ch8

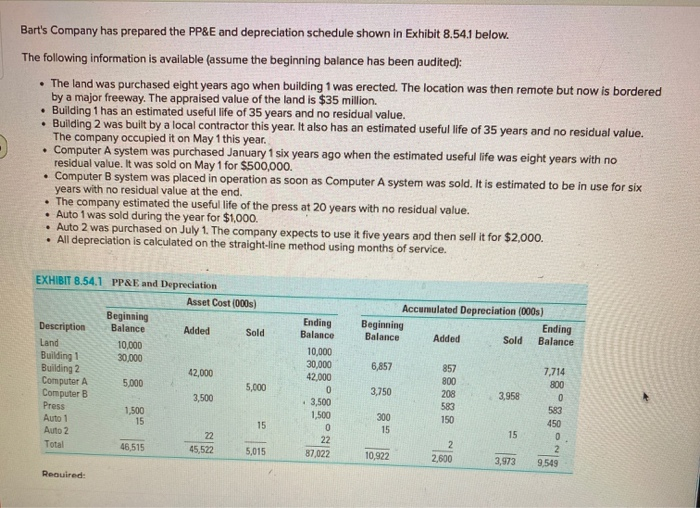

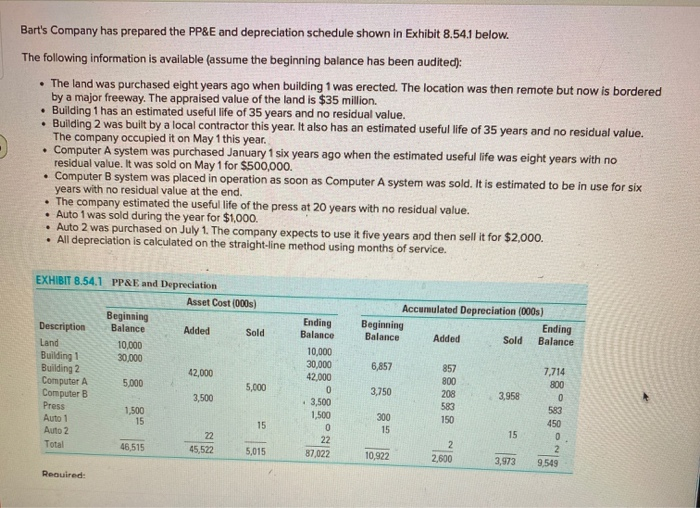

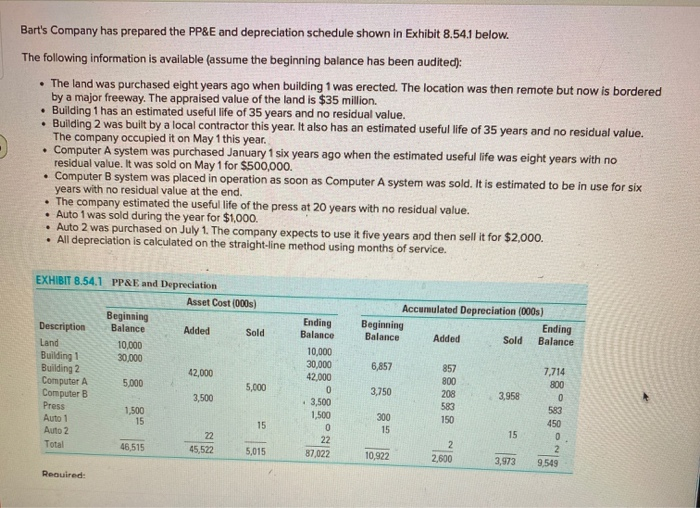

Bart's Company has prepared the PP&E and depreciation schedule shown in Exhibit 8.54.1 below. The following information is available (assume the beginning balance has been audited): The land was purchased eight years ago when building 1 was erected. The location was then remote but now is bordered by a major freeway. The appraised value of the land is $35 million. Building 1 has an estimated useful life of 35 years and no residual value. Building 2 was built by a local contractor this year. It also has an estimated useful life of 35 years and no residual value. The company occupied it on May 1 this year. Computer A system was purchased January 1 six years ago when the estimated useful life was eight years with no residual value. It was sold on May 1 for $500,000. Computer system was placed in operation as soon as Computer A system was sold. It is estimated to be in use for six years with no residual value at the end. The company estimated the useful life of the press at 20 years with no residual value. Auto 1 was sold during the year for $1,000. Auto 2 was purchased on July 1. The company expects to use it five years and then sell it for $2,000. All depreciation is calculated on the straight-line method using months of service. Accumulated Depreciation (000s) Beginning Ending Balance Added Sold Balance EXHIBIT 8.54.1 PP&E and Depreciation Asset Cost (000) Beginning Description Balance Added Sold Land 10,000 Building 1 30,000 Building 2 42,000 Computer A 5.000 5,000 Computer B 3,500 Press 1,500 Auto 1 15 15 Auto 2 22 Total 46,515 45,522 5,015 6,857 Ending Balance 10,000 30,000 42,000 0 3,500 1,500 0 22 87,022 857 800 208 583 150 7,714 800 0 3,750 3,958 583 300 15 450 15 0 10,922 2 2.600 3,973 2 9,549 Required: Required: Verify the depreciation calculations. Are there any errors? Put the errors in the form of an adjusting journal entry, assuming that 90 percent of the depreciation on the buildings and the press has been charged to Cost of Goods Sold and 10 percent is still capitalized in the inventory, and the other depreciation expense is classified as General and Administrative Expense (i.e., building and press depreciation is considered a product cost; inventory on hand includes 10 percent of the depreciation expense for buildings and the press: $180,700, Cost of Goods Sold contains the other 90 percent: $1,626,300). (If no entry is required for a transaction/event, select "No journal entry required". Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. Enter your answers in dollars and not in millions or thousands of dollars.) View transaction list Journal entry worksheet 1 Record the rectification of depreciation calculation. Note: Enter debits before credits Event General Journal Debit Credit