is accepted or rejected e. both a and d are examples of sunk costs 17 You are considering the purchase of an investment that would pay your $5,000 per year for Years 1-5. $3,000 per year for Years 6-8, and $2,000 per year for Years 9 and 10. If you require a 14 percent rate of return, and the cash flows occur at the end of each year, then what is the most that you would be willing to pay for this investment? a. $15,819.27 b. $21,937.26 C. $32,415.85 d. $38,000.00 e. $52,815.71