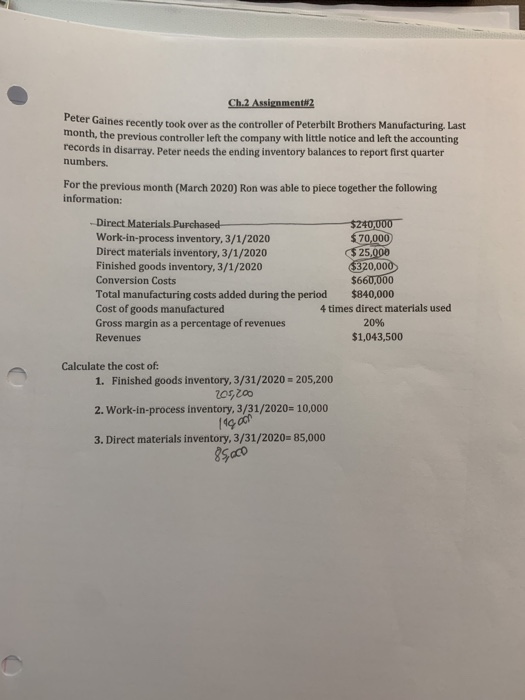

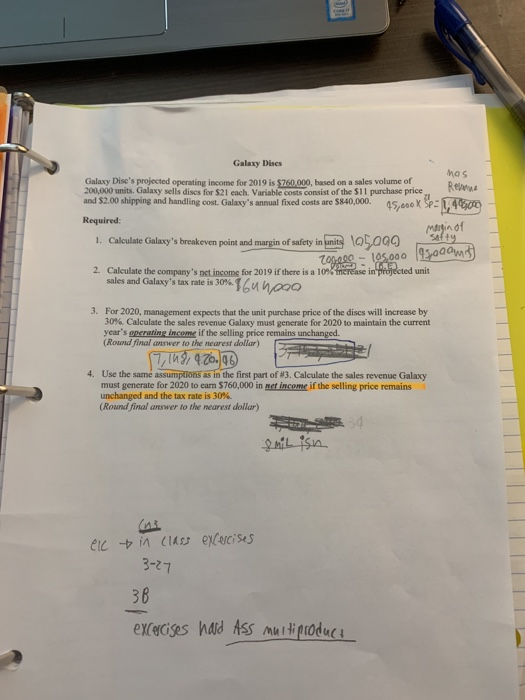

Ch.2 Assignment2 Peter Gaines recently took over as the controller of Peterbilt Brothers Manufacturing, Last month, the previous controller left the company with little notice and left the accounting records in disarray. Peter needs the ending inventory balances to report first quarter numbers. For the previous month (March 2020) Ron was able to piece together the following information: Direct Materials Purchased $240,000 Work-in-process inventory, 3/1/2020 $70,000 Direct materials inventory, 3/1/2020 $ 25,000 Finished goods inventory, 3/1/2020 $320,000 Conversion Costs $660,000 Total manufacturing costs added during the period $840,000 Cost of goods manufactured 4 times direct materials used Gross margin as a percentage of revenues 20% Revenues $1,043,500 Calculate the cost of: 1. Finished goods inventory, 3/31/2020 = 205,200 205,200 2. Work-in-process inventory, 3/31/2020= 10,000 3. Direct materials inventory, 3/31/2020=85,000 11.com 85,000 nos Margin of Galaxy Discs Galaxy Dise's projected operating income for 2019 is $760,000, based on a sales volume of 200,000 units. Galaxy sells discs for $21 each. Variable costs consist of the $11 purchase price Relarus and $2.00 shipping and handling cost. Galaxy's annual fixed costs are $840,000. 45,000 x $=1, 46,00 Required: 1. Calculate Galaxy's breakeven point and margin of safety in units \05090 A 2. Calculate the company's net income for 2019 if there is a 10% ferease in projected unit sales and Galaxy's tax rate is 3046.160 nooo 3. For 2020, management expects that the unit purchase price of the discs will increase by 30%. Calculate the sales revenue Galaxy must generate for 2020 to maintain the current year's operating income if the selling price remains unchanged. (Round final answer to the nearest dollar) 17,149.9.20.90 4. Use the same assumptions as in the first part of #3. Calculate the sales revenue Galaxy must generate for 2020 to earn $760,000 in net income if the selling price remains unchanged and the tax rate is 30% (Round final answer to the nearest dollar) & mil isn ( ell + in CIAST excercises 3-27 38 excercises hard Ass multiproduct Ch.2 Assignment2 Peter Gaines recently took over as the controller of Peterbilt Brothers Manufacturing, Last month, the previous controller left the company with little notice and left the accounting records in disarray. Peter needs the ending inventory balances to report first quarter numbers. For the previous month (March 2020) Ron was able to piece together the following information: Direct Materials Purchased $240,000 Work-in-process inventory, 3/1/2020 $70,000 Direct materials inventory, 3/1/2020 $ 25,000 Finished goods inventory, 3/1/2020 $320,000 Conversion Costs $660,000 Total manufacturing costs added during the period $840,000 Cost of goods manufactured 4 times direct materials used Gross margin as a percentage of revenues 20% Revenues $1,043,500 Calculate the cost of: 1. Finished goods inventory, 3/31/2020 = 205,200 205,200 2. Work-in-process inventory, 3/31/2020= 10,000 3. Direct materials inventory, 3/31/2020=85,000 11.com 85,000 nos Margin of Galaxy Discs Galaxy Dise's projected operating income for 2019 is $760,000, based on a sales volume of 200,000 units. Galaxy sells discs for $21 each. Variable costs consist of the $11 purchase price Relarus and $2.00 shipping and handling cost. Galaxy's annual fixed costs are $840,000. 45,000 x $=1, 46,00 Required: 1. Calculate Galaxy's breakeven point and margin of safety in units \05090 A 2. Calculate the company's net income for 2019 if there is a 10% ferease in projected unit sales and Galaxy's tax rate is 3046.160 nooo 3. For 2020, management expects that the unit purchase price of the discs will increase by 30%. Calculate the sales revenue Galaxy must generate for 2020 to maintain the current year's operating income if the selling price remains unchanged. (Round final answer to the nearest dollar) 17,149.9.20.90 4. Use the same assumptions as in the first part of #3. Calculate the sales revenue Galaxy must generate for 2020 to earn $760,000 in net income if the selling price remains unchanged and the tax rate is 30% (Round final answer to the nearest dollar) & mil isn ( ell + in CIAST excercises 3-27 38 excercises hard Ass multiproduct