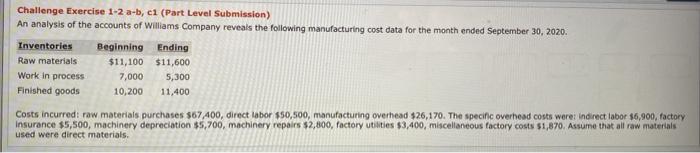

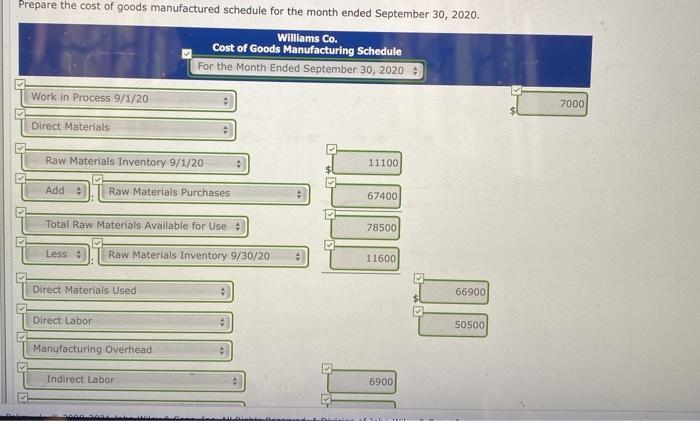

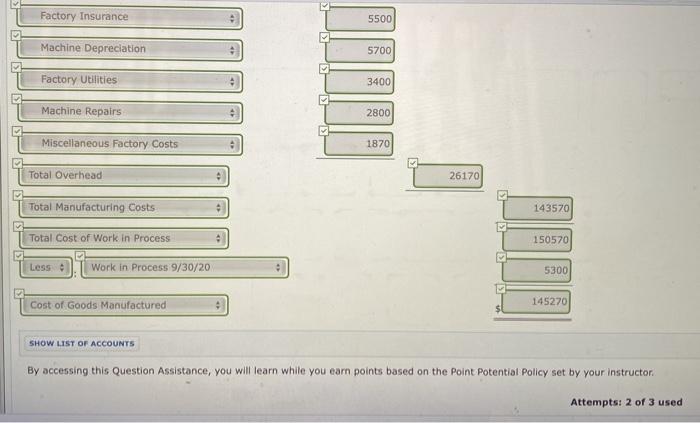

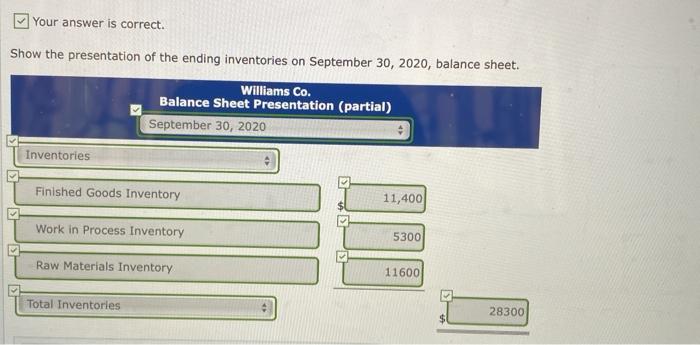

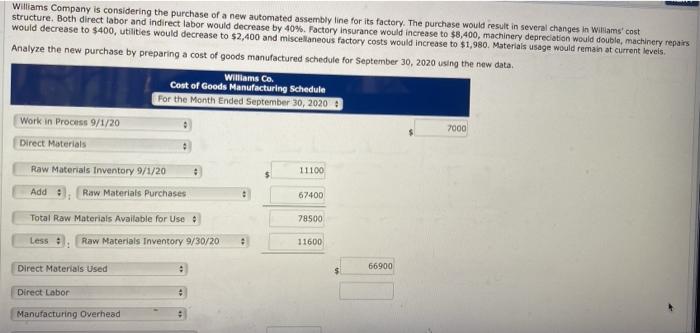

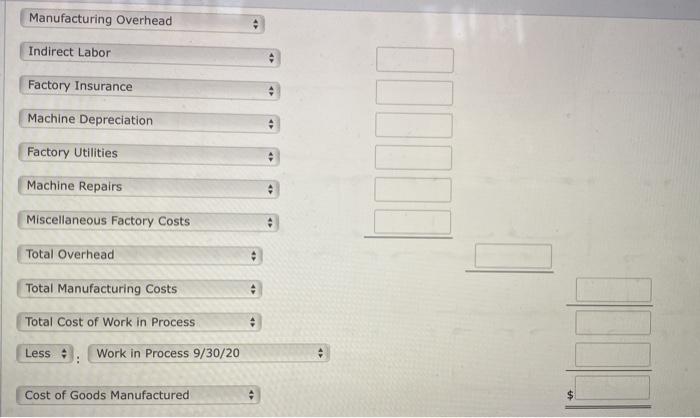

Challenge Exercise 1-2 a-b, c1 (Part Level Submission) An analysis of the accounts of Williams Company reveals the following manufacturing cost data for the month ended September 30, 2020. Inventories Beginning Ending Raw materials $11,100 $11,600 Work in process 7,000 5,300 Finished goods 10,200 11,400 Costs incurred: raw materials purchases $67,400, direct labor $50,500, manufacturing overhead $26,170. The specific overhead costs were Indirect labor $6,900, factory Insurance $5,500, machinery depreciation $5,700, machinery repairs $2,800, factory utilities $3,400, miscellaneous factory costs $1,870. Assume that all raw materials used were direct materials. Prepare the cost of goods manufactured schedule for the month ended September 30, 2020. Williams Co. Cost of Goods Manufacturing Schedule For the Month Ended September 30, 2020 Work in Process 9/1/20 7000 Direct Materials > Raw Materials Inventory 9/1/20 11100 Add Raw Materials Purchases 67400 1 Total Raw Materials Available for Use 78500 Less Raw Materials Inventory 9/30/20 11600 Direct Materials Used 66900 Direct Labor 50500 S Manufacturing Overhead M Indirect Labor 6900 Factory Insurance 5500 Machine Depreciation 5700 Factory Utilities 3400 Machine Repairs 2800 Miscellaneous Factory Costs 1870 Total Overhead 26170 Total Manufacturing Costs 143570 Total Cost of Work in Process 150570 CHHE Less Work in Process 9/30/20 5300 Cost of Goods Manufactured 145270 $ SHOW LIST OF ACCOUNTS By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor Attempts: 2 of 3 used Your answer is correct. Show the presentation of the ending inventories on September 30, 2020, balance sheet. Williams Co. Balance Sheet Presentation (partial) September 30, 2020 Inventories Finished Goods Inventory 11,400 Work in Process Inventory 5300 Raw Materials Inventory 11600 Total Inventories 28300 Williams Company is considering the purchase of a new automated assembly line for its factory. The purchase would result in several changes in Williams' cost structure. Both direct labor and indirect labor would decrease by 40%. Factory Insurance would increase to $8,400, machinery depreciation would double, machinery repairs would decrease to $400, utilities would decrease to $2,400 and miscellaneous factory costs would increase to $1,980. Materials usage would remain at current levels Analyze the new purchase by preparing a cost of goods manufactured schedule for September 30, 2020 using the new data Williams Co. Cost of Goods Manufacturing Schedule For the Month Ended September 30, 2020 Work in Process 9/1/20 7000 Direct Materials Raw Materials Inventory 9/1/20 Add .. Raw Materials Purchases 67400 Total Raw Materials Available for Use 78500 Less Raw Materials Inventory 9/30/20 11600 66900 Direct Materials Used 11100 Direct Labor Manufacturing Overhead Manufacturing Overhead Indirect Labor Factory Insurance Machine Depreciation Factory Utilities Machine Repairs Miscellaneous Factory Costs Total Overhead Total Manufacturing Costs Total Cost of Work in Process Less :: Work in Process 9/30/20 Cost of Goods Manufactured