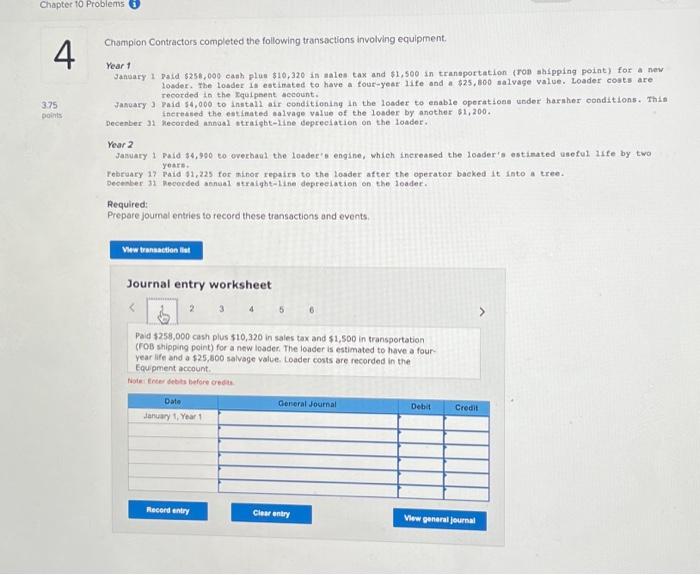

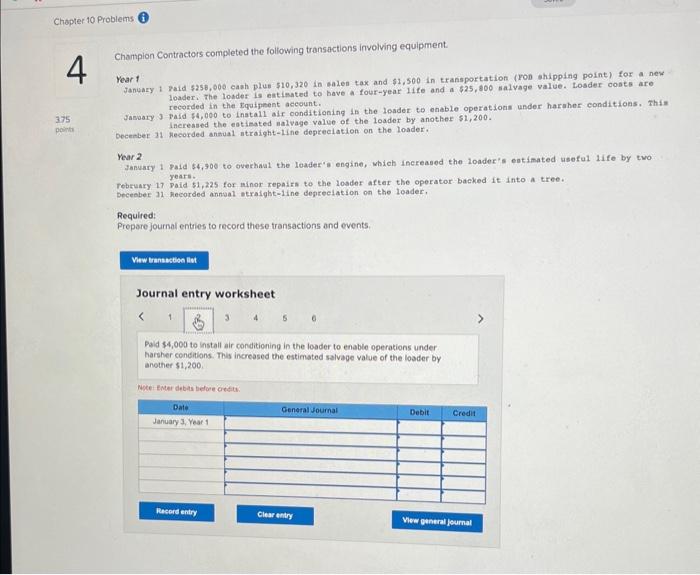

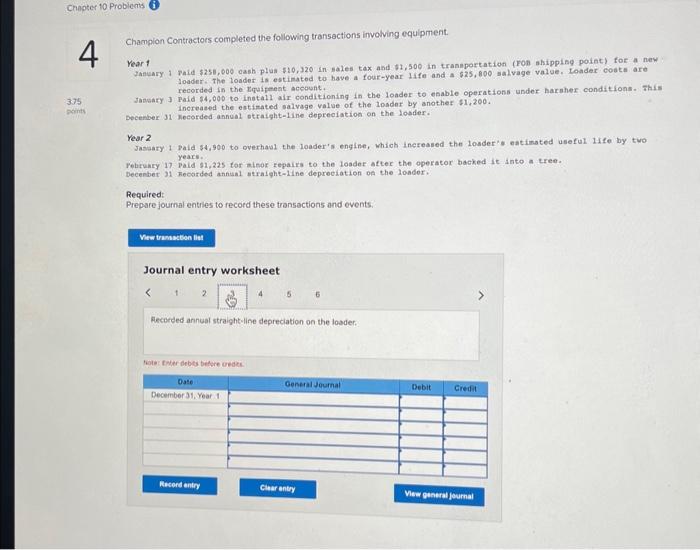

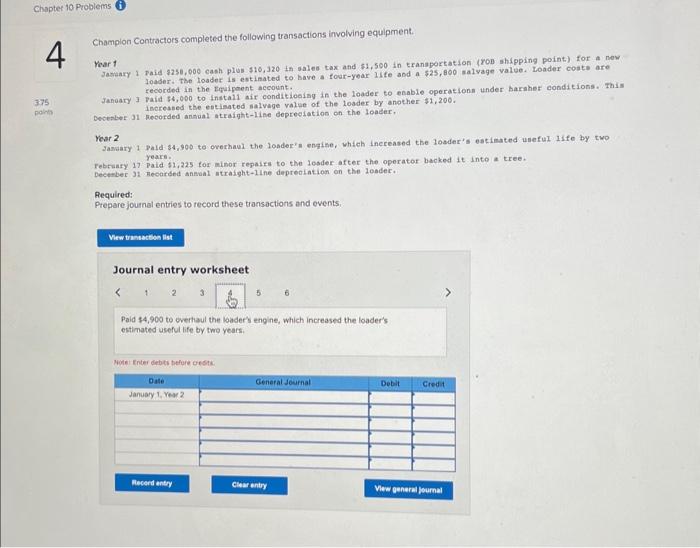

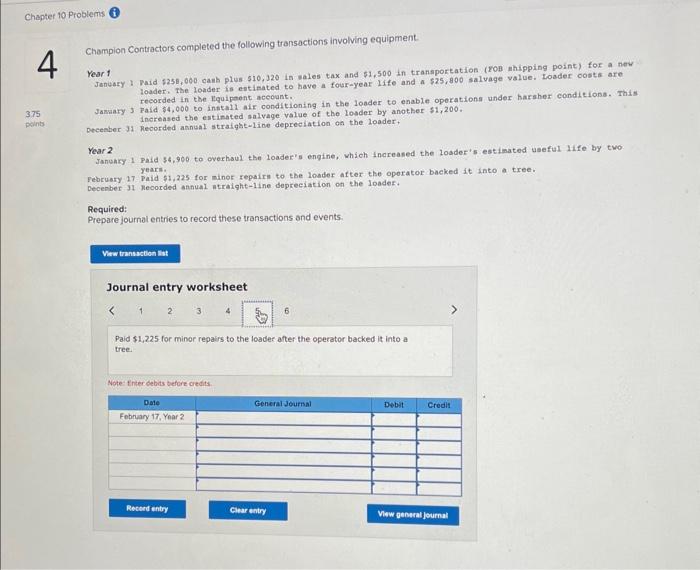

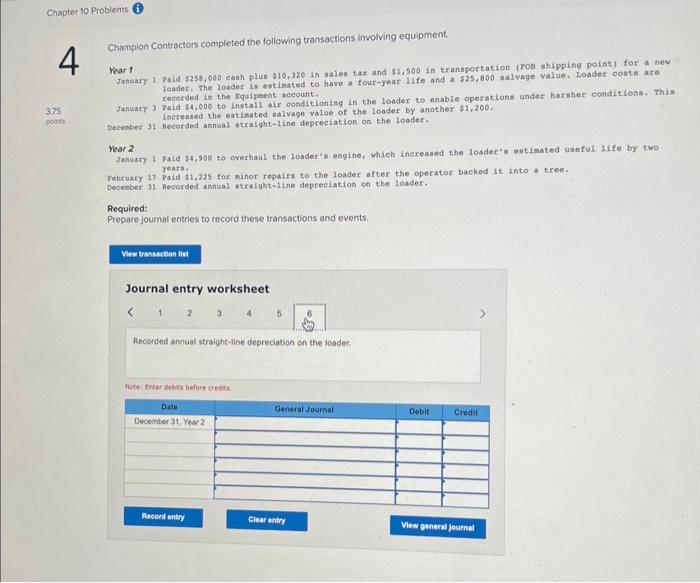

Champion Contractors completed the following transactions involving equipment. Year 1 January 1 Fald $258,000 eash plus $10,320 in salen tax and $1,500 in transportation (ron ohipping point) for a new loader. The loader is eatisated to bave a four-year life and a $25,800 salvage value. Losder costs are recorded in the Equipeent account. Janoary 3 paid $4,000 to inatall air conditioning in the loader to enable operations under haraher conditions. This increased the eatimated nalvage value of the loader by another 51,200. becenter 11 hecorded ansual itraight-line depreciation on the loader. Year 2 Janusy 1 pald 54,500 to overhani the loader's engine, which Increased the Loader's entimated useful life by two years. rebruary 17 Paid $1,225 for ainor repairs to the losder after the operator backed it into a tree. Decenber al hecorded ansal otraight-1ine deprectation on the loader. Required: Prepare journal entries to record these transactions and events. Journal entry worksheet Pald $4,000 to install air conditioning in the loader to enable operations under harsher conditions. This increased the estimated salvage value of the loader by another $1,200. Wote iner debas before oteds: Champlon Contractors completed the following transactions involving equipment. Your 1 Jasuary + paid $250,000 cash plus $10,320 th sales tax and $1,500 in transportation (ron shipping point) for a now Foader. The toader is estinated to bave a four-yoar ilte and a $25,800 salvage value. Loader costo are recorded in the Equipont account. Janoary 3 paid $4,000 to install air conditiooing in the loader to enable operation under baraher conditions. This increased the estisated salvage value of the losder by another $1,200. Detaber al Recorded ansal atraight-line depreciatioe on the loader. Yoser2 reare. rebruary 17 Paid $1,225 for minor repasta to the losder after the operator backed it into a tree. Required: Prepare journal entries to record these transactions and events. Journal entry worksheet 123 Paid $4,900 to evertaul the loader's engine, which increased the loader's estimated useful life by two years. Noble Enter debtis befure orots. Champion Contractors completed the following transactions involving equipment. Year 1 Jahuary 1 pald $254,000 cash plun $10,320 in anles tax and $1,500 in tranaportation (ron shipping point) for a new louder. The loader is eatinated to have a four-year life and a $25,800 salvage value. Loader costs are recorded in the Equiphent secount. Jancary 3 Faid 54,000 to Initall air conditioning in the loader to enable operation under haraher conditions. This inereased the estimated oalvage value of the loader by another $1,200. Decenber 31 Mecorded annoal ntralght-1ine depreclation on the loador. Year 2 Jasuary i paid \$4,980 to overbaul the loader'b engine, which increaned the loader's estinated useful life by two yeare. rebraary 17 Faid 01,225 for minor repairs to the losder after the operator backed it into a tree. Decenter 31 Recocded annal straight-line depreciation on the loader. Required: Prepare joumal entries to record these transactions and events. Journal entry worksheet 23456 Paid $259,000 cash plus $10,320 in sales tax and $1,500 in transportation (rob shipping point) for a new loader. The loader is estimated to have a fouryear life and a $25,500 salvage value. Loader costs are recorded in the Equpment account. Champion Contractors completed the following transactions involving equipment. Year 1 January i paid $251,000 cash plus $10,320 in sales tax and $1,500 in trannportation (ron ahipping poinc) for a new loader. The loader is estimatod to have a four-year life and a $25,800 salvage value. Loader coate are recorded in the xquipent account. Janeary I Faid $4,000 to inatall alr conditioning in the loader to epable operations under haraher conditions. Fhis increased the estinated salvage value of the loadar by another $1,200. Decenter 31 Mecorded annual atraight-1ine dopreciation on the losder. Year 2 Jasary i paid 54,900 to overhas the loader's engine, which inereased the loader's eatinated useful Iffe by two years. rebruncy '1) Paid $1,22 s for aleor repairs to the losder atter the operator backed it into a tree. Decenber 31 . Fecorded annisal atralght-1ine depreciation on the londor. Required: Prepare joumal entries to record these transactions and events: Journal entry worksheet Champion Contractors completed the following transactions involving equipment. Year 1 loader. The loader is entinated to have a four-year life and a $25,800 salvage vslue. Loader costs are recorded in the tiquipent aceount. Janary 3 record $4,000 to install air conditioning in the loader to enable operations under harsher conditions. This increased the estinated salvage value of tho losder by another $1,200. Deenber 31 Reoorded annual straight-line deprecintion on the Loader. Year 2 Januncy 1 Pald $4,900 to overhsul the loader's engine, which increased the loader's estimated useful lifo by two years. February 17 Paid $1,225 for minor repairn to the loader after the oporator backed it into a tree. Decenber 11 heoorded annual ntraight-1ine depreciation on the loader. Required: Prepare journal entries to record these transactions and events. Journal entry worksheet Paid $1,225 for minor repairs to the loader after the operator backed it into a tree. Note Enter debits beforz credits. Champlon Contractors completed the following transactions involving equipment. Year 1 January 1 pald $259,000 cash plun $10,320 in nalen tax and $1,500 in transportation (ros shipping point) for a now loader. The looder is eatinated to have a four-year life and a $25,800 nalvage value. Loader conts are recorded is the Equipent account. Jandary, Paid $4,000 to install air conditionisg in the loader to enable operations under harsher conditions. This increased the estisated nalvago value of the loador by another $1,200. Decenber 31 Hecorded asnual otraight-1ine dopreciation on the loader. Year 2 January 1 pald $4,900 to overhaul the Loader'a engine, which increaned the loader's estimated useful iffe by two years. Tebruary 17 paid $1,225 for minor repairs to the loader after the operator backed it into a tree. Decenber it Recorded asnoal otraight-line depreciation on the 2 oader. Required: Prepare journal entries to record these transactions and events. Journal entry worksheet Recorded annual straight-line depreciation on the loader: Nobei Ener debits before credta