Answered step by step

Verified Expert Solution

Question

1 Approved Answer

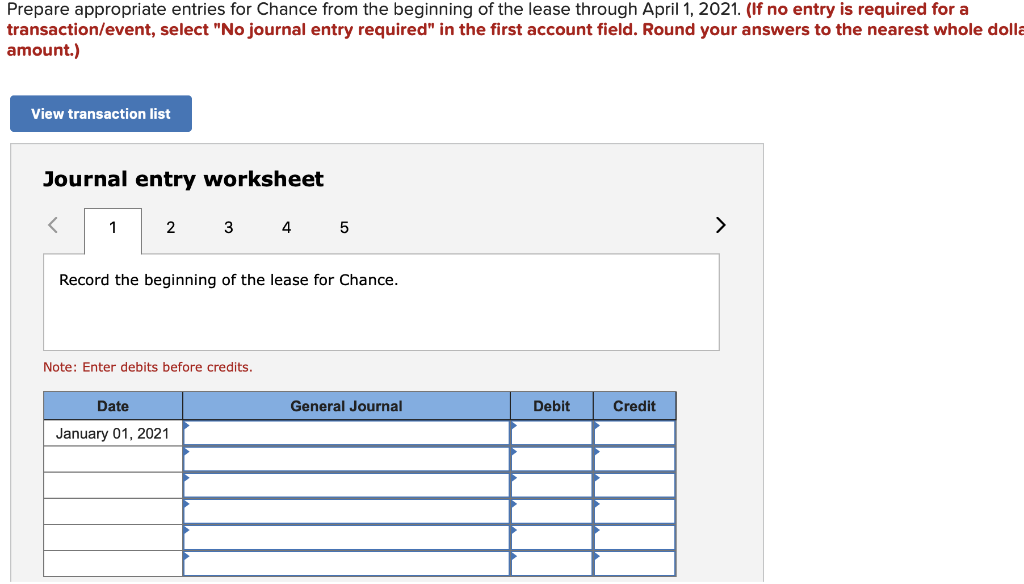

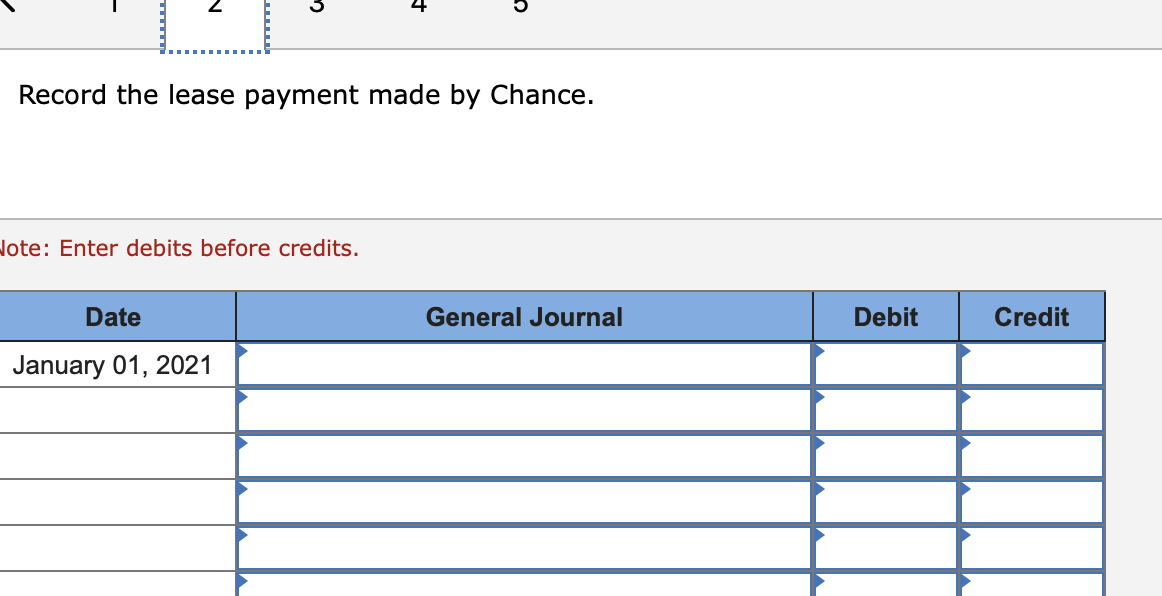

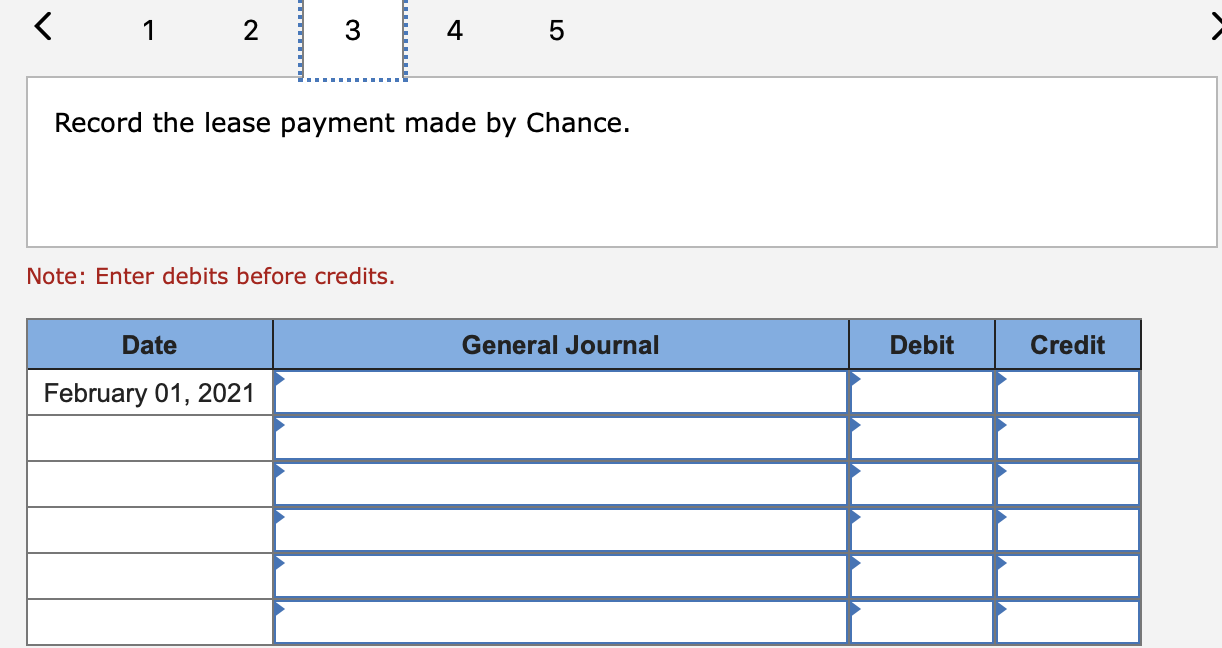

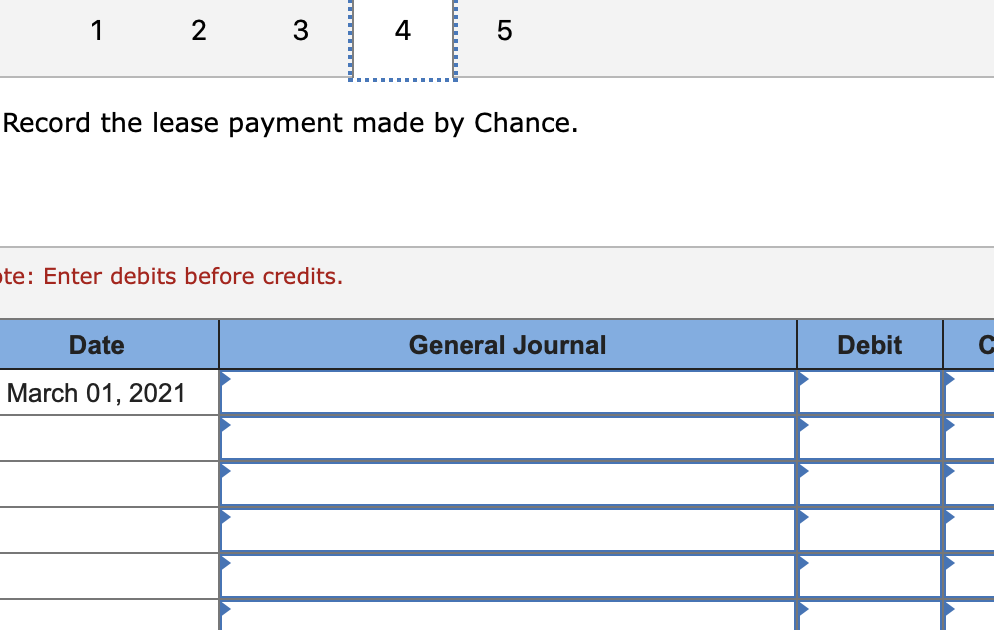

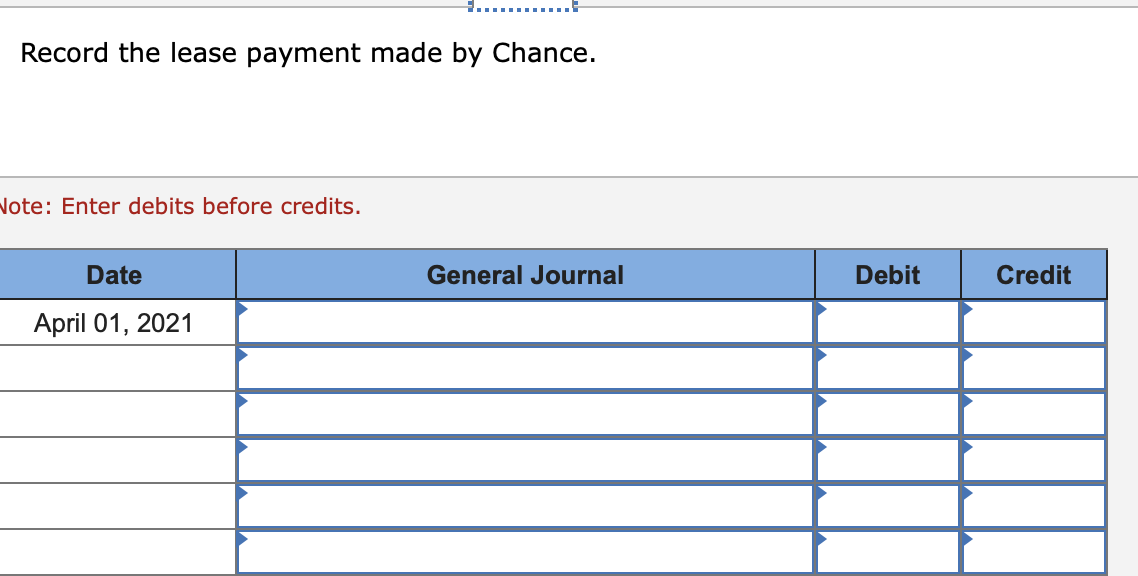

Chance Enterprises leased equipment from Third Bank Leasing on January 1, 2021. Chance elected the short-term lease option. Appropriate adjusting entries are made annually. Related

Chance Enterprises leased equipment from Third Bank Leasing on January 1, 2021. Chance elected the short-term lease option. Appropriate adjusting entries are made annually.

| Related Information: | |

| Lease term | 1 year (12 monthly periods) |

| Monthly lease payments | $72,000 at Jan. 1, 2021, through Dec. 1, 2021. |

| Economic life of asset | 5 years |

| Interest rate charged by the lessor | 6%     |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started