Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chamberlain Enterprises Inc. reported the following receivables in its December 31, 2018, year-end balance sheet: Current assets: Accounts receivable, net of $32,000 in allowance for

Chamberlain Enterprises Inc. reported the following receivables in its December 31, 2018, year-end balance sheet:

| Current assets: | |||

| Accounts receivable, net of $32,000 in allowance for uncollectible accounts | $ | 258,000 | |

| Interest receivable | 11,900 | ||

| Notes receivable | 340,000 | ||

Additional Information:

- The notes receivable account consists of two notes, a $85,000 note and a $255,000 note. The $85,000 note is dated October 31, 2018, with principal and interest payable on October 31, 2019. The $255,000 note is dated June 30, 2018, with principal and 8% interest payable on June 30, 2019.

- During 2019, sales revenue totaled $1,420,000, $1,320,000 cash was collected from customers, and $30,000 in accounts receivable were written off. All sales are made on a credit basis. Bad debt expense is recorded at year-end by adjusting the allowance account to an amount equal to 10% of year-end accounts receivable.

- On March 31, 2019, the $255,000 note receivable was discounted at the Bank of Commerce. The bank's discount rate is 10%. Chamberlain accounts for the discounting as a sale.

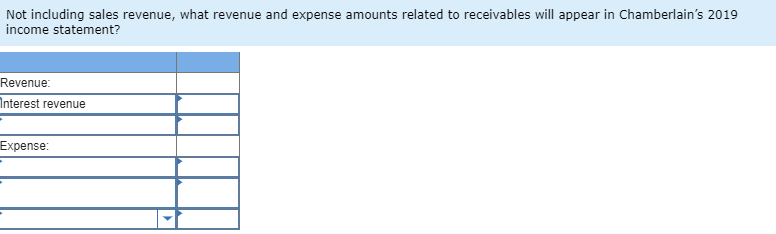

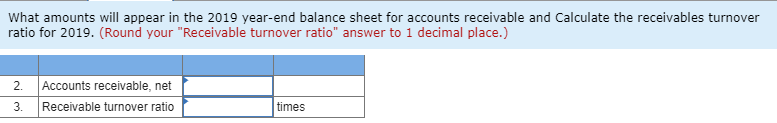

Required: 1. Not including sales revenue, what revenue and expense amounts related to receivables will appear in Chamberlains 2019 income statement? 2. & 3. What amounts will appear in the 2019 year-end balance sheet for accounts receivable and Calculate the receivables turnover ratio for 2019.

Not including sales revenue, what revenue and expense amounts related to receivables will appear in Chamberlain's 2019 income statement? Revenue: nterest revenue Expense What amounts will appear in the 2019 year-end balance sheet for accounts receivable and Calculate the receivables turnover ratio for 2019. (Round your "Receivable turnover ratio" answer to 1 decimal place.) 2. Accounts receivable, net Receivable turnover ratio 3. times

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started