Answered step by step

Verified Expert Solution

Question

1 Approved Answer

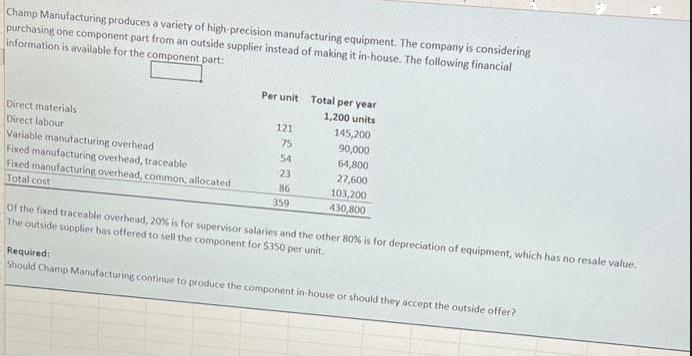

Champ Manufacturing produces a variety of high-precision manufacturing equipment. The company is considering purchasing one component part from an outside supplier instead of making

Champ Manufacturing produces a variety of high-precision manufacturing equipment. The company is considering purchasing one component part from an outside supplier instead of making it in-house. The following financial information is available for the component part: Direct materials Direct labour Variable manufacturing overhead Fixed manufacturing overhead, traceable Fixed manufacturing overhead, common, allocated Total cost Per unit Total per year 1,200 units 121 75 54 23 86 359 145,200 90,000 64,800 27,600 103,200 430,800 of the fored traceable overhead, 20% is for supervisor salaries and the other 80% is for depreciation of equipment, which has no resale value. The outside supplier has offered to sell the component for $350 per unit. Required: Should Champ Manufacturing continue to produce the component in-house or should they accept the outside offer?

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether Champ Manufacturing should continue producing the component inhouse or accept t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started