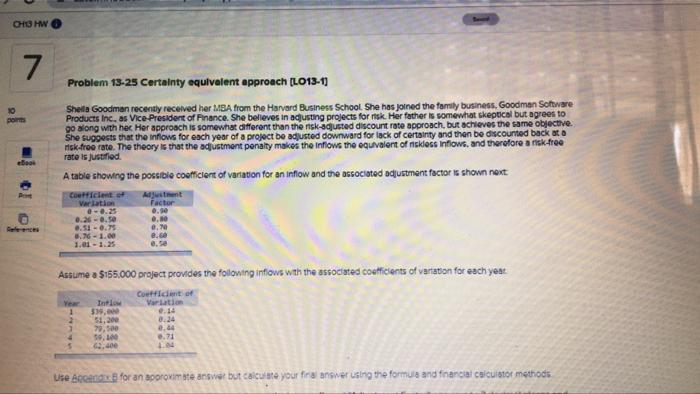

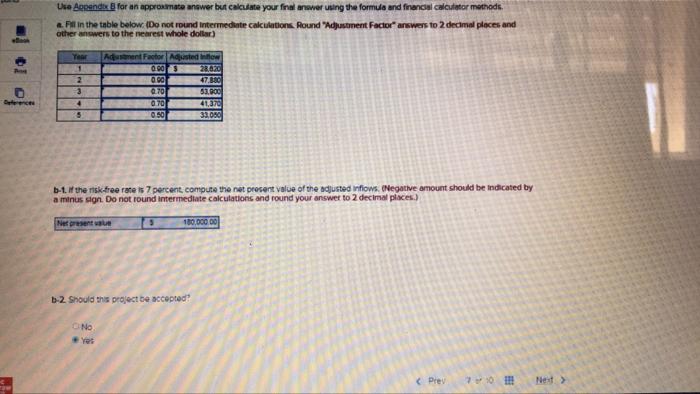

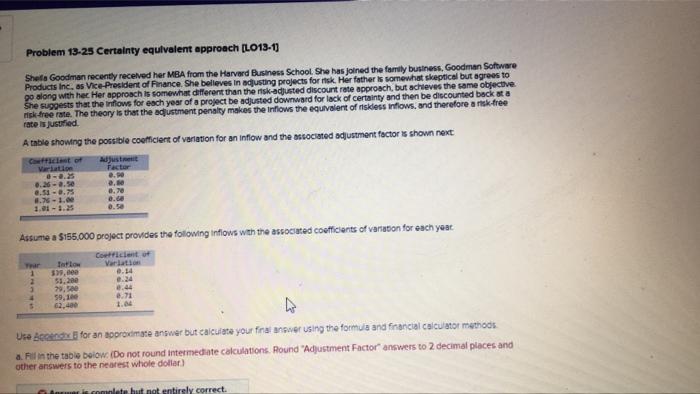

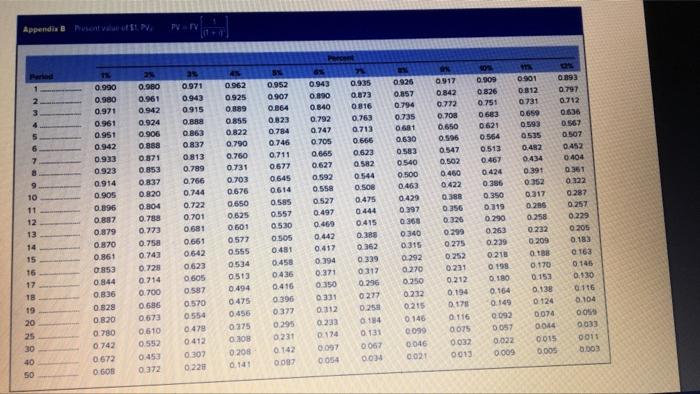

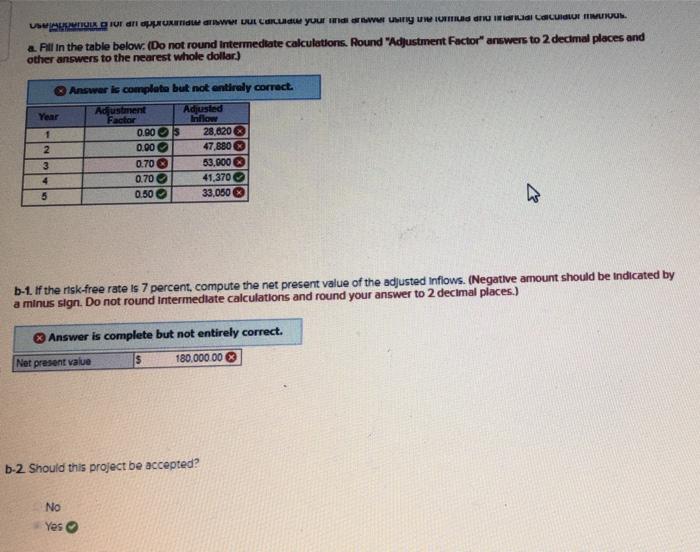

CH13 HW 7 Problem 13-25 Certainty equivalent approach [LO13-1] Shella Goodman recently received her MBA from the Harvard Business School. She has joined the family business, Goodman Software Products Inc. as Vice-President of Finance. She believes in adjusting projects for risk. Her father is somewhat skeptical but agrees to go along with her. Her approach is somewhat different than the risk-adjusted discount rate approach, but achieves the same objective. She suggests that the inflows for each year of a project be adjusted downward for lack of certainty and then be discounted back at a risk-froe rate. The theory is that the adjustment penalty makes the inflows the equivalent of niskless Inflows, and therefore a risk-free rate is justified. eBook A table showing the possible coefficient of variation for an inflow and the associated adjustment factor is shown next Coefficient of Variation Adjustment Factor 0-0.25 0.90 0.50 0.26-0.50 0.51 -0.75 8.76-1.00 0,70 8.60 1.01 -1.25 0.50 Assume a $155.000 project provides the following inflows with the associated coefficients of variation for each year Coefficient of Year Intlose Variation 1 $39,000 0.14 2 51.200 8:24 3 79,500 0.44 4 39,400 0.71 5 62,400 4.04 Use Agend for an approximate answer but calculate your final answer using the formula and financial calculator methods 10 points 01 Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. Fill in the table below. (Do not round intermediate calculations. Round "Adjustment Factor" answers to 2 decimal places and other answers to the nearest whole dollar) Book Adjustment Factor Adjusted inflow Year 1 0.00 $ 28.620 Prog 2 0.00 47.880 3 0.70 53.900 Deferences 4 0.70 41.370 5 0.50 33.050 b-1. if the risk-free rate is 7 percent, compute the net present value of the adjusted inflows. (Negative amount should be indicated by a minus sign. Do not round Intermediate calculations and round your answer to 2 decimal places) Net present value 5 180.000.00 b-2. Should this project be accepted? ONO Yes Problem 13-25 Certainty equivalent approach [LO13-1] Shefa Goodman recently received her MBA from the Harvard Business School. She has joined the family business, Goodman Software Products Inc., as Vice-President of Finance. She believes in adjusting projects for risk. Her father is somewhat skeptical but agrees to go along with her Her approach is somewhat different than the risk-adjusted discount rate approach, but achieves the same objective She suggests that the inflows for each year of a project be adjusted downward for lack of certainty and then be discounted back at a risk-free rate. The theory is that the adjustment penalty makes the inflows the equivalent of riskless inflows, and therefore a risk-free rate is justified. A table showing the possible coefficient of variation for an inflow and the associated adjustment factor is shown next Coefficient of Variation Adjustment Factor 0-0.25 0.90 0.26-8.50 0.00 0.51-0.75 0.70 8.76-1.00 0.00 1.01 -1.25 0.50 Assume a $155,000 project provides the following inflows with the associated coefficients of variation for each year Coefficient of Inflow Variation 0.14 1 $39,000 51,200 2 0.24 3 29,500 0.44 59,100 8.71 S 62,400 1.04 Use Agendx for an approximate answer but calculate your final answer using the formula and financial calculator methods a. Fill in the table below: (Do not round Intermediate calculations. Round "Adjustment Factor answers to 2 decimal places and other answers to the nearest whole dollar) Anwer is complete but not entirely correct. Appendix B Pusont value of $1. PV. Period 1% 2% 0.990 0.980 2 0.980 0.961 3 0.971 0.942 4 0.961 0.924 5 0.951 0.906 6 0.942 0.888 7 0.933 0.871 8 0.923 0.853 9 0.914 0.837 0.905 0.820 0.896 0.804 0.887 0.788 0.879 0.773 0.870 0.758 0.861 0.743 0853 0.728 0.844 0.714 0.836 0.700 0.828 0.686 0.820 0.673 0.780 0.610 0.742 0.552 0672 0.453 0608 0.372 10 11 12 13 14 15 16 17 8885833 18 19 20 25 30 40 50 PV - FV 25 0.971 0.943 0.915 0.888 0.863 0.837 0813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0642 0.623 0.605 0.587 0570 0554 0478 0412 0.307 0,228 AS 5%. 0.962 0.952 0.925 0.907 0.889 0.864 0.855 0.823 0.822 0.784 0.790 0.746 0.760 0.711 0.731 0.677 0.703 0.645 0.676 0614 0.650 0.585 0.625 0.557 0.601 0.530 0.577 0.505 0.555 0.481 0534 0.458 0513 0436 0.494 0.416 0475 0.396 0.456 0.377 0.375 0.295 0.308 0231 0208 0.142 0.141 0.087 Percent 6% 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0.331 0312 0.233 0174 0.097 0.054 75 0.935 0.873 0816 0.763 0.713 0.666 0.623 0.582 0.544 0.500 0.475 0.444 0.415 0.388 0.362 0.339 0317 0.296 0277 0.258 0.184 0.131 0067 0.034 0.926 0.857 0.794 0.735 0681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0215 0146 0.099 0.046 0.021 17% 0901 0812 0731 0.659 0.593 0535 0.482 0.434 0.391 0352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0124 0.074 0044 0015 0.005 9% 10% 0917 0.909 0.842 0.826 0.772 0.751 0.708 0683 0621 0.650 0.596 0.564 0.547 0.513 0.502 0.467 0.460 0.424 0.422 0.386 0.388 0.350 0.356 0.319 0.326 0.290 0.299 0.263 0.275 0.239 0.252 0218 0231 0 198 0.212 0.180 0.194 0.164 0,178 0.149 0.116 0:092 0075 0057 0.032 0.022 0013 0.009 1.2% 0.893 0.797 0.712 0.636 0.567 0.507 0452 0404 0.361 0.322 0287 0.257 0.229 0:205 0.183 0163 0.145 0.130 0116 0.104 0059 0033 0011 0.003 for approxide awww out cacude your indi drw using ue comme il Calculator mu a. Fill in the table below. (Do not round intermediate calculations. Round "Adjustment Factor" answers to 2 decimal places and other answers to the nearest whole dollar) Answer is complate but not entirely correct. Adjustment Factor Adjusted Year Inflow 1 0.90 28,620 2 0.00 47,880x 0.70 53,000 4 0.70 41,370 5 0.50- 33,050 b-1. If the risk-free rate is 7 percent, compute the net present value of the adjusted Inflows. (Negative amount should be indicated by a minus sign. Do not round Intermediate calculations and round your answer to 2 decimal places.) Answer is complete but not entirely correct. Net present value S 180.000.00 b-2. Should this project be accepted? No Yes O 3 S