Answered step by step

Verified Expert Solution

Question

1 Approved Answer

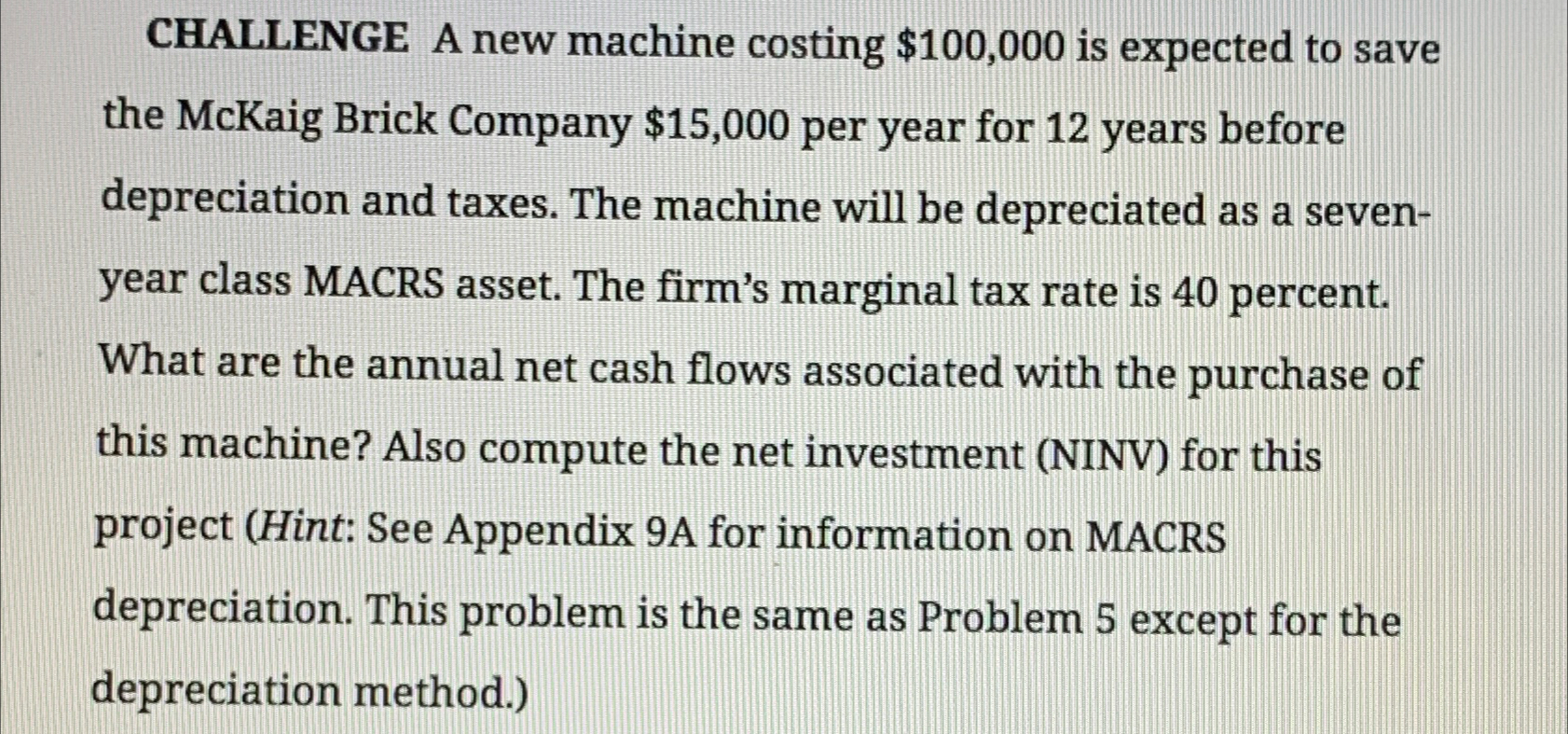

CHALLENGE A new machine costing $ 1 0 0 , 0 0 0 is expected to save the McKaig Brick Company $ 1 5 ,

CHALLENGE A new machine costing $ is expected to save the McKaig Brick Company $ per year for years before depreciation and taxes. The machine will be depreciated as a sevenyear class MACRS asset. The firm's marginal tax rate is percent. What are the annual net cash flows associated with the purchase of this machine? Also compute the net investment NINV for this project Hint: See Appendix A for information on MACRS depreciation. This problem is the same as Problem except for the depreciation method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started