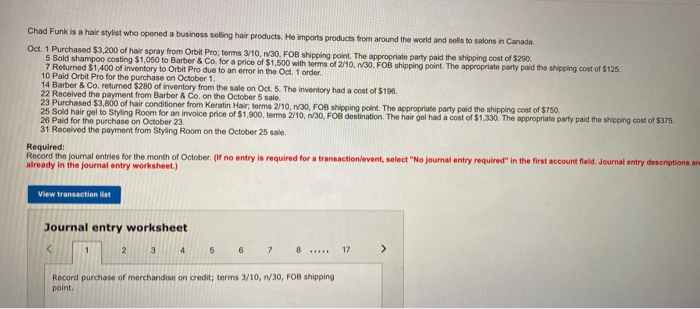

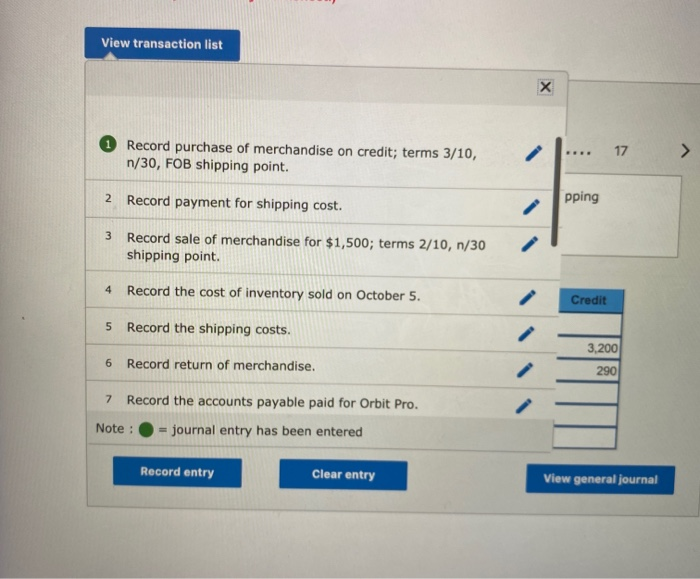

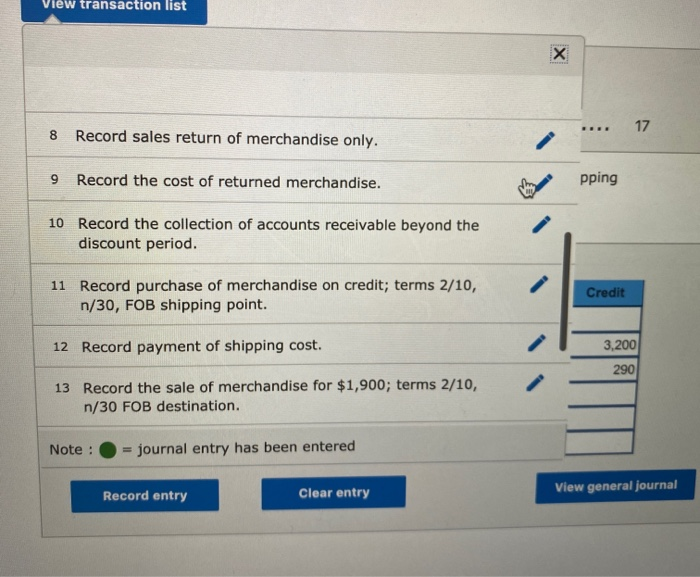

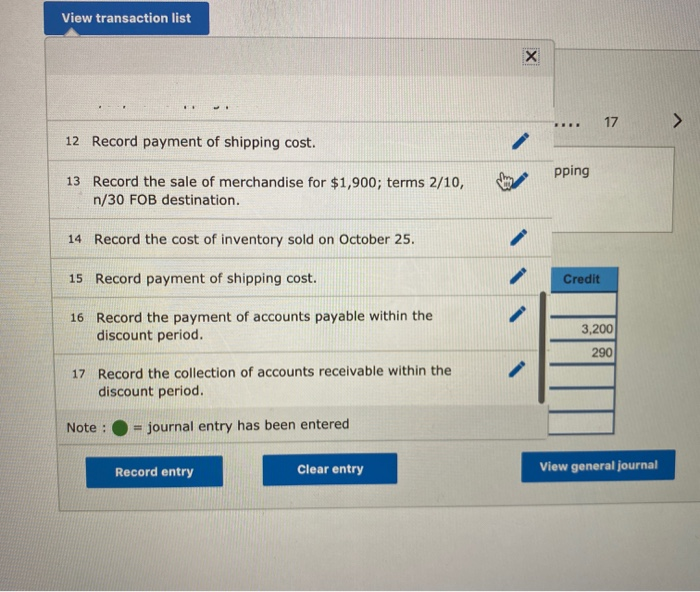

Chad Funk is a hair stylist who opened a business selling hair products. He imports products from around the world and sell to salons in Canada Oct 1 Purchased $3.200 of hairspray from Orbit Procterms 10.30. FOB shipping point. The appropriate party and the shipping cost of $290 5 Sold shampoo costing $1050 to Barber & Co for a price of $1.500 with forms of 20.30. FOB shipping point. The appropriate party paid the shipping cost of $125 7 Returned $1,400 of inventory to Orbit Pro due to an error in the Oct. 1 order 10 Paid Orbit Pro for the purchase on October 1. 14 Barber & Co. returned $280 of inventory from the sale on Oct. 5. The inventory had a cost of $198. 22 Received the payment from Barber & Co. on the October 5 sale 23 Purchased $3,800 of hair conditioner from Keratin Hair terms 2/10, 1/30, FOB shipping point. The appropriate party paid the shipping cost of $750 25 Sold hair gel to Styling Room for an invoice price of $1,900, terms 2/10, 1/30, FOB destination. The hair gel had a cost of $1,330. The appropriate party paid the shipping cost of $375. 28 Paid for the purchase on October 23 31 Received the payment from Styling Room on the October 25 sale. Required: Record the journal entries for the month of October ( no entry is required for a transaction event select "No journal entry required in the first account fald. Journal entry descriptions are already in the journal entry worksheet) View transaction lit Journal entry worksheet 2 3 4 5 6 7 8 ..... 17 Record purchase of merchandise on Credit; terms 3/10, 1/30, FOB shipping point. View transaction list Record purchase of merchandise on credit; terms 3/10, n/30, FOB shipping point. .... 2 Record payment for shipping cost. pping Record sale of merchandise for $1,500; terms 2/10, n/30 shipping point. 4 Record the cost of inventory sold on October 5. Credit 5 Record the shipping costs. 6 Record return of merchandise. 3,200 290 7 Record the accounts payable paid for Orbit Pro. Note : journal entry has been entered Record entry Clear entry View general journal View transaction list 17 8 Record sales return of merchandise only. 9 Record the cost of returned merchandise. pping 10 Record the collection of accounts receivable beyond the discount period. 11 Record purchase of merchandise on credit; terms 2/10, n/30, FOB shipping point. Credit 12 Record payment of shipping cost. 3,200 290 13 Record the sale of merchandise for $1,900; terms 2/10, n/30 FOB destination. Note : = journal entry has been entered Record entry View general journal Clear entry View transaction list 12 Record payment of shipping cost. pping 13 Record the sale of merchandise for $1,900; terms 2/10, n/30 FOB destination. 14 Record the cost of inventory sold on October 25. 15 Record payment of shipping cost. Credit 16 Record the payment of accounts payable within the discount period. 3,200 290 17 Record the collection of accounts receivable within the discount period. Note : = journal entry has been entered Record entry Clear entry View general journal