Answered step by step

Verified Expert Solution

Question

1 Approved Answer

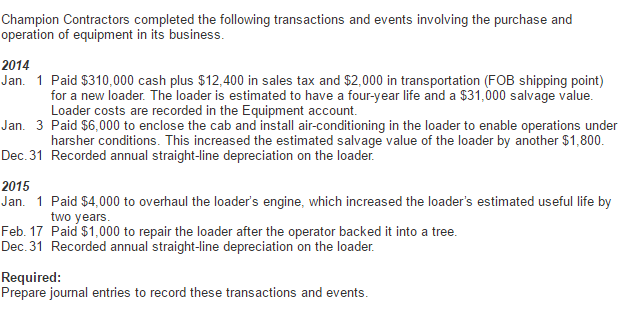

Champion Contractors completed the following transactions and events involving the purchase and operation of equipment in its business. 2014 Jan. 1 Paid $310,000 cash plus

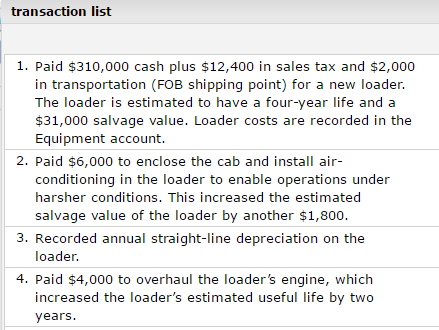

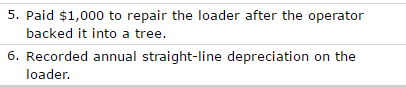

Champion Contractors completed the following transactions and events involving the purchase and operation of equipment in its business. 2014 Jan. 1 Paid $310,000 cash plus $12,400 in sales tax and $2,000 in transportation (FOB shipping point) for a new loader The loader is estimated to have a four-year life and a $31,000 salvage value. Loader costs are recorded in the Equipment account. Jan. 3 Paid $6,000 to enclose the cab and install air-conditioning in the loader to enable operations under conditions. This increased estimated salvage value of the loader by another $1,800 Dec. 31 Recorded annual straight-ine depreciation on the loader. 2015 Jan. 1 Paid $4,000 to overhaul the loader's engine, which increased the loader's estimated useful life by two years Feb. 17 Paid $1,000 to repair the loader after the operator backed it into a tree. Dec. 31 Recorded annual straight-line depreciation on the loader. Required Prepare journal entries to record these transactions and events

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started